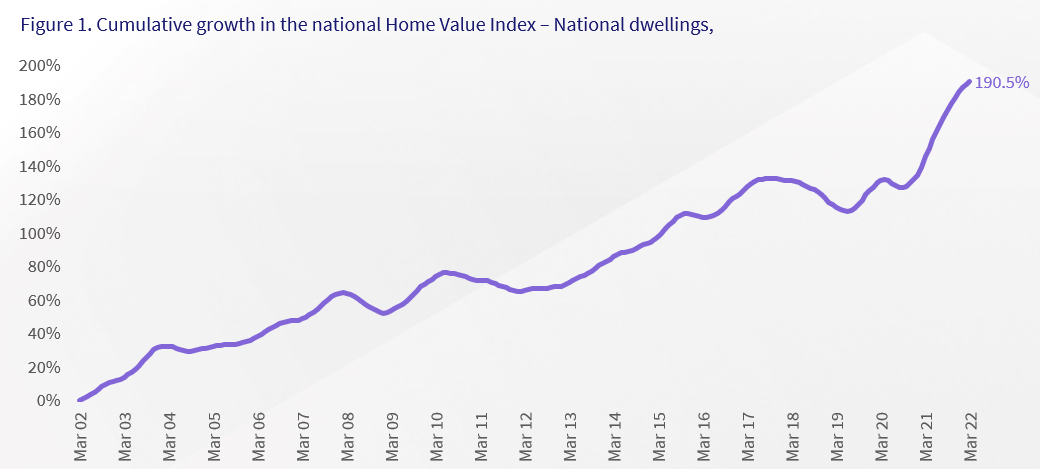

National dwelling values increased 190.5% in the past 20 years.

Figure 1 shows the cumulative growth in the CoreLogic Home Value Index for national dwellings over the past two decades. The change in the index measures the movement in values across the Australian dwelling market over time. It is equivalent to a rise of around $485,000 dollars at the median value level, where the median dwelling value in Australia was recorded at $738,975 in March 2022.

The increase in dwelling values over this period was comprised of a 139.4% lift in Australian unit values, and a 209.3% rise in detached houses. Of the greater capital cities and regional markets of Australia, the highest gains over the 20 year period were across the Hobart dwelling market (up 315.2%), while the lowest gains were across Darwin dwellings (89.4%).

In the past 20 years, the Australian housing market has seen six periods of upswing, interrupted by 5 periods of notable decline. These downswings in the housing market have largely occurred off the back of changes to credit conditions, such as macro-prudential changes or lift in interest rates, alongside negative economic shocks like the GFC, or the initial onset of COVID-19. In the past two decades, housing market downturns have lasted, on average, around 25 months, with an average peak-to-trough decline of -5.0% in value.

Housing values have generally trended higher over time through this period. Market upswings in the past two decades have averaged around 30 months, with average gains of 24.8% through these periods of uplift. The past 20 years has largely been characterized by declines in the official RBA cash rate, especially from late 2008 amid the GFC. Strong value growth was also realized off the back of a surge in net overseas migration between 2004 and 2009, which remained fairly elevated until the start of the COVID pandemic. However, the pandemic period also coincided with ultra-low cash rate settings, high household savings and government incentives for home purchases, which has actually generated the fastest upswing in values since the 1980s. The past year has taken cumulative growth in dwelling values from 145.8% at March 2021, to 190.5% at March 2022.