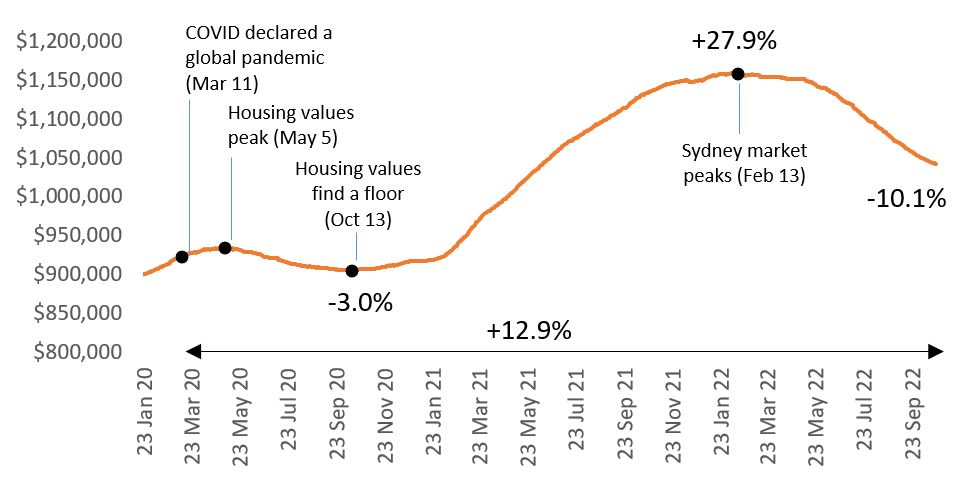

Sydney home values are down -10.1%, equivalent to approximately $116,500, since the city hit its peak value in February 2022, CoreLogic’s daily home value index shows.

The double-digit decline follows six successive cash rate hikes and record-low affordability after a surge of 27.9% or roughly $252,900 in the city’s dwelling values from the COVID-trough to peak.

CoreLogic Research Director Tim Lawless said it was unsurprising Sydney was leading the capitals in the current downturn given it is the country’s most expensive capital city housing market and arguably has the greatest susceptibility to rising interest rates.

“Although Sydney’s housing values were already in decline when the rate hiking cycle began, the pace of decline accelerated sharply following the first interest rate increase in May,” he said.

“Sydney values are now down –9.5% since 3 May, and -10.1% since peaking on 13 February this year.”

Sydney dwelling values since January 2020

The daily index shows Melbourne’s values are second to Sydney, falling -6.4% since 14 January 2022 while Brisbane is down -6.1 % since its 19 June 2022 peak. Adelaide and Perth have both declined less than -1% since their August peaks.

CoreLogic’s monthly Home Value Index shows Hobart and Canberra down -4.7% and -4.4% respectively since their month-end peaks. Darwin remains the only capital city where housing values haven’t started to trend lower, although dwelling values remain -10.1% below its record high in 2014.

“Despite the -10.1% decline so far, Sydney home values still have a way to go before wiping out the capital gains accrued over the recent growth cycle. Home values would need to fall a further -11.4% to get back to the levels seen at the onset of COVID,” Mr Lawless said.

“The good news for Sydney home owners is that the rate of decline has continued to moderate through October, improving from a -2.2% decline over the four-week period ending 3 September to -1.3% over the most recent four-week period ending 23 October.”