CoreLogic Research team’s Monthly Chart Pack provides a detailed overview of key market metrics including the combined value of residential real estate, sales volumes and dwelling values. Catch up on everything that happened in June.

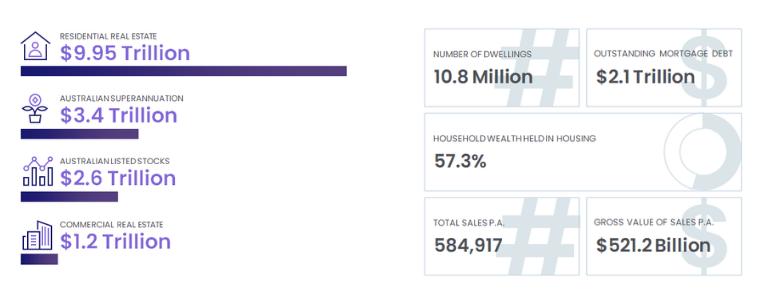

- The combined value of residential real estate in Australia fell to $9.95 trillion at the end of June, with 57.3% of household wealth held in housing.

- Dwelling values in Australia are 11.2% higher over the past 12 months, down from a cyclical peak of 22.4% in the 12 months to January 2022.

- Conditions are diversified, but every capital city has moved through a peak rate of growth. Growth over the quarter ranged from 5.1% in Adelaide to -2.8% in Sydney.

- In the three months to June, the change in capital city dwelling values dropped -0.8% compared to regional markets which increased 2.0% for the period.

- Sales volumes are starting to ease from recent highs. CoreLogic estimates that in the 12 months to June, there were 584,917 sales nationally, up 3.2% compared to the previous year. However, initial sales estimates over the June quarter were -15.9% lower than the same quarter of the previous year.

- At the national level, properties are taking longer to sell. In the three months to June, the median days on market was recorded at 30, up from a recent low of 20 days in the three months to November.

- Similarly, vendor discounting has also increased from the recent low of 2.8% recorded in the three months to April last year. In the three months to June, the median vendor discount at the national level was 3.5%.

- In the four weeks to July 4, there were 37,708 dwellings listed for sale nationally. While new listings volumes have steadied, they are now 5.9% higher than the five-year average for the equivalent period.

- The combined capital cities clearance rate continued to trend lower through June, averaging 55.6% in the four weeks to July 3. This is down from 73.1% in the equivalent period of 2021.

- Unlike changes in dwelling purchase values, rental value growth remains high across Australian dwellings. Rent values increased a further 0.9% in June, taking rents 9.5% higher over the year.

- Through June, Australian gross rent yields rose to 3.33%, up from a recent low of 3.21% through January this year. Since the end of 2021, gross rent yields in Sydney have lifted 23 basis points, and 18 basis points in Melbourne.

- Through May, 16,390 dwellings were approved, up 9.9% from the month prior. The increase was largely driven by a 35.1% increase in unit approvals, however unit approvals remain below the decade average (7,457). While detached house approvals fell 2.4% in May house approvals remain above the decade average of 9,773.

- Lending for property purchases rose 1.7% over the month of May. This was largely led by a 2.1% increase (or $455 million) in owner occupier lending, while investor lending was up 0.9% ($99 million).

- Nationally, investor finance comprised 35.5% of new mortgage lending through the month of May. This is above the decade average of 34.8%.

- The RBA lifted the cash rate a further 50 basis points in July to 1.35%. This takes the cumulative hike since May to 125 basis points. The household sector remains a key source of uncertainty, especially spending amidst high prices and higher interest rates.

Download the July Monthly Housing Chart Pack.