CoreLogic Research team’s Monthly Chart Pack provides a detailed overview of key market metrics including the combined value of residential real estate, sales volumes and dwelling values. Catch up on everything that happened in August.

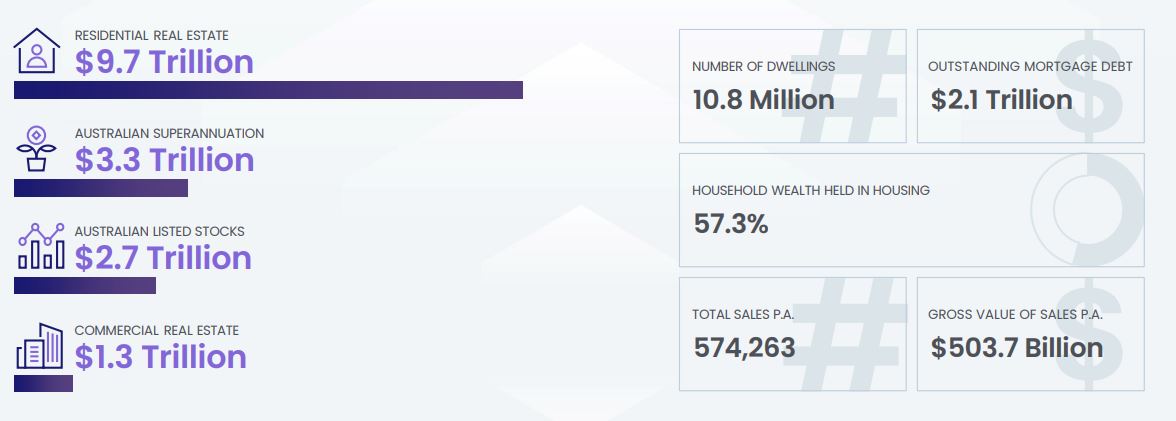

- The combined value of residential real estate in Australia fell to $9.7 trillion at the end of August, down from $9.8 trillion in the previous month.

- Dwelling values in Australia are 4.7% higher over the past 12 months, down from a cyclical peak of 22.4% recorded in the 12 months to January 2022.

- In the month of August, every capital city dwelling market except Darwin saw a fall in values.

- The highest annual growth rate in dwelling values among the regional and capital city dwelling markets was across Regional SA, at 22.1%. The lowest rate of change in values was across Sydney, down -2.5% over the year.

- The rolling 28-day change in the combined capitals home value index fell a further -1.6% through the 28 days ending August 31st.

- Sales volumes are trending lower as buyer demand slows. CoreLogic estimates that in the 12 months to August, there were 574,263 sales nationally, down -2.3% compared to the previous year.

- At the national level, properties are taking longer to sell. In the three months to August, the median days on market was 33, up from a recent low of 20 days over the three months to November.

- Vendor discounting has also increased from the recent low of -2.8% recorded in the three months to April last year. In the three months to August, the median vendor discount at the national level was -4.0%.

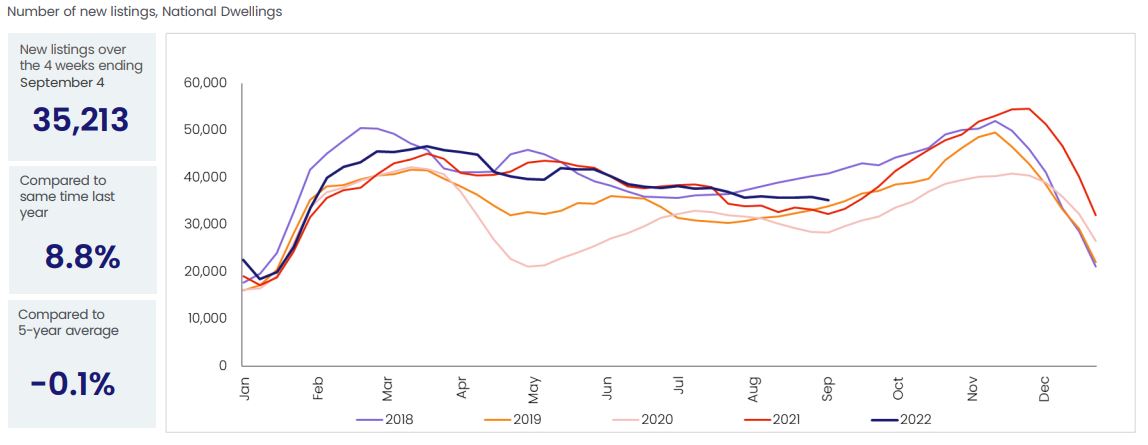

- In the four weeks to September 4th, there were 35,213 newly advertised dwellings for sale nationally. While the volume of new listings has trended lower, the flow of new listings is higher than in previous years, and is expected to rise in the coming weeks.

- The combined capital cities clearance rate stabilized a little through August, averaging 56.8% in the four weeks to August 28th.

- National rent values rose 10.0% in the 12 months to August, which is a new record high annual growth rate. Rent value increases are fairly broad-based, but the pace of growth is slowing in some smaller capital cities.

- The number of residential dwellings approved for construction dropped -17.2% over the month of July. The sharp drop was due to a -45% decline across the unit sector, due to a lack of high rise approvals.

- Lending for property purchases dropped a notable -8.5% in July. Investor housing finance fell -11.2% in the month, while total owner occupier lending fell -7.0%.

- The RBA lifted rates to 2.35% in September. The board emphasised it could increase interest rates over the months ahead, but is not on a ‘pre-set path’.

- APRA data shows the amount of potentially risky mortgage lending has generally trended lower through the June quarter of 2022, with the exception of the portion of lending on interest only terms.

Download the Monthly Housing Chart Pack