In July, Australian home values were -2.0% lower than the peak in April 2022. On top of price declines, many other data points suggest a slowing in market conditions.

Properties are taking longer to sell, vendors are gradually lowering their prices, and reduced appetite for finance means there is less buyer competition amid a larger number of properties available for sale.

For those considering purchasing their first home, does this mean it is a good time to buy?

While buyers may aspire to purchase at the bottom of the cycle and then sell at the top, ultimately, it’s notoriously difficult to time the market perfectly. Further to this, most buyers and sellers will generally work towards a more practical timetable based on their personal situation and housing requirements or investment strategy. Even when prices fall, it’s not a straightforward decision to get into the market.

Here I explore some of the ‘pros’ and ‘cons’ associated with buying property in a falling market.

Pros to buying a first home in a falling market

Pro 1. Property values are declining

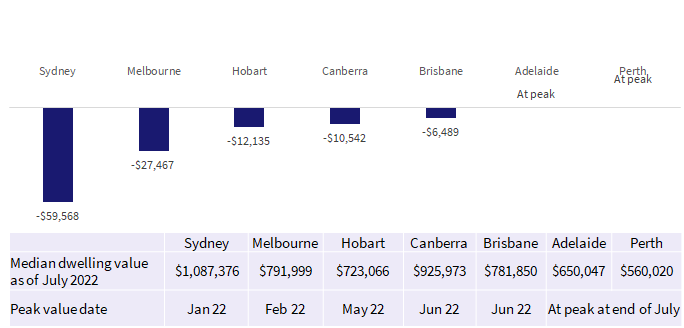

In many parts of the country, dwellings are generally cheaper now than they were in early 2022, before the Reserve Bank of Australia (RBA) started increasing the cash rate, which led to rising mortgage interest rates. Figure 1 shows capital city median dwelling values as of July 2022, as well as how far median home values in capital city markets have fallen this year. This fall is expressed in dollar terms on the median value.

Figure 1 highlights Adelaide and Perth are yet to show monthly declines, while there have been more substantial falls in Sydney and Melbourne. Perth and Adelaide have been relatively resilient to rate hikes until recently, however the trend in CoreLogic’s daily home value index has started to show these markets flattening out through August too, ahead of likely declines in value in the coming months.

Figure 1. How much have prices changed since peaking in 2022?

Change in indexed median value

Falling property values may make it easier for some to access a home loan. In fact, for those that have already been saving through the upswing, savings could represent a larger portion of the home price as property values ease, enabling buyers to provide a larger deposit than they may have needed at the peak of the market.

Lower property prices also reduce transaction costs, such as stamp duty, and may see more properties qualify for first home buyer schemes that have price caps.

Pro 2. Properties are taking longer to sell

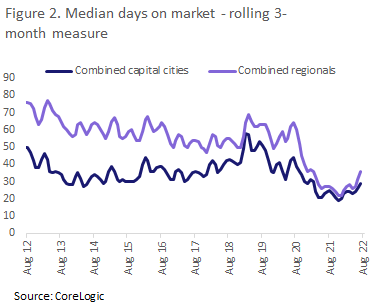

At the national level, the median amount of time a property spends on the market rose to 32 days in the three months to July. This is up from a recent low of just 20 days in the three months to November (Figure 2). For most broad capital city and regional markets, properties are taking longer to sell now than this time last year.

As properties take longer to sell, buyers have more time to organise their finance, complete due diligence on properties, and check out what other properties are on the market. Similarly, as homes take longer to sell, vendors typically become more flexible on their pricing expectations. We can see this in growing vendor discounts which have moved from 2.9% in November last year to 3.8% over the three months ending July.

Pro 3. Lenders are offering competitive rates for new customers

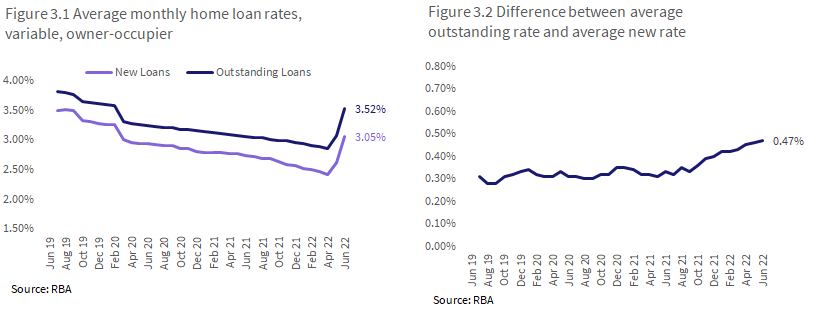

One of the major downsides of trying to buy a home now, as opposed to four months ago, is that mortgage rates are higher, and are likely to continue rising further. However, average new variable rates are typically lower than what existing mortgage holders are paying, with rates still lower than they were in 2019.

Figure 3 shows average variable mortgage rates for new and existing owner occupied loans, as well as the gap between the two series over time. The gap between rates on average new and existing loans is 47 basis points - a series high. This suggests lenders are still trying to be as competitive as they can to win new customers in a softening market.

Pro 4. Getting out of the rental market

It’s an undeniably tough time for renters at the moment. Rent listings are around one third below the previous five-year average. Australia’s rental vacancy rate is a record low 1.2% and CoreLogic’s rent value index rose a record 9.8% in the past year, meaning upcoming lease renewals could spell higher rents.

While not everyone has money saved for a deposit, those that do may be tempted into home ownership to avoid rising rents. Australians typically prefer home ownership to renting, and recent ABS data reveals owner occupiers are generally more satisfied with their living conditions. As rents rise and property values fall, this may trigger more home buying decisions from people who are renting.

Cons to buying a first home in a falling market

Con 1. Property values are falling

While falling property prices may seem like a good thing, it can also create a potentially risky time to buy. This is because the amount of money borrowed for a home is fixed, even as property values move daily. Buying in a declining market means the home could potentially be worth less than the purchase price, although this is only a risk if the owner needs to sell their home within a short period of time, incurring a loss.

However, Australian home owners generally don’t sell within a short period of time. The median hold period of properties across Australia has averaged just over eight years for the past decade. Even when property values fall, people can generally keep up with mortgage repayments. In the current environment, mortgage serviceability has been boosted by higher assessment buffers by banks and lenders, a tight labour market and some momentum in wages growth.

Con 2. Mortgage rates are rising

The cash rate is rising at its fastest pace since the early 1990s, and banks have been passing these increased costs to borrowers. Average new variable rates for owner occupiers increased 64 basis points between April and June, from 2.41% to 3.05%. Considering the cash rate has increased by another 100 basis points since that time, it’s likely average mortgage rates are now a full percentage point higher than the published June averages.

This may not seem like a big increase, but it adds up when the size of a loan is hundreds of thousands of dollars. For example, a $500,000 loan with an interest rate of 2.41% over 30 years, assuming no fees, amounts to monthly loan repayments of around $1,950. If the loan amount is reduced 5%, to $475,000, but has a higher interest rate of 3.05%, monthly repayments are higher at $2,015 per month.

Property prices are expected to continue falling, but this is off the back of further expected rate rises. The trade-off for a lower purchasing price could be a higher cost of debt.

Con 3. Vendors don’t sell as much in a declining market

In the current environment, vendors are typically offering greater price discounts to get their properties sold. However, vendors do have another option: not to sell at all.

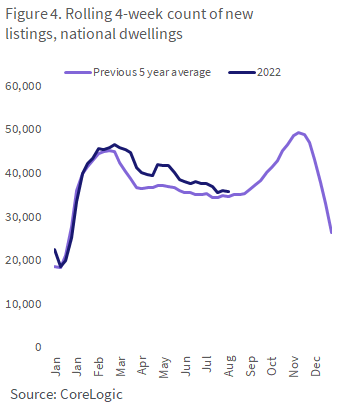

Property prices and listings volumes tend to move together. Fewer new listings might hit the market this spring selling season than last year, when sellers were cashing in on strong price rises.

Figure 4 shows how new listings counts nationally have been tracking in 2022 relative to previous years. As the housing market has started to come off a peak value in April, new listings have started to converge closer to the previous five-year average, suggesting a little less exuberance from sellers.

There may still be quality properties advertised over the coming weeks amid the spring selling season, because not all vendors are concerned with maximising profit. For example, people who have held their property for decades in many parts of the country, but need to move, will still make a sizeable gain from selling.

The higher interest rate environment also means not as many people are buying. With less competition, properties take longer to sell, reflected in the total advertised stock levels, which are already starting to accumulate as a result, even as the rate of new properties being added to the pool of listings slows.

So … is now a good time to buy?

Overall, market conditions do not determine whether it is a “good” time to buy your first home. Low mortgage rates will generally mean higher prices and more competition, while falling prices often mean finance is more expensive, or harder to get, and the rate at which new stock is advertised slows down.

The perfect time to buy comes down to personal circumstances. These include things like current living situation, whether that is renting, or living rent-free with parents. It might depend on whether you have enough of a deposit to offset higher mortgage costs. The security of your employment is also an important consideration, as well as your ability to service a mortgage and how you feel about home ownership and property investment more broadly. Keeping across market trends can be useful, but so is careful assessment of your own situation and personal goals.