CoreLogic Australia Head of Research Eliza Owen unpacks the abolition of stamp duty and implementing an ongoing, broad-based property tax for NSW first home buyers.

NSW first home buyers (FHBs) will have the option to swap stamp duty for an ongoing property tax from 16 January 2023 after the NSW Government passed the ‘First Home Buyer Choice’ policy in mid November.

While this will be welcome news for first home buyers, especially those who do not qualify for concessions on stamp duty, there are key efficiencies missing from the policy associated with abolishing stamp duty and implementing an ongoing, broad-based property tax. This policy is a first home buyer incentive, and it could add upwards pressure to housing demand in an otherwise soft market.

Key features of the First Home Buyer Choice policy

- From 16 January 2023, first homebuyers can opt out of paying stamp duty in favour of an ongoing annual payment. If the property purchase settles before 16 January, first home buyers can still access the scheme by seeking a reimbursement on stamp duty from 2023.

- The scheme applies for properties valued up to $1.5 million. For the purchase of vacant land for construction of a new home, the price cap on the scheme is $800,000.

- The scheme is open to owner occupiers only, although you can later convert the property to an investment, with a markedly higher rate of ongoing property tax. Purchasers must move in within 12 months of purchasing the property and live in it continuously for at least six months before it becomes an investment.

- In place of an upfront stamp duty payment, the annual property tax will be equal to $400 per annum, plus 0.3% of the value of land.

- The property will not be subject to an ongoing property tax once it is sold on.

- The average property tax payment is set to grow in line with Gross State Product per capita (a measure of average income). Over the past 15 years, GSP per capita has seen average annual growth of 3.2%. The legislation provides that individual property taxes cannot grow by more than 4% annually.

- Stamp duty exemptions will still apply for properties up to $650,000 (no stamp duty), and stamp duty concessions will still apply for properties up to $800,000 (stamp duty sliding scale).

- Only first home buyers have the option to pay an ongoing property tax, while all other home buyers must pay stamp duty.

Information sourced from: https://www.nsw.gov.au/initiative/first-home-buyer-choice

Sellers may benefit rather than first home buyers

Removing stamp duty for first home buyers saves on up-front costs of buying a home but could push up home values overall. This is because stamp duty is a part of what buyers are willing to pay for their home. Removing stamp duty payments means the buyer has more money to put toward the purchase price.

The price of a first home might also be discounted by the estimated costs of an ongoing property tax. However, modelling by NSW Treasury estimates the majority of FHBs purchasing a property between $800,000 and $1.5 million would pay less on an ongoing property tax than on stamp duty, because FHBs are thought to have relatively short hold periods.

The ‘breakeven’ point for expenditure on stamp duty and the property tax in this price range varies between dwelling type and purchase price. It is estimated to be between 36 and 63 years for units, and 21 and 29 years for houses. But any savings on property tax may be put towards the purchase price, ultimately benefitting the seller of the property.

If the removal of stamp duty and the implementation of an ongoing property tax could push up values, why do so many economists love the idea of substituting stamp duty for land tax?

One of benefits thought to come from an ongoing property or land tax is it makes housing more efficient. By taxing households on land on an ongoing basis, and removing the transaction barrier of stamp duty, it is thought that people will be more incentivised to buy the housing that is right for them in their current stage of life.

The tricky case of downsizers

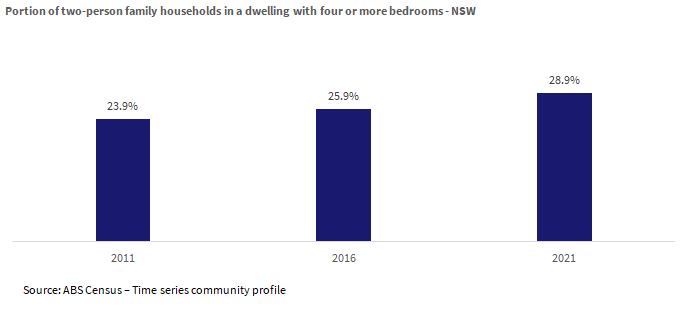

Consider older Australians living in a large family home, whose children have moved out (empty nesters). It is possible these households are becoming more common in Australia, with census data indicating that for NSW, the portion of two-person family households in dwellings with four or more bedrooms increased from 25.9% in 2016 to 28.9% in 2021. The majority of two person households in the census (66.6%) were in detached houses, and 41.5% of them were in houses with four or more bedrooms.

Having ‘empty nesters’ pay an annual property tax for the additional land they are living on and abolishing the disincentive of stamp duty payable on a subsequent downsized purchase, could make it more expensive to hold onto the family home, and less expensive to downsize. This may lead to more downsizing decisions and free up housing stock for larger families.

However, it is worth noting the COVID period has also likely led to smaller households occupying larger dwellings, with spare bedrooms being used for other purposes, like a home office. Not all of these two-person households will necessarily be empty nesters.

Property tax should be broadened

The NSW Government’s First Home Buyer Choice policy does not extend to empty nesters, other downsizers or upsizers. Because the stamp duty reform is so narrowly focused, there are missed opportunities to make NSW housing in general more efficient.

Politically, it is difficult to impose an ongoing property tax on homeowners other than FHBs. Recent buyers especially may feel they should not have to pay ongoing land tax because they have already paid stamp duty, but there are ways of navigating this. In 2019, economic think tank Prosper Australia outlined a transition model which included using stamp duty payments as tax credit for ongoing property tax for recent home buyers, and a three-year ‘tax holiday’ to give homeowners time to adjust, or perhaps even bring forward their next purchasing decision.

However, this small step in the right direction toward more efficient property tax may also be very deliberate. Familiarising a new generation of homeowners with the concept of an ongoing property tax, especially one that appears cheaper than stamp duty, may make it easier to broaden ongoing property taxes in the years to come. No doubt other state and territory governments will be paying close attention to the reception and impact of this policy.