The Australian unit market's performance in 2022 can be split into two acts. The first four months of the year were characterised by an easing in the monthly growth rate, resulting in a modest 1.1% rise in values between December 2021 and April 2022.

Increasing interest rates, low consumer confidence and persistently high inflation dominated the second act, adding downward pressure on values and taking unit values -5.2% below their April peak. While the detached housing market followed a similar pattern, one difference between the two housing types has been the severity of these value movements.

CoreLogic Economist Kaytlin Ezzy said the current downturn, May to December 2022, has shaved approximately -$73,000 off the average Australian house value, compared to a decline of -$32,400 in the average national unit value.

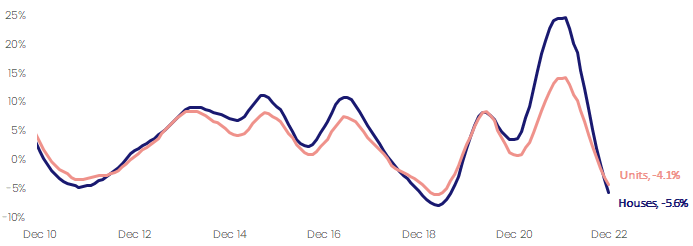

"Historically, house values have been more volatile than units, recording larger gains through the upswing and larger depreciation during a downswing. The current cycle has been no different," she said.

"As the downturn matures, the resilience of the unit market has now become evident in the annual growth trend, with the annual performance gap between house and unit values inverting for the first time since May 2020 in November (-50 basis points) and widening further in December(-150 basis points).”

"This is in stark contrast to September 2021, when the annual performance gap between houses and units peaked at 10.9 percentage points."

Rolling annual growth rate, National houses and units

Affordability is a leading factor protecting unit values from steeper declines. At just under $600,000, the median value for national units is approximately $170,000 cheaper compared to the average house, while across the combined capitals, the gap is wider, at approximately $247,000.

"With eight consecutive rate rises reducing the average borrowing capacity by around 13.3%1, it's likely a number of prospective buyers can no longer borrow the amount required to purchase a house and are instead looking towards the unit market as a more affordable option," Ms Ezzy said.

Despite unit values being supported by their relative affordability, the rate-tightening cycle has seen the overall affordability of unit's decrease. Previous CoreLogic research shows the portion of the average household income required to service a unit mortgage increased from 30.0% in September 2021 to 35.8% in September 2022.

"Mortgage serviceability has likely continued to erode with further rate rises in October, November and December, taking the cash rate 300 basis points above the emergency lows in April," Ms Ezzy said.

"Assuming the November and December rises are passed on in full, the monthly mortgage repayment on a typical unit will have increased by $614, despite the mortgage principle decreasing by approximately $26,000²."

Sydney remains the country's most expensive capital city unit market, with a median value of $772,807, despite recording an annual decline in value of -9.2%, the largest of the capital cities. Suburbs in Sydney's Eastern Suburbs and Northern Beaches recorded the largest unit value declines, falling more than 20% in some instances. Units in Centennial Park, Belrose and Vaucluse recorded declines of 23.8%, 23.4% and 23.1%, respectively.

On the flip side, Adelaide had some of the best-performing unit values in 2022, with suburbs such as Seacliff Park, Paradise, Campbelltown, Newton and Mitchell Park all recording annual increases in excess of 30%. Across the broader Adelaide region, unit values rose 0.4% in December, taking values 14.0% higher over the 12 months to December 31.

Across the other capital cities and 'rest of state' regions, unit values across Regional Western Australia rose by 8.3% annually, followed by Brisbane (6.7%), Regional SA (6.7%), Regional Queensland (4.5%) and Darwin (4.0%). Canberra and Perth recorded milder annual increases of 2.6% and 1.1% respectively, while Regional New South Wales (-0.1%), Regional Victoria (-0.6%), Regional Tasmania (-3.0%), Melbourne (-4.8%) and Hobart (-7.9%) all saw values fall below the levels recorded this time last year.

Outlook for the unit market

The outlook for 2023 remains skewed to the negative, with the cumulative rate rises now above the 300-basis point serviceability buffer that recent borrowers were assessed under. Additionally, a large portion of fixed-term loans are expected to expire throughout 2023, with many borrowers who entered the market in the past two or three years transitioning from a fixed-term rate around the 2% mark to rates in excess of 5.0%. With interest rates expected to rise throughout the first quarter of 2023, it’s likely a growing number of households will be feeling the pinch from higher interest rates along side such high inflation, stretching household balance sheets.

However, Ms Ezzy suggested a number of tailwinds should help shield unit values from the worst of the current downturn, including relative affordability, low supply levels, and the return of investors, who typically prefer the medium to high-density sector.

"As units approach the floor in values, the prospect of medium to long term capital gains, coupled with strong rental returns, could entice more investors," she said.

Another potential tailwind for NSW units is the introduction of a land tax option for first-home buyers.

"It's not uncommon for many first home buyers to postpone looking for a property until they can afford a home that will meet their medium to long-term needs, rather than purchase a more affordable unit that would meet their short-term needs. As one of the largest transaction costs, stamp duty is a significant factor contributing to the cost of entering the housing market.”

"The introduction of the land tax as a stamp duty alternative for NSW first home buyers could see more demand shift towards the medium to high-density segment as younger buyers look to satisfy their short-term needs.”

1 Using the June 2022 median household income ($1701 p/w) sourced from ANU, the average borrowing capacity has decreased from $594,100 in April (P&I of 2.41%) to $515,300 in December (P&I of 5.08%- assuming the November and December rate rises are passed on in full).

²Monthly mortgage repayments were calculated assuming a 20% deposit and a 30-year loan. The current mortgage repayment is calculated using the current national median unit value and an average variable mortgage rate of 5.08%. The April mortgage repayments was calculated using April's index-adjusted median value and the average variable rate of 2.41%.

Download a copy of the Unit Market Update