The June cash rate decision doused hopes for many Australians that rate hikes were nearing an end. It prompted the major bank economists to reset their forecasts for the terminal cash rate to at least 4.35%, dragged on consumer sentiment, and may take some steam out of the recent housing market recovery.

Of the 400 basis point increase in the cash rate so far, it’s likely that around 350 basis points will have been passed through to outstanding variable loan holders by the end of June. Using the example of a $750,000 mortgage, this takes monthly home loan repayments up by around $1,550 per month. Additionally, the bulk of fixed-term home loans taken on during the pandemic are expiring this year, exposing more households to a spike in interest costs.

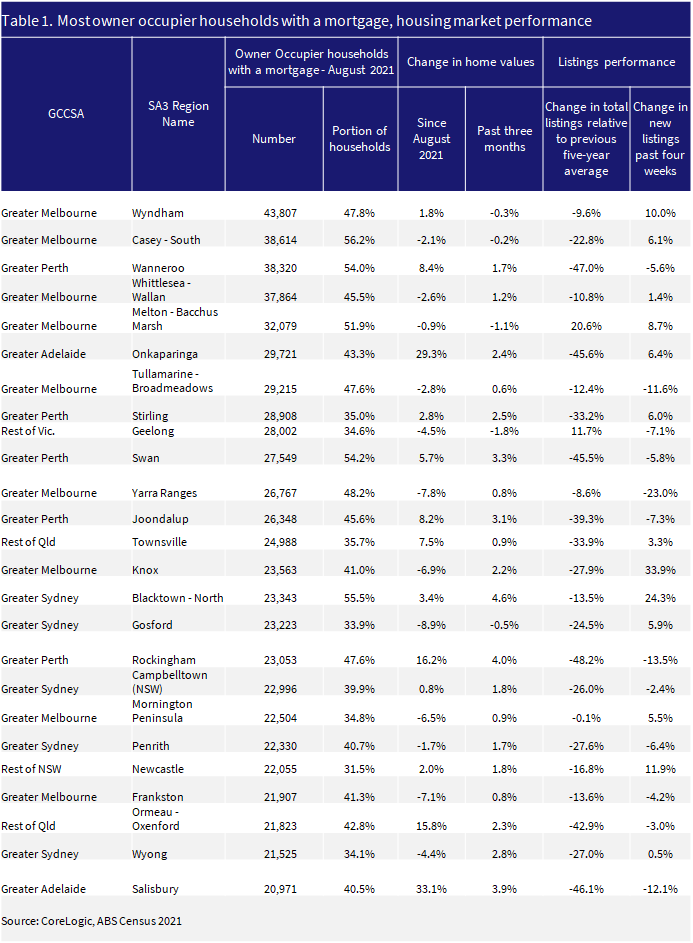

But households in some regions will feel the pinch more than others. The number of mortgaged, owner occupier households are generally highest in outer regions of major cities, particularly Melbourne. Looking at SA3 regional boundaries at the time of the 2021 Census, the highest number of mortgaged owner occupiers were in Wyndham (43,807, or around 48% of households), Casey – South (38,614, or 56.2% of households), and Wanneroo in Perth (38,320, or 54.0% of households).

The top 25 SA3 regional boundaries with the highest number of mortgaged households are set out in table 1, alongside a summary of value and listings performance. Of these 25 regions, nine are in Melbourne, five are in Perth and Sydney and two are in Adelaide. The remaining four are large regional centres, including Ormeau-Oxenford on the Gold Coast, Geelong, Newcastle and Townsville.

For markets in the capital city regions, there is an average distance to the city centre of about 34 km, ranging from Stirling in Perth (which has a 9 km distance to the CBD), to Wyong in the Central Coast of NSW (70 km from the Sydney CBD). As of the 2021 Census, median weekly household incomes across these markets had a sizable range, from $2,722 per week across Blacktown – North in Sydney, to $1,364 in Salisbury in Greater Adelaide. However, 16 of the 25 regions had a median weekly household income that was lower than the respective greater capital city or region.

Capital growth trends across these markets are an important consideration in the financial stability of the Australian housing market. This is because in the event of a ‘forced sale’, growth in home values allows a seller to come away with some capital gain, or allows a mortgagee in possession to recuperate the entirety of debt on a property. In these dwelling markets with high mortgage volumes, capital growth since the 2021 Census has averaged 3.1%, compared to national housing market growth of just 1.0% in the same period. However, there is a large range in capital growth performance from 40.5% in Salisbury, to -8.9% in Gosford.

New listings volumes have generally crept lower across Australia in the past few weeks, as the market enters a seasonal slowdown. However, in the four weeks to 18 June, new listings have risen across 12 of the 25 high mortgage markets.

Across the Blacktown – North market, new listings have increased from 185 in the four weeks to May 2023, to 230 in the past four weeks. Total listings are still low relative to where they have been in the past five years, but the monthly median time on market across Blacktown – North has been rising since February, which may lead to an accumulation of total stock as interest rates continue to climb and buyer uncertainty increases.

Another market that holds some uncertainty is the Melton – Bacchus Marsh region of Melbourne. Total listings are elevated relative to where they have been historically, and the flow of new listings has increased steadily to 312 new properties for sale in the four weeks to 18 June (up 8.7% from four weeks ago). On the other hand, the western suburbs of Melbourne have seen remarkable population growth in recent years, are a popular destination for overseas migrants, and while home values still fell in the three months to May, the pace of decline has been easing.

Are high mortgage markets risky?

There is also a lot of nuance to consider across these markets that is not currently captured in census data. These include the size and maturity of mortgages, and serviceability. At the other end of the spectrum, markets with a low concentration of owner occupier mortgages include inner city areas, and mining towns, and will presumably carry their own risk of investment loans. The location of these investors and what mortgage stress they may be facing is unclear.

At this stage, most markets with a high volume of owner occupier mortgages do not exhibit capital growth trends that are alarmingly out of step with the national housing market. Indeed, some markets have had extraordinary capital gains since the onset of the pandemic, and since the Census snapshot.

However, it is noticeable that new listings volumes are climbing in some of these markets, where the national trend is seeing a seasonal slowdown. This could make it more difficult for recent buyers to make a capital gain if they are struggling to meet mortgage repayments. As buyer demand wanes amid higher interest costs and seasonal trends, there could be an extended downturn in some of these markets as stock accumulates, such as in Melton – Bacchus March. In areas such as Blacktown – North, where values have seen a strong bounce back in the three months to May, as supply creeps up it may put downward pressure on the growth trend in the coming months.