The ‘fixed-rate cliff’ has emerged as one of the biggest potential risks to housing market values, and overall stability in 2023. Eliza Owen explains what the cliff is, and five must-know pieces of information that put the cliff into context.

What is the ‘fixed-rate cliff’?

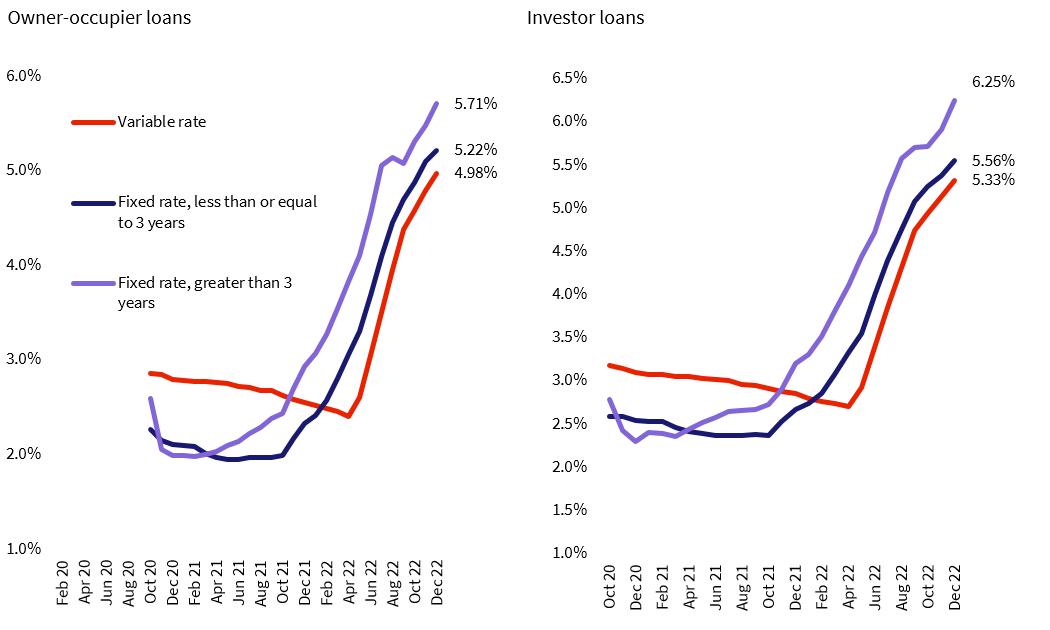

Mortgage rates fell dramatically during the pandemic. This was particularly the case for debt on ‘fixed’ terms (where payments are held steady for a specified period). Short-term fixed loan rates averaged as low as 1.95% in May 2021 for owner-occupiers, as bank funding costs plunged in line with the RBA’s temporary Term Funding Facility and fierce competition among lenders.

Figure 1. Monthly average new lending rates

Source: RBA

Source: RBA

Banks financed around 1.2 million new home loans between January 2020 and October 2021 based on ABS data, when fixed rates were falling and stayed low. Fixed term home lending has historically comprised around 15% of new home loans, however as fixed interest rates plunged to record lows, fixed term home lending surged to 46.0% of new mortgage commitments in July and August of 2021. The RBA October Financial Stability Review noted that about 35% of outstanding housing credit was on fixed terms. This included the fixed component of split loans, so not all of these fixed loans represent the entire debt value of housing purchases.

The RBA noted in the Financial Stability Review that around two thirds of the 35% outstanding fixed mortgage debt would expire in 2023. Hence the ‘cliff’: around 23% of all outstanding mortgage debt will be re-priced over the course of the year, and re-priced at a much higher rate. When fixed terms come to an end, borrowers will need to refinance their loan. Factoring in another 50 basis points of rate hikes over March and April, average variable rates could be around 5.7% for owner-occupiers and over 6.0% for investors.

So how worried should we be about the expiry of fixed-rate terms? The extent of risk is not really known, but here’s five things to know about the looming expiries which may provide some perspective.

1. The pain will be felt most acutely from April 2023

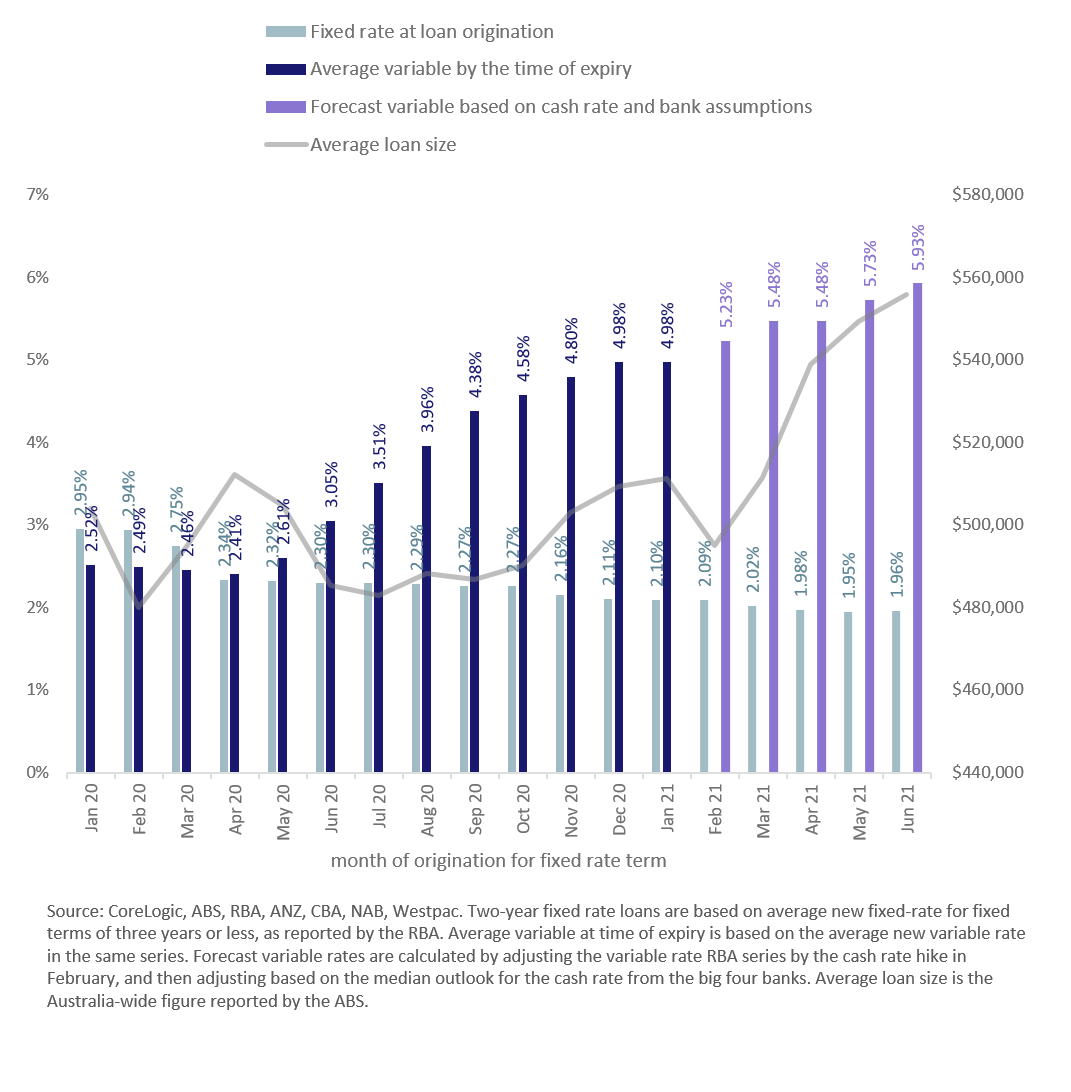

Figure 2 shows the initial repricing from an average two-year fixed term rate during the pandemic, to a variable rate two years later. Not only will the change in rates be stark for expiring fixed terms this year because of more rate rises, but average loan sizes also grew notably from April 2021 during the housing boom.

Figure 2. Initial rate transitions from two-year fixed to variable, based on when the loan was originated

What does the end of a fixed term look like for the average home loan taken out in April 2021? | |

Average loan size | $538,936 |

Fixed rate April 2021 | 1.98% |

Variable rate April 2023* | 5.48% |

Monthly repayment under fixed term | $1,986.63 |

Monthly repayment under new variable rate | $3,053.26 |

Data source: average loan size is the national figure reported by the ABS. Average interest rates as reported by RBA for owner occupier. | |

As more fixed loans revert to variable rates, there is likely to be some challenge to serviceability. Interest rates have risen beyond 3 percentage points for many borrowers, which is the minimum serviceability buffer recommended by APRA in assessing whether someone can repay their debt.

Stretched serviceability could be compounded by an increase in the unemployment rate this year along with higher than budgeted household costs due to high inflation. A rise in distressed sales could also put added downward pressure on property values. If people are forced to sell their home in a declining market, there is the added risk of being unable to recover mortgage debt from the sale of a home.

2. Variable borrowing has a lot to teach us

The RBA reported just under 70% of outstanding mortgage debt was on variable rates in the February Statement of Monetary Policy. Between April 2022 and December 2022, average outstanding variable mortgage rates lifted 263 basis points, while the official cash rate had lifted 300 basis points. Based on average outstanding variable rates with a 30-year loan term and average loan size, a loan secured in April 2022 would see mortgage repayments rise $935 per month by the end of the year.

In other words, the majority of outstanding mortgage debt has already been subject to steep rate rises.

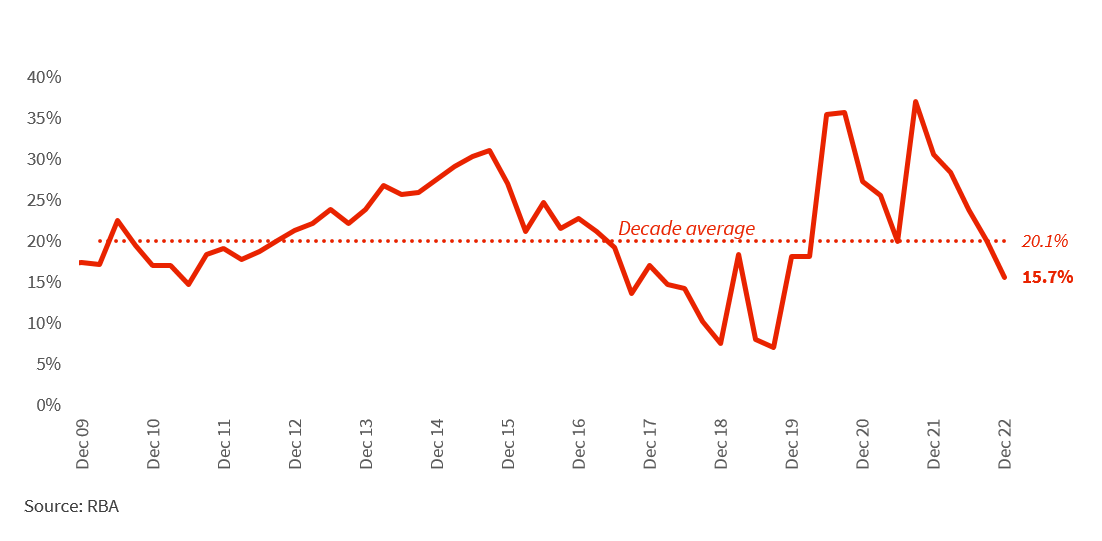

And yet, housing market measures show resilience in mortgaged households. The volume of new advertised properties hitting the market for sale nationally remains contained, trending 14.8% below the previous five-year average. As of December, borrowers were still dedicating 15.7% of housing payments to offset and redraw accounts. However, these contributions are declining, and are below the pre-COVID average of 20.1% (figure 3).

Figure 3. Excess repayments as a share of total mortgage payments

If variable rate holders are coping with rising mortgage rates, will fixed-rate borrowers cope any less? The RBA Financial Stability Review from October last year noted that the current cohort of fixed-rate borrowers have a similar income to variable rate holders, so they should be able to save in a comparable way. Those with split loans were saving a similar amount as full variable rate holders in their offset and redraw accounts. The paper also noted that in 2022, borrowers that rolled onto variable rates quickly transferred large savings into offset and redraw accounts. This suggests that fixed-rate borrowers have also been stowing money away, even if they haven’t had the offset and redraw facilities to put those savings into.

An ongoing risk however, that even variable-rate holders have not experienced the full extent of rate rises, with the cash rate expected to continue rising in the coming months. RBA analysis suggests that there is also a small cohort of households on variable repayments without savings and pre-payment buffers to fall back on, and this may extend to some fixed-rate borrowers.

3. Variable rates are rising, but they can also come back down

The vast majority of new housing finance is currently being taken out on variable home loan terms, following the ballooning in fixed borrowing (only 4.9% of lending went out on fixed terms in December 2022). Alongside most fixed term lending expiring this year, meaning most outstanding housing debt will be exposed to fluctuations in interest rates by the end of 2023.

On one hand, this increases the risk of reduced serviceability as interest rates rise. On the other hand, borrowers may be better positioned to seek a lower interest rate as the cash rate passes a peak, which some believe could be as soon as late 2023. For example, a recent economic note from CBA highlighted that the RBA may need to start reducing rates by the fourth quarter of this year in order avoid a recession. This means while increased variable rates could create tough conditions for households in the short term, the steep hike in interest repayments will not be for the entire life of the loan. With external refinancing hovering around record highs, banks will also be more incentivised to reduce their mortgage rate offerings to stay competitive.

4. Equity remains high… in most markets

Unfortunately for some households, interest costs will rise such that they may fall into arrears, and have to sell. Large value gains in the past few years mean that a relatively small cohort of borrowers may actually fail to pay off their debt with the sale of their home.

Since April 2022, national home values have fallen -8.9% through to the end of January. The median home value across Australia is currently $702,725, back down to around where it was in July 2021. The decline in Australia’s housing markets from respective peaks is highly varied. CoreLogic estimates only 2.9% of suburbs across the country have seen home values fall more than 20% from a recent peak.

Large deposits also help to strengthen the equity position of mortgage holders. RBA assistant governor Brad Jones recently noted that around 0.5% of home loans were in negative equity amid current price falls. If home values were to fall a further 10%, the RBA estimates the rate of loans in negative equity would only rise to around 1%.

5. It will take a while to see an impact

Are we seeing signs of distress in the housing market from a data perspective? No, and it will take a long time to show.

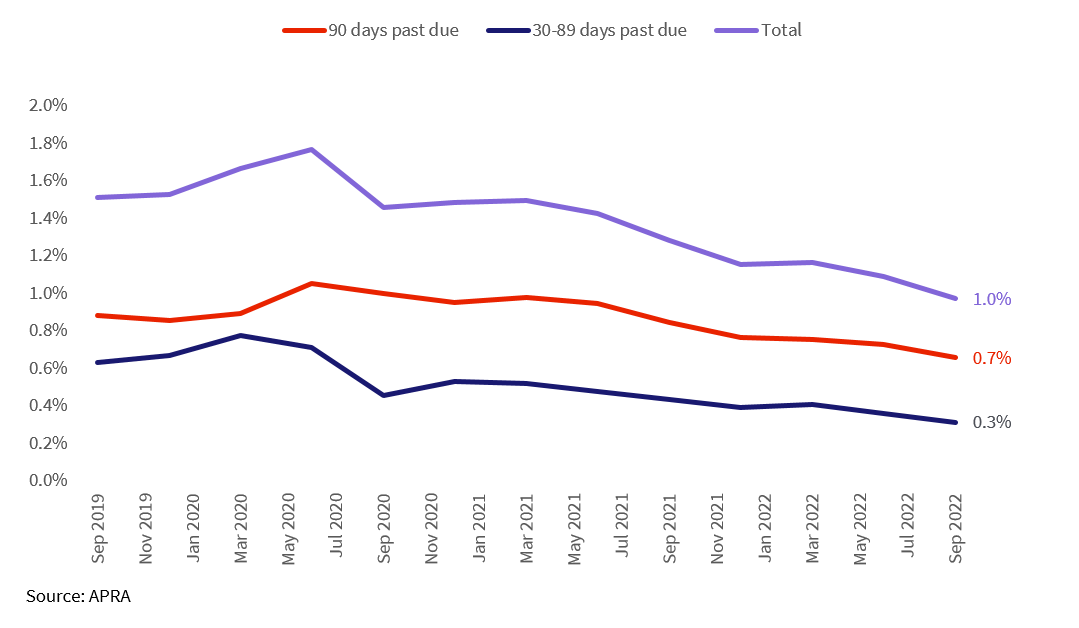

Official data on ‘non-performing’ loans is produced by the banking regulator APRA on a quarterly basis. The latest publicly available data is to September 2022, and non-performing loans themselves are generally considered repayments that have not been made for 90 days or more. The September quarter data showed only 1.0% of home loans were at least 30 days past due (figure 4), and has been falling. But this reporting period only captures around two-thirds of interest rate increases seen to date.

Understanding the impact of rising rates on some households is difficult, because different income cohorts and support networks will vary in their response to higher interest costs. For example, some people may be able to move in with parents and rent out their home to supplement mortgage payments. People on higher incomes can also generally expend a higher portion of their income on housing.

Institutions will also be working proactively to avoid mass loan defaults in the housing market. Banks may put temporary forbearance measures in place, as with ‘mortgage repayment holidays’ at the onset of the pandemic. For example, distressed borrowers may have the option to extend their loan term, thereby reducing their monthly repayments, or temporarily revert to interest-only repayments.

Figure 4. Portion of home loans with late payments

Notably, the ‘mortgage repayment holiday’ period also saw the rise of a ‘cliff’ narrative. In the end, the deadline for resumption of payments was extended by banks. There did not appear to be any material impact on the property market by the time those deferrals expired, though the economic and housing value context was starkly different then, to what it is now.

Looking ahead, there’s no escaping that Australians with fixed-rate loans are about to see a painful adjustment. This is partly the intention of rising rates, as households have to curb spending in response to higher interest costs. So far, listings data and arrears data suggest there is minimal impact on the housing market from defaults. However, the true test of the market will be over the next ten months.

Download 'Five things to know about the fixed-rate cliff'