ABS figures this week show quarterly headline inflation was 1.9% for December, an increase from 1.8% in the September quarter. Annual inflation was 7.8%, close to the Reserve Bank of Australia (RBA) forecast that headline inflation would peak at 8% over the year.

More importantly, underlying core inflation (the RBA’s preferred reading on inflation), which is measured by trimming excessively volatile components of CPI, actually fell in the quarter, from 1.9% in September to 1.7%. Annual core inflation is still a long way from the 2-3% target range set by the RBA, at 6.9%. However, December marked the first fall in quarterly core inflation since March 2021, following eight consecutive interest rate rises from May 2022.

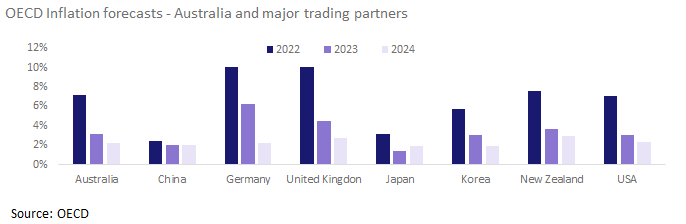

Despite headline figures surprising to the upside this quarter, the worst of inflation could still be behind us. Inflation across the combined OECD slowed to 1.8% in the September 2022 quarter, after peaking at 2.1% through June. Forecasts from the OECD also suggest a fall in inflation through 2023 across most major economies, as global economic demand starts to slow.

In Australia, many housing market metrics suggest the rate of growth in new build costs and rents is slowing, while falling property prices and volume of sales are taking heat of the economy indirectly. The housing component has the highest weighting of any sub-group, so a slower rate of growth in housing costs is a key factor that should support a further reduction in both core and headline inflation.

Signs a softer housing market is taking some heat out of the economy

- Housing costs were still up a substantial 1.9% in the quarter, but this was down from a 3.2% lift in the three months to September.

- The volume of household goods demanded has eased from recent highs through to the end of 2022, as fewer home sales may equate to less demand for new appliances and furnishings.

- Labour markets remain tight, job vacancies have started to curtail in the rental, hiring and real estate and financial services industries.

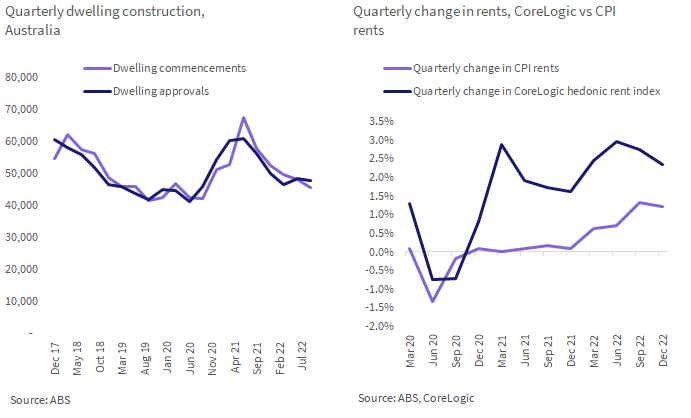

- As interest rates have risen, the pipeline of new dwelling approvals and commencements have also eased, which may take further pressure out of the construction sector and costs of new home builds. CoreLogic’s Cordell Construction Cost Index report also showed a sharp decline in the rate at which construction costs increased through the December quarter (at 1.9%), compared to the September quarter (4.9%).

- Growth in CoreLogic rent valuations, a leading indicator of CPI rents, also showed an easing trend in the December quarter. Growth in capital city rent valuations slowed to 2.3% in the December quarter of 2022. This was down from 2.7% in the previous quarter, and a recent peak of 3.0% in the three months to June.

How this will impact the housing market in 2023

The extent to which inflation slows down in 2023 will determine whether the RBA needs to keep tightening, or can hit pause on rate hikes. Therefore, the inflation outlook remains important to the housing outlook.

In the year ahead, inflation may be subject to the competing forces of falling global demand, but rising demand from China as the country moves away from zero COVID. The potential for extreme weather events should also be kept in mind, as this can impact production capacity, and lead to inflation spikes.

Given the slightly stronger than expected headline inflation result for December, along with the fact that core inflation remains well outside the RBA’s target range, a further increase in interest rates seems likely for February, and possibly March. This will likely mean further falls in housing demand and values in the months ahead. However, with inflation potentially moving through a peak, we are likely to see interest rates peak lower than some forecasters were expecting last year.

Once interest rates stabilise, we would expect consumer sentiment to improve alongside a gradual stabilisation in housing prices.