In this article, CoreLogic Head of Research Eliza Owen explores the surge in short-term resales as a significant housing trend in 2023.

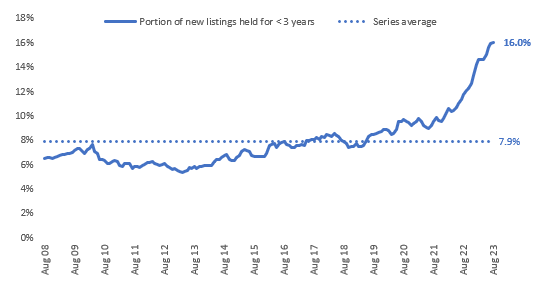

Short-term resales have emerged as a major housing market trend in 2023. New CoreLogic analysis shows that in winter, 16% of listings added to the market for sale had been owned for less than three years. This marks a series high going back to 2008, where the 15-year average proportion is less than half that (7.9%). The underlying number of new listings held for three years or less also reached a series high of 17,828.

Figure 1. Portion of new listings held for < 3 years (Australia wide, all dwellings)

Short-term resales can occur for many reasons, including people ‘flipping’ homes, making large capital gains, or moving for work. But in an environment where interest rates have risen rapidly and cost of living pressures are high, resales due to mortgage serviceability constraints may also be a contributor. The accelerated rise of short-held listings (where the previous sale date was in the past three years), is distinctly noticeable from May 2022, when the underlying cash rate started to move higher from record lows.

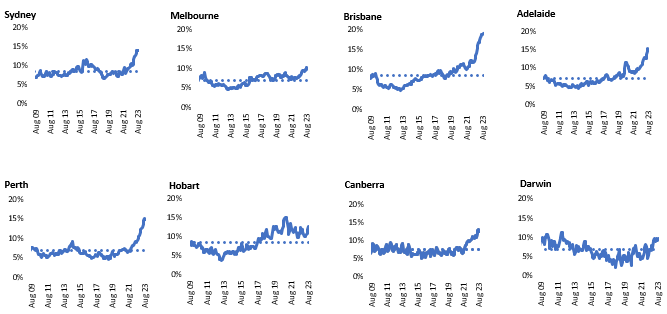

There is also a marked difference between the trend in regional Australia and the capital city markets. Proportionately, the uplift in short-held listings is higher in regional Australia, where a fifth of all new listings added to the market through winter had only been purchased in the past three years (or as early as September 2020).

This is an interesting trend to emerge in the context of COVID-19, which was associated with record-levels of internal migration to regional Australia. Data from the ABS showed net movements to regional Australia from capital cities hit almost 12,000 in the March quarter of 2021, up from a previous decade average of 5,298. By March 2023, the latest (provisional) ABS figures show net regional migration has eased back to 5,645 in the quarter. It is possible that some of the recent departures from regional Australia are some of those who moved to the regions through COVID, which may be associated with the sale of a property purchased through the pandemic.

However, it is worth noting that the rise in short-held new listings was trending higher in regional Australia before the pandemic, from around mid-2019. This was in an environment of falling interest rates, and was near the trough of the downturn in regional Australia from 2019.

Figure 2. Portion of new listings held for < 3 years and series averages (capitals versus regions, all dwellings)

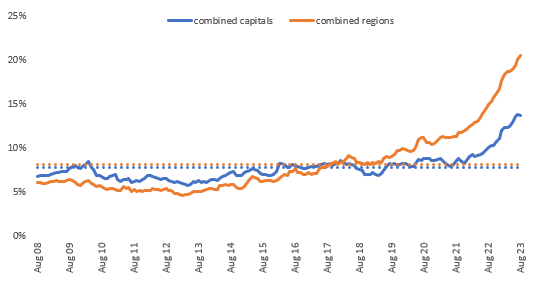

Across the capital city markets, the trend in short-held listings has been broad-based. Brisbane had the highest concentration of short-held listings through winter, comprising 19.2% of all listings added to the market. Interestingly, the rest of Queensland also had the highest portion of the combined regional markets at 23.8%. Like the broader regional market, south-east Queensland was an exceedingly popular internal migration location through the pandemic. The charts below summarise the portion of short-held new listings added to the market on a rolling three-month basis. With the exception of Hobart and Darwin, each of the capital cities is showing near-record high proportions of short-held listings coming to market through winter.

A more granular breakdown of the data at an SA4 level shows the highest concentrations of short-held listings were in Wide Bay (29.6%), Cairns (26.2%) and the Gold Coast (25.8%). In the case of Cairns and Wide Bay, this is more than triple the historic average concentration of new listings held for less than three years, and was around double the rate for the Gold Coast. The lowest concentrations were across Melbourne, including Melbourne – Inner (7.0%), Melbourne – Outer East (9.6%) and Melbourne – North East (9.6%).

Figure 3. Portion of new listings held for < 3 years and series averages (greater capital cities, all dwellings)

Are short-held resales anything to worry about?

Housing is typically not an asset that is traded quickly or easily. This is because of high transaction costs (a cost of both time and money) associated with stamp duty, financing, moving, and more. This can be an inconvenience for the seller, more so if they make a loss from the sale.

However, the recent phenomenon of short-term reselling is unlikely to result in a loss of broader financial stability, especially while housing market values are rising. In fact, periods of strong capital gain can be associated with short-term reselling, because the seller can realise a strong profit which can offset high transactional costs or might be put towards buying a higher quality property.

Figure 4 is a useful indicator of whether vendors on short-held properties might expect to sell at a profit or a loss. It plots the portion of short-held listings where the advertised price is less than the previous sale price.

Figure 4. Portion of short-held listings where listing price < previous sale price (Australia wide, all dwellings)

The portion of properties listed for less than the previous sale price has been rising through 2022. This was also seen in our latest Pain and Gain report, which showed 9.7% of properties held for 2 years or less actually sold for a loss. The latest listings data indicates 18.0% of short-held properties listed were lower than the previous purchase price. But that is lower than the series average (which was 18.2%), and the rate has moved down slightly from the three months to July.

Interestingly, the recent pain around short-term resales was at the onset of COVID, when 28.3% of vendors who had recently bought listed their property for less in the March 2020 quarter. The underlying number was also higher during that period than through winter 2023.

Considering these different factors suggest that there might be more to recent short-term sell offs than high interest rates, and the possibility of falling behind on mortgage payments. Part of this may be a reversal of COVID-related migration trends to the regions, or even the realisation of recent strong gains, particularly in markets across Queensland, South Australia and Western Australia where capital gains have been especially strong despite recent rate rises. For these states in particular, a rise in short-term resales has done little to drive up total listing volumes, and selling conditions remain strong. The more home values rise, as they are expected to in the near term, the more short-term resales are de-risked in terms of servicing outstanding debt.