Australia’s auction market is expected to start with a whimper rather than a bang when it returns in full next week, despite a slight seasonal uptick in clearance rates and volumes in the final months of 2022.

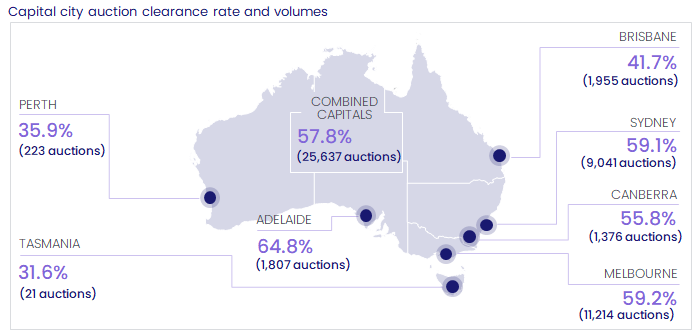

CoreLogic’s Quarterly Auction Market Review shows 25,637 properties went under the hammer across the combined capitals with a clearance rate of 57.8% in the December quarter. It was a marginal improvement on September’s quarterly figures of 23,087 auctions and a 56.4% clearance rate, but still well below the decade average of 65%.

CoreLogic Research Director Tim Lawless said since peaking in March 2021, quarterly auction clearance rates have been trending lower, with the December 2022 quarter the first to show some, albeit small, improvement.

For the entire year, 103,911 properties went under the hammer across the combined capitals, resulting in an annual clearance rate of 61.2%.

There were 116,711 residential auctions held for the same period in 2021, and a clearance rate of 74.0%.

“Auction volumes were well below the numbers seen only 12 months ago, when a record breaking 42,918 homes were taken to auction across the combined capitals over the December 2021 quarter, the busiest quarter since CoreLogic auction records commenced in 2008,” Mr Lawless said.

“The clearance rate during that time was also significantly higher at 71.3%, which reflects the feverish buyer activity in late 2021 given the record low interest rate environment, tight stock levels and rapidly rising housing prices.”

Mr Lawless said the slight improvement in the December quarter figures was most visible through the first two months of the quarter with the combined capital cities clearance rate holding around the high 50% to low 60% range. In December, clearance rates trended lower, finishing the year in the low 50% range.

He noted below average clearance rates have been accompanied by a trend towards fewer home sales.

“Over the past two decades during each of the downturns, we’ve seen the volume of home sales drop by about 25%, which is remarkable given every downturn has been different,” he said.

“The trend in home sales through the current downturn is likely to be similar, with annual sales already down an estimated 17% from the December 2021 peak. Private treaty metrics are showing a similar trend to the auction market, with homes taking longer to sell and vendors applying larger discounts.”

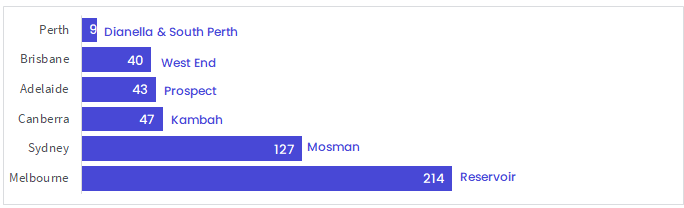

Highest number of auctions for the quarter across capital city suburbs

(Based on total auctions held across the suburb over the reporting period)

Capital city auction trends

Adelaide recorded the highest clearance rate across the capital cities for the fourth consecutive quarter, with 64.8% of auctions returning a successful result over the three months to December.

Melbourne’s clearance rate of 59.2% was second highest, followed by Sydney (59.1%) and Canberra (55.8%). At 41.7%, Brisbane recorded its lowest quarterly clearance rate since June 2020 (34.2%), Perth had a clearance rate of 35.9%, while almost one in three properties auctioned in Tasmania sold under the hammer.

Melbourne was the busiest auction market, with 11,214 homes taken to auction, followed by Sydney with 9,041 auctions. Brisbane was the busiest of the smaller capital cities (1,955), followed by Adelaide (1,807), Canberra (1,376) and Perth (223). There were just 21 auctions held in Tasmania over the December quarter.

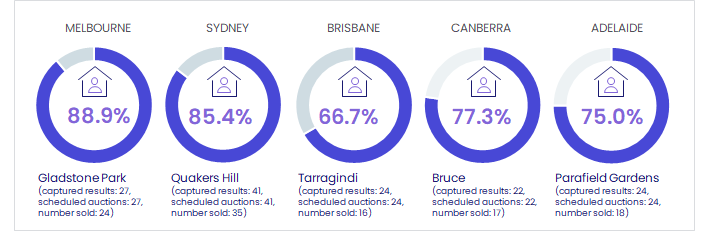

Highest clearance rate for the quarter by capital city suburbs

(Clearance rates are calculated when there have been at least 20 auction results reported over the period)

Auction outlook

Mr Lawless said the final week of January and first few weeks of February would provide more clarity around vendors willingness to go to auction and whether buyer confidence has picked up.

“When clearance rates start being reported again through late January and February it’s likely we’ll see them recommence where they left off at the end of 2022, particularly in the larger auction cities of Sydney and Melbourne and to a lesser extent Canberra, where more listings go under the hammer,” he said.

“We also anticipate at least one more rate hike which means we’re likely to see fewer properties go to auction as vendors may not be willing to test the market, opting to hold their property off the market altogether or list via a private treaty campaign.”

A full city-by-city suburb analysis, where at least 20 auction results were reported over the December quarter, can be found in the report.

Download the latest Quarterly Auction Market Review