The amount of cheap, fixed-term finance picked up through the pandemic is rolling over and is gradually on a downward curve, whilst new housing finance has been trending higher. What could this mean for valuation volumes in 2024?

With COVID now well and truly behind us, and peak market conditions tapering, there are a few interesting factors playing out, although it’s still a tale of two markets – purchases and refinances.

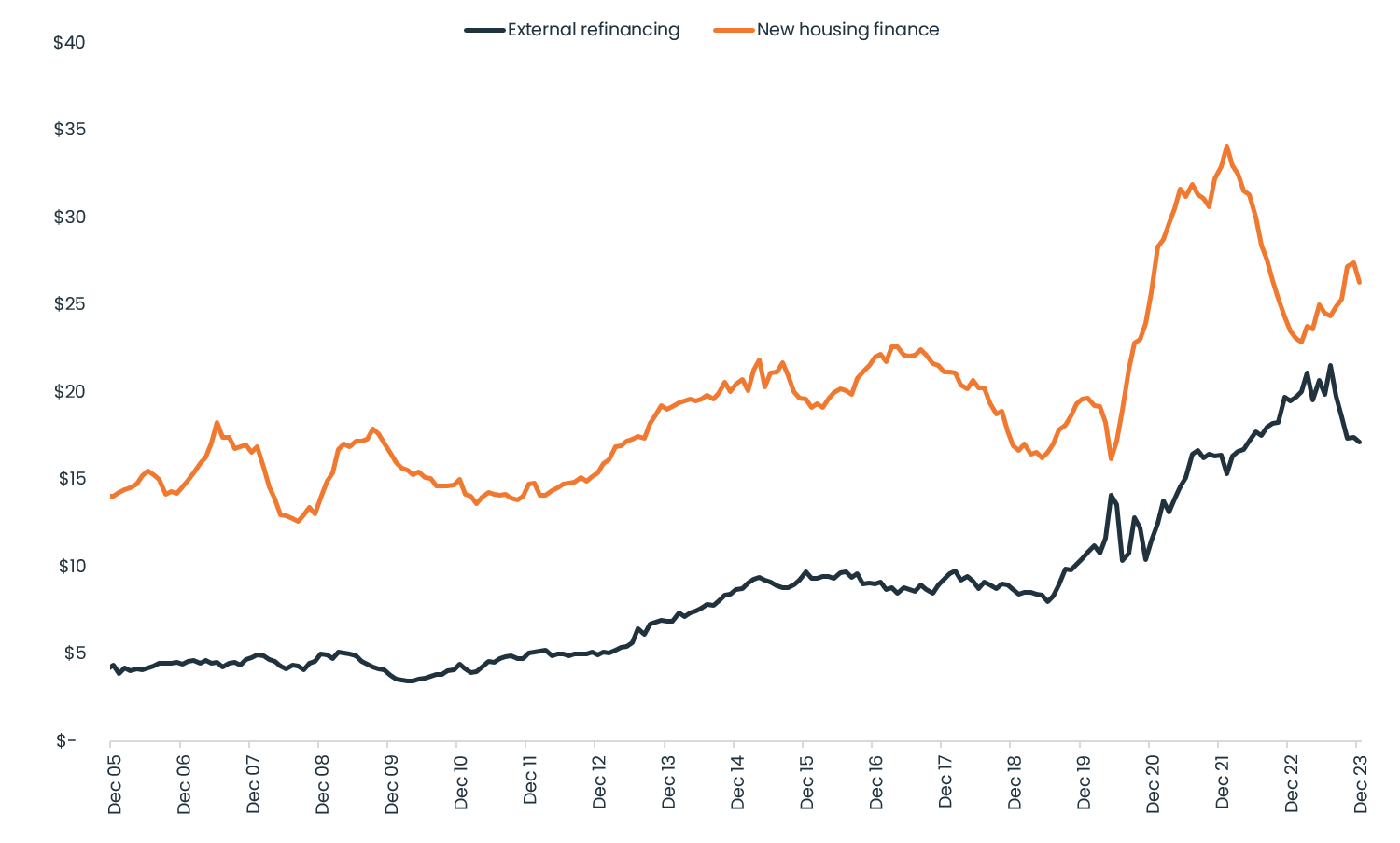

The monthly value of external refinancing reported by the ABS in November was down by 20.5% from highs in July 2023, with reduced competition among the major banks and the withdrawal of cashback offers. The amount of cheap, fixed-term finance picked up through the pandemic is rolling over and is gradually on the way down, which is also contributing to reduced urgency for refinancing.

New housing finance on the other hand, where money is secured for the purchase of housing, generally trended higher (despite a sharp fall in the month of December). This aligns well with slightly above-average purchasing activity toward the end of 2023.

In 2024, we expect refinancing to continue trending lower, while new housing finance is expected to continue rising, albeit at a slightly slower pace than in 2023. This could potentially offer stable valuation volumes in the longer term. The chart below shows the current housing finance trends reported monthly by the ABS:

Monthly value of housing finance - refinance versus new ($ billions)

Source: ABS

The RBA estimates the number of fixed loan facilities ending is expected to lower in 2024, from 880,000 in 2023 to 450,000 in 2024. This is likely to reduce the incidence of “sticker shock” for borrowers and the urgency to refinance. However, 450,000 still is an elevated level of fixed-rate expiries, so this should keep a floor under refinancing activity, keeping it higher than the pre-COVID average.

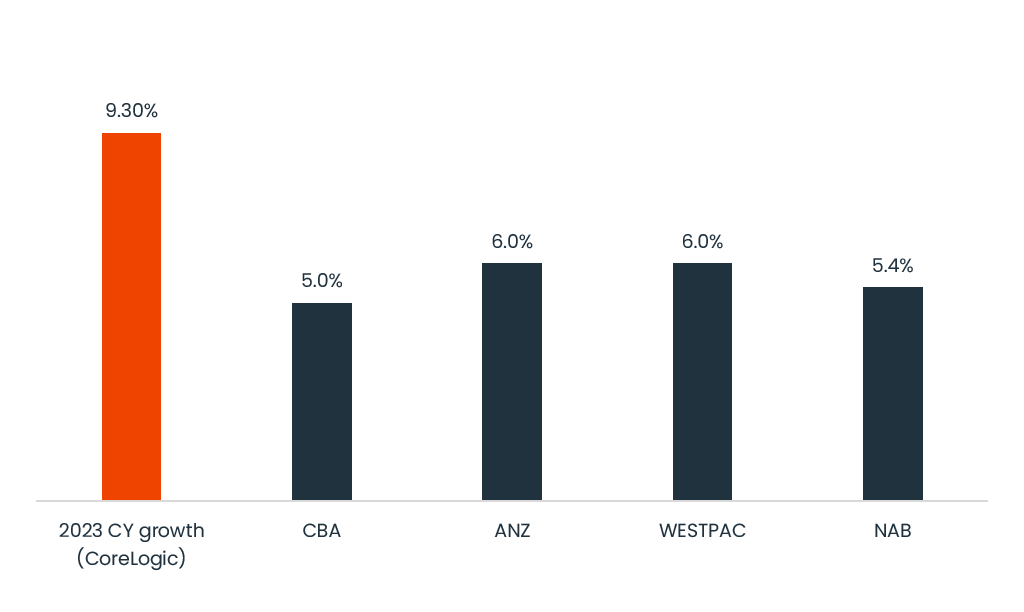

The major banks have slightly increased their capital growth forecasts, with the median outlook now at +5.7% for the combined capital cities. Expectations are that we are now at the peak in the cash rate with inflation generally trending down in line with RBA forecasts.

Summary of combined capital city dwelling market forecast for CY 2024

Source: CoreLogic, ANZ, CBA, NAB and Westpac

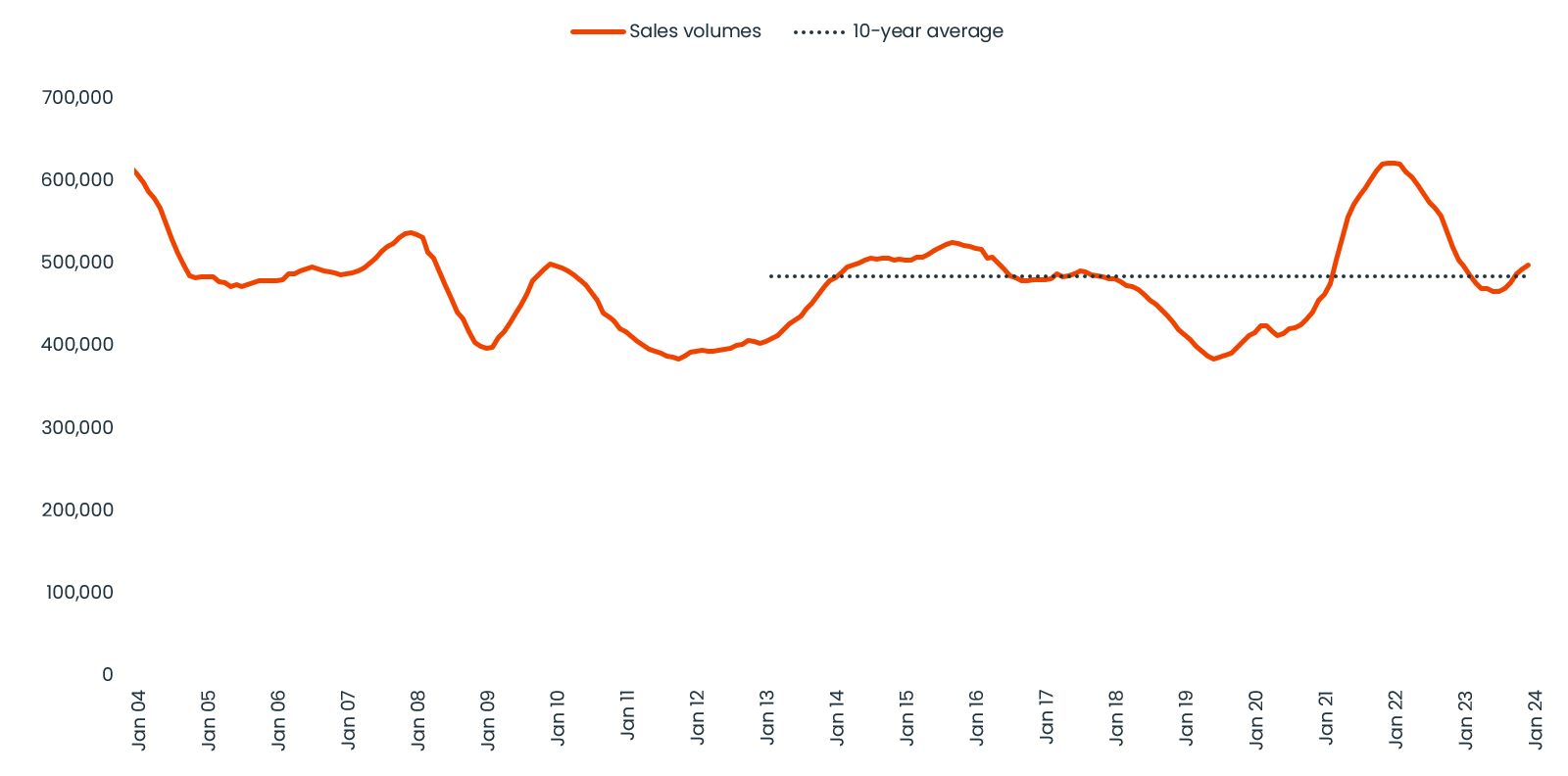

The revised outlook also suggests stronger sales activities to follow, with potential for more concentrated sales volumes in Spring if we see a reduction in the cash rate by then. This may result in a slight increase in purchase valuations, with the chart below showing annual sales volumes already starting to trend higher than the decade average of circa 480,000:

Rolling 12-month volume of sales, national

Source: CoreLogic

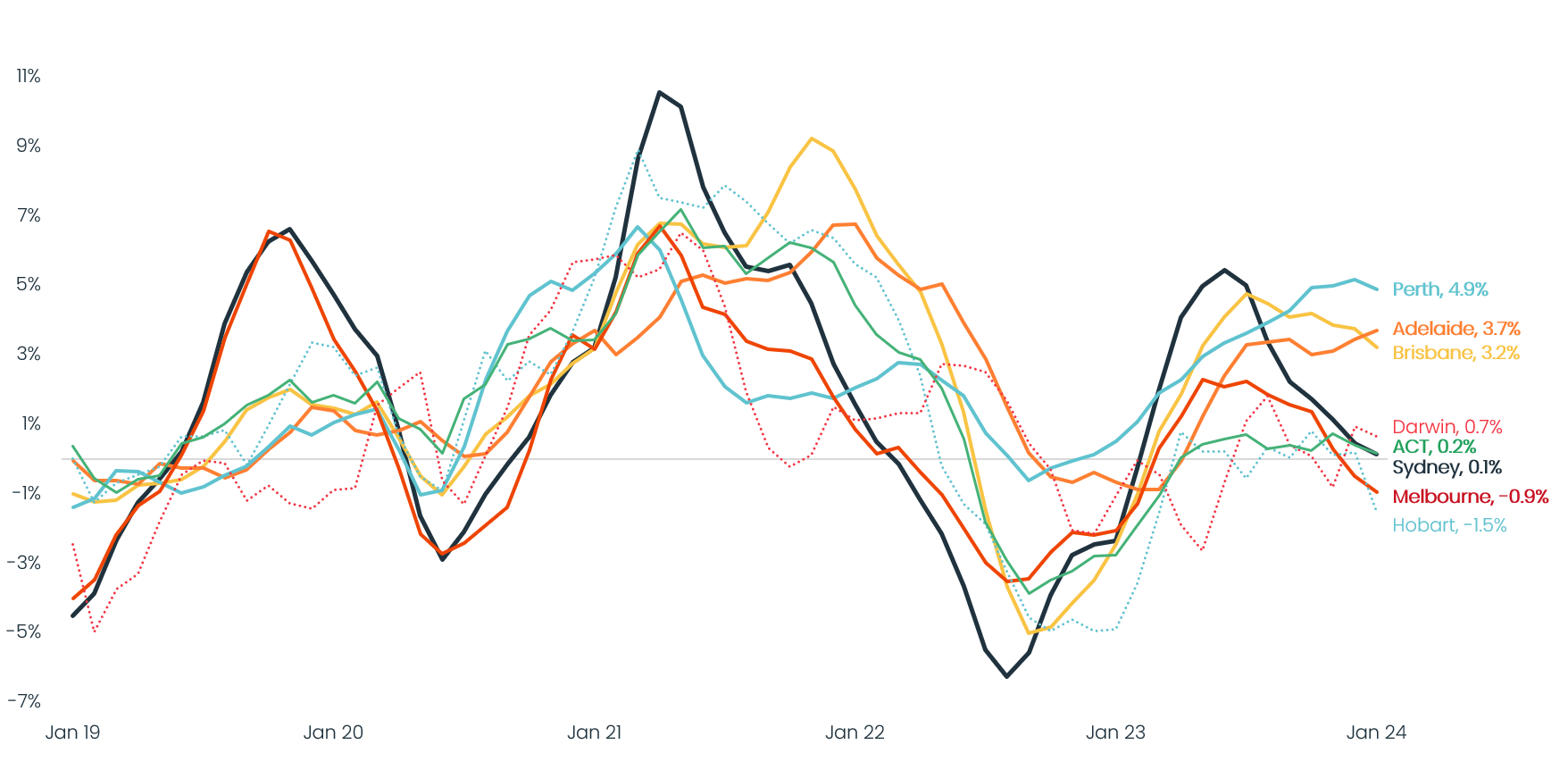

Advertised stock levels for dwellings are now trending higher across Sydney, Hobart, ACT and Melbourne than in previous years, which is reflected in softer value growth across those cities – Adelaide, Brisbane and Perth are still looking critically under-supplied and strong capital growth trends persist.

Quarterly capital growth rate in capital city dwelling markets

Source: CoreLogic

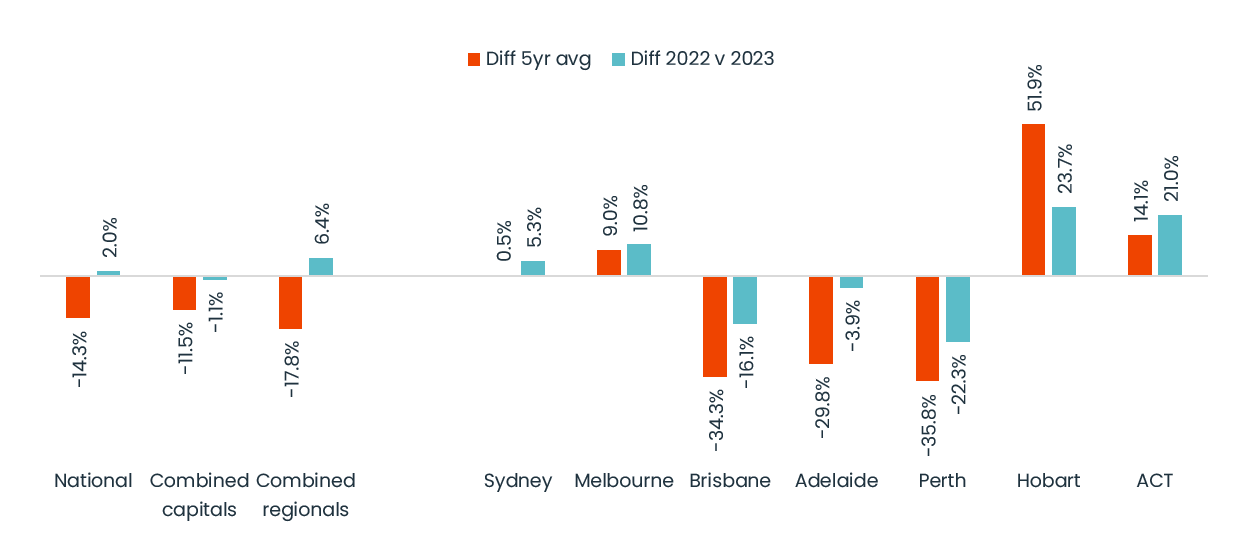

Chang in total listings (Nov 2022 v Nov 2023 and Nov 2023 v 5-year average)

Source: CoreLogic

While the outlook is for a slight uptick in sales and home values in 2024, some factors could see a weaker, or stronger outlook for the housing market.

Headwinds for the market include affordability constraints, low consumer sentiment and rising unemployment. However, market tailwinds include extremely elevated levels of net overseas migration. Treasury puts the net overseas migration forecast at around 375,000 for this financial year, before settling to 250,000 in the following financial year. Most recent arrivals are renters, but with rental market conditions remaining fairly tight, we expect that there may be some wealthier migrants at the margins who opt to try and buy instead.

All in all, it feels like we are in for a fairly steady year in regard to valuation volumes with no significant peaks or troughs. But as we all know, there is always something brewing in the world of valuations, so I’m sure it will be an eventful year nonetheless.

All the best to everyone, and looking forward to an exciting 2024!