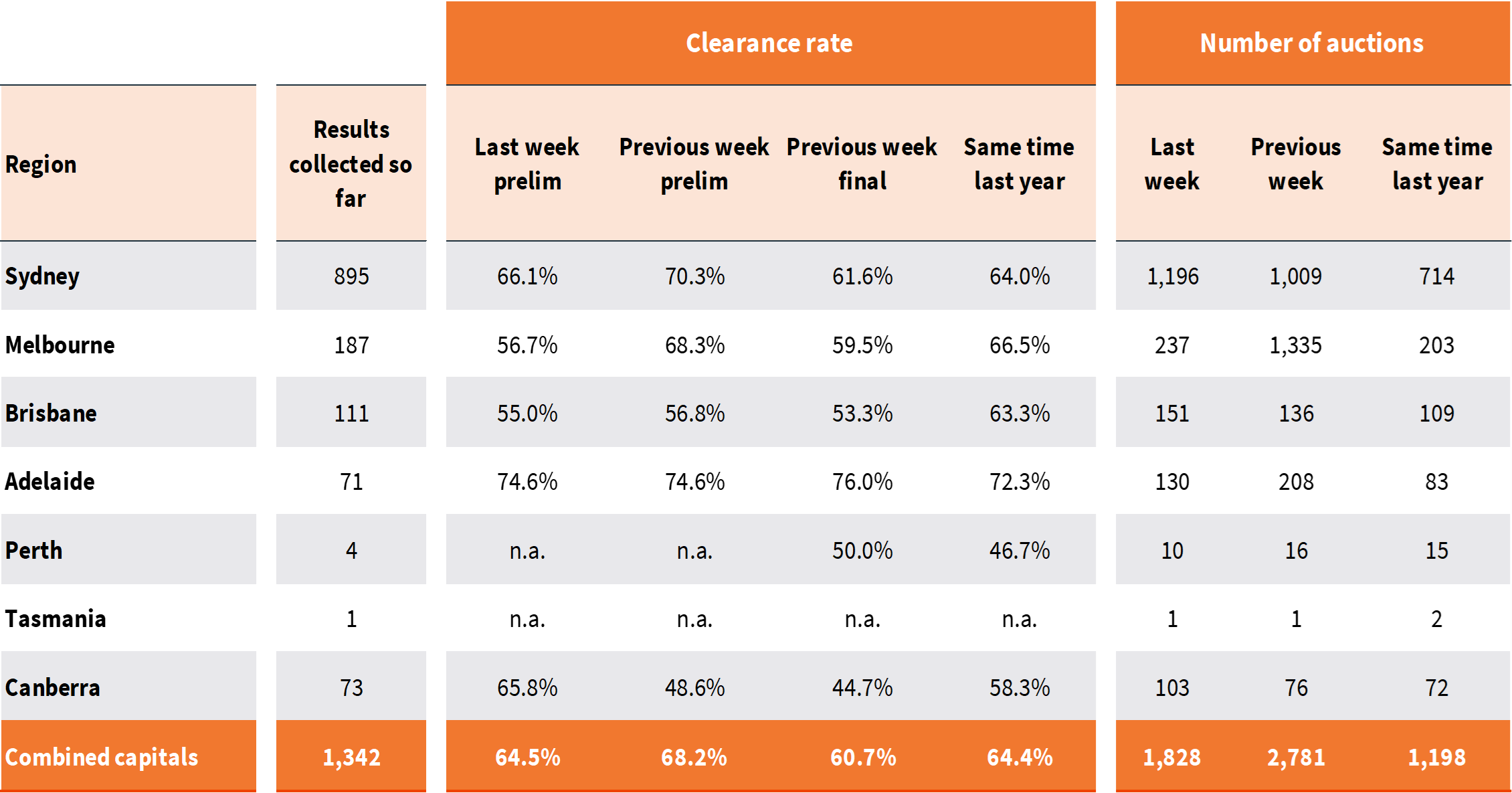

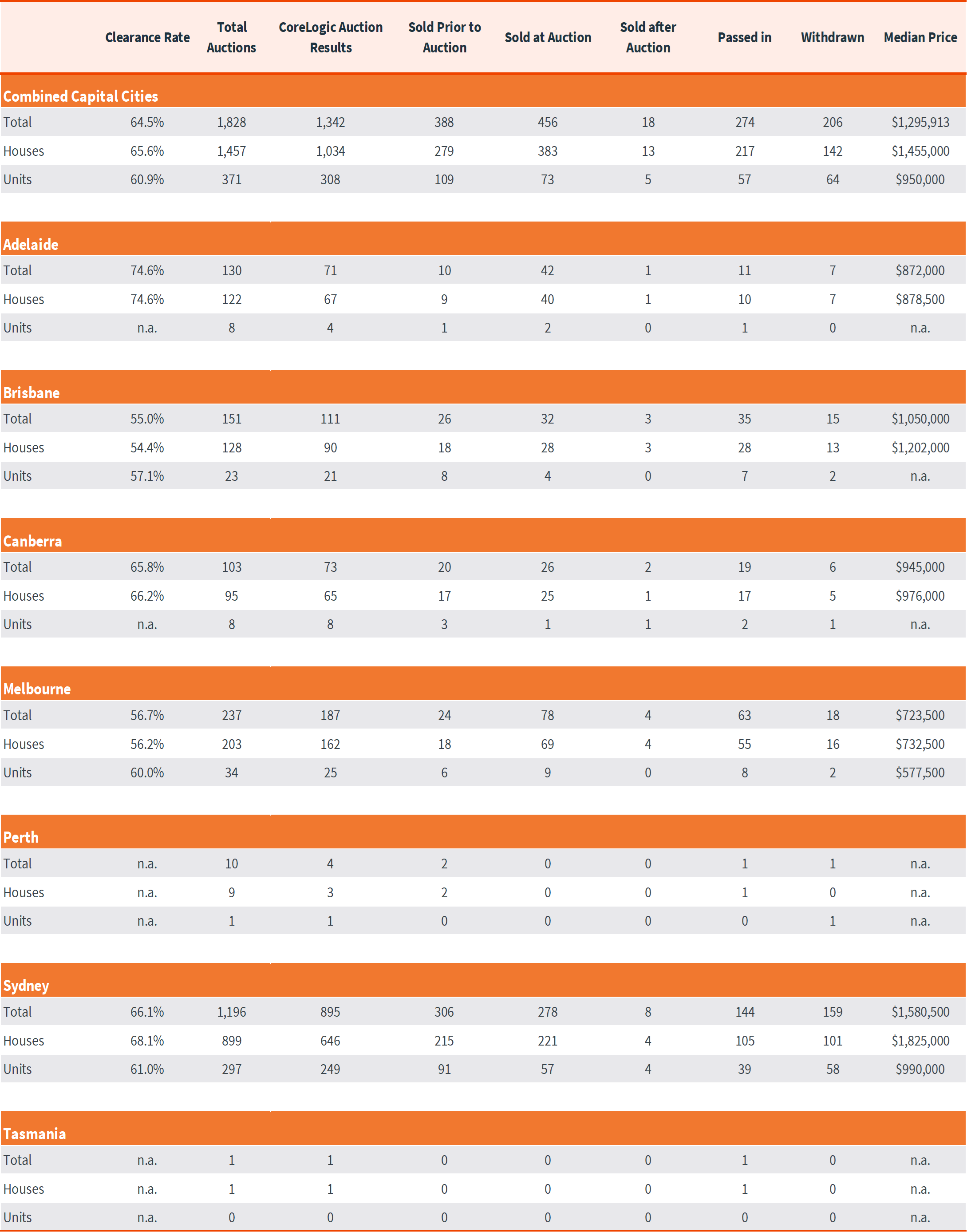

The volume of auctions held last week dipped to 1,828, down 34% from the previous week (2,781) as the Melbourne auction market paused amid the grand final long weekend.

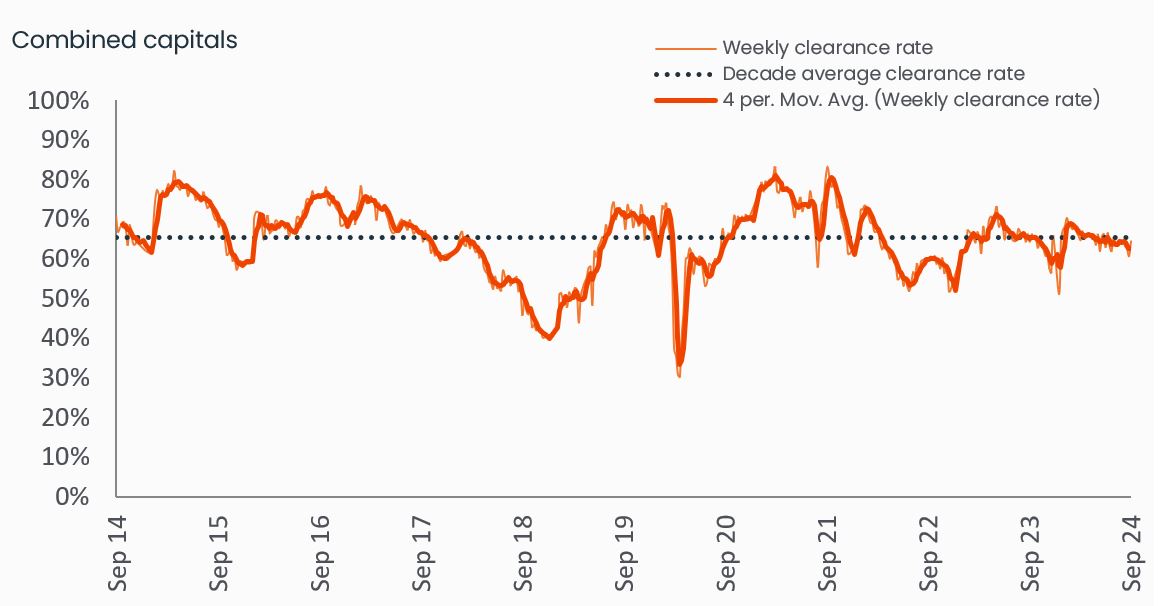

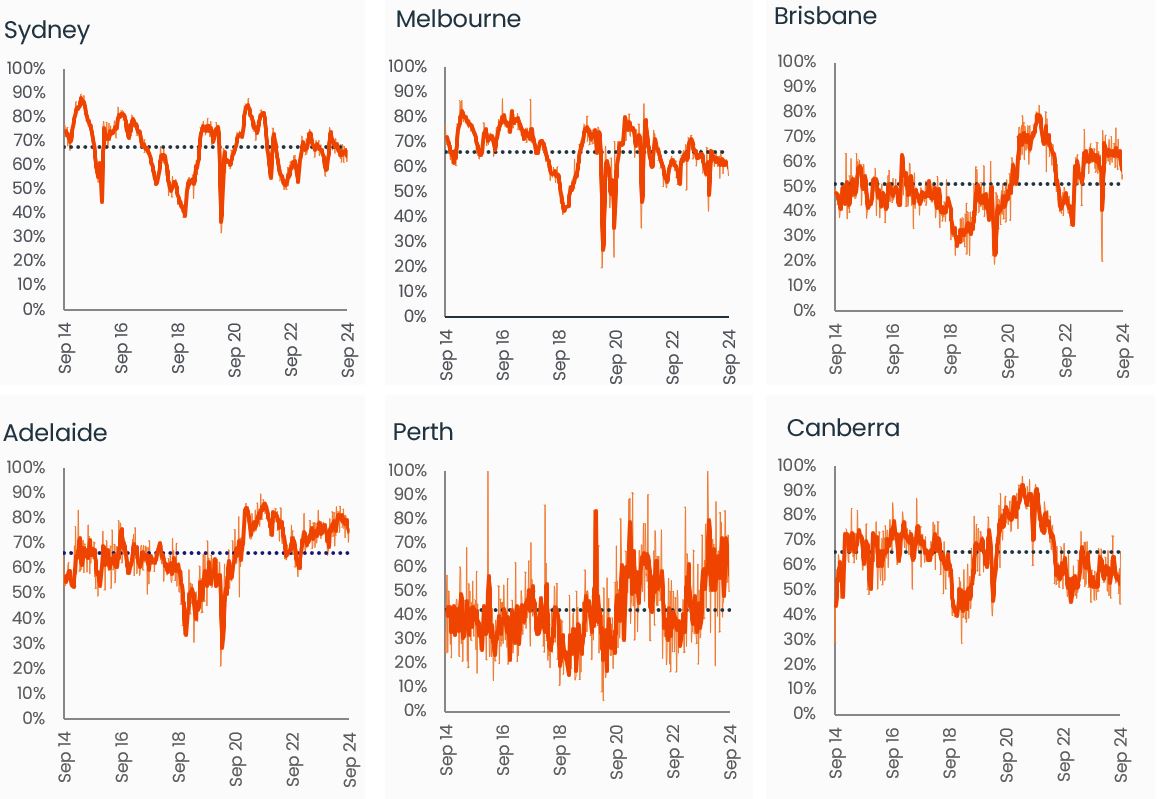

The preliminary auction clearance rate fell sharply last week, coming in at 64.5% across the combined capitals; the lowest early clearance rate since December 2022 when preliminary results held below 60% through most of the month. The previous week saw a preliminary clearance rate of 68.2%, which revised down to 60.7% (the lowest finalised clearance rate since mid-December last year at 56.6%).

Historical clearance rates utilise the final auction clearance rate, while the current week is based on the preliminary clearance rate.

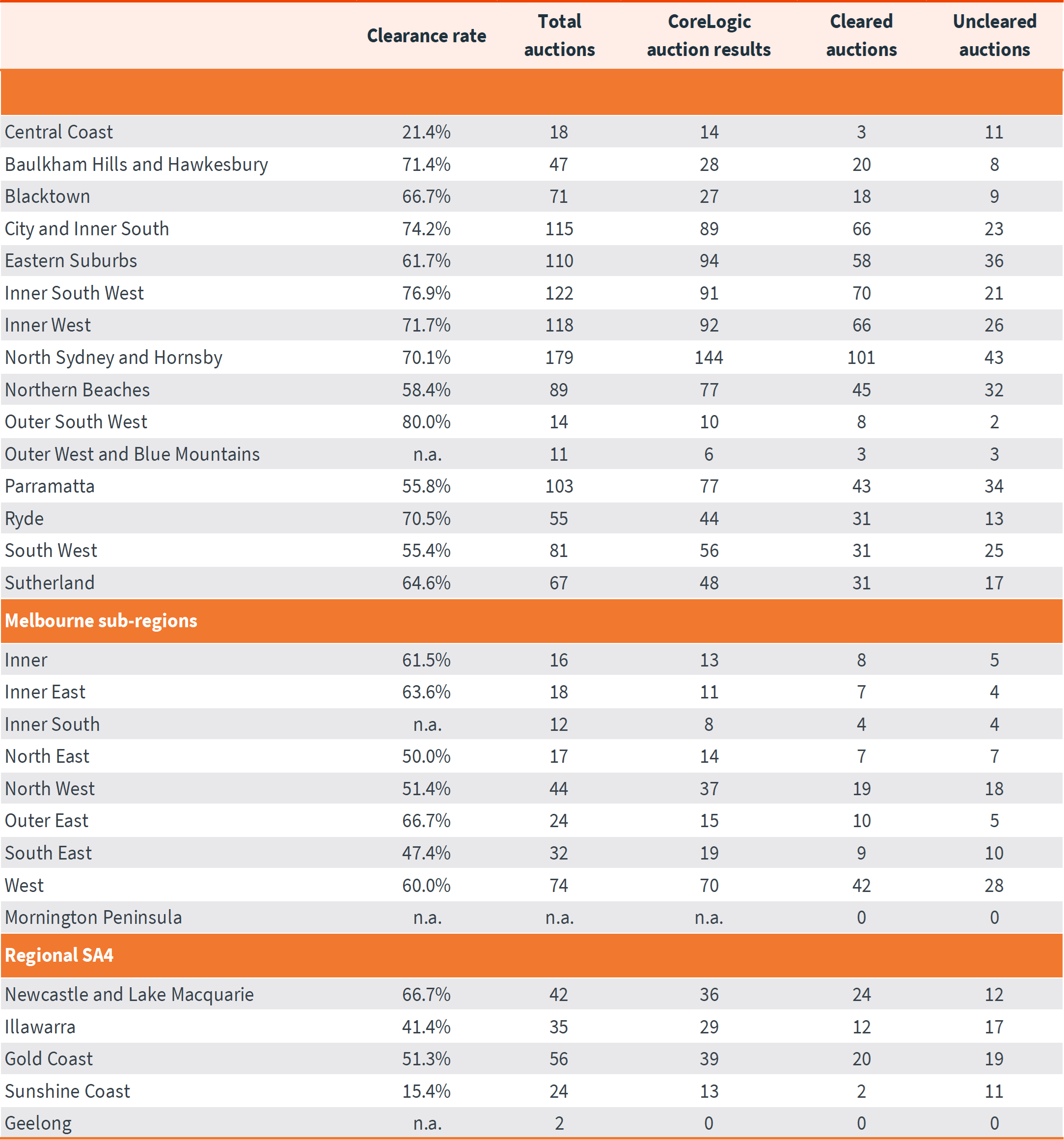

Sydney hosted the largest number of auctions, with 1,196 homes going under the hammer, roughly on par with the number of auctions held in the week leading into the Easter long weekend (1,199). Prior to that, this was the most auctions held in a week since the week ahead of Easter 2022 (1,490). Sydney’s preliminary clearance rate fell to 66.1% last week, down 4.2 percentage points from the previous week (70.3% which revised down to 61.6% once finalised).

Only 237 auctions were held in Melbourne as the market paused for the AFL grand final. Buyer’s also seemed to be distracted, with the preliminary auction clearance rate falling to 56.7%, the lowest preliminary rate since mid-July of 2022 (55.6%) and down 11.6 percentage points from the previous week’s preliminary auction clearance rate (68.3% which revised down to 59.5% on final numbers).

The above results are preliminary, with ‘final’ auction clearance rates published each Thursday. CoreLogic, on average, collects 99% of auction results each week. Clearance rates are calculated across properties that have been taken to auction over the past week.

Across the smaller auction markets, Brisbane held the most auctions with 151 homes going under the hammer, returning an early clearance rate of 55.0%, which was the lowest since the last week of April 2023 (43.0%). 130 auctions were held across Adelaide, down from 208 the week prior, with the preliminary clearance rate holding at 74.6% (same as previous week). 103 auctions were held across the ACT with a preliminary clearance rate of 65.8%.The volume of auctions scheduled this week is set to bounce back above the 2,000 mark, with more than half of the scheduled auctions to be held in Melbourne.

CoreLogic, on average, collects 99% of auction results each week. Clearance rates are calculated across properties that have been taken to auction over the past week.

Download Property Market Indicator Summary