With 2,387 auctions held over the week, last week was the busiest for homes going under the hammer since the week prior to Easter, when 3,519 auctions were held. Last week’s auction volume was up 13% on the week prior and was the fifth busiest week so far this year.

The number of auctions scheduled for this week is set to rise further, with around 2,800 auctions currently scheduled, before dropping back the week after due to the AFL grand final long weekend.

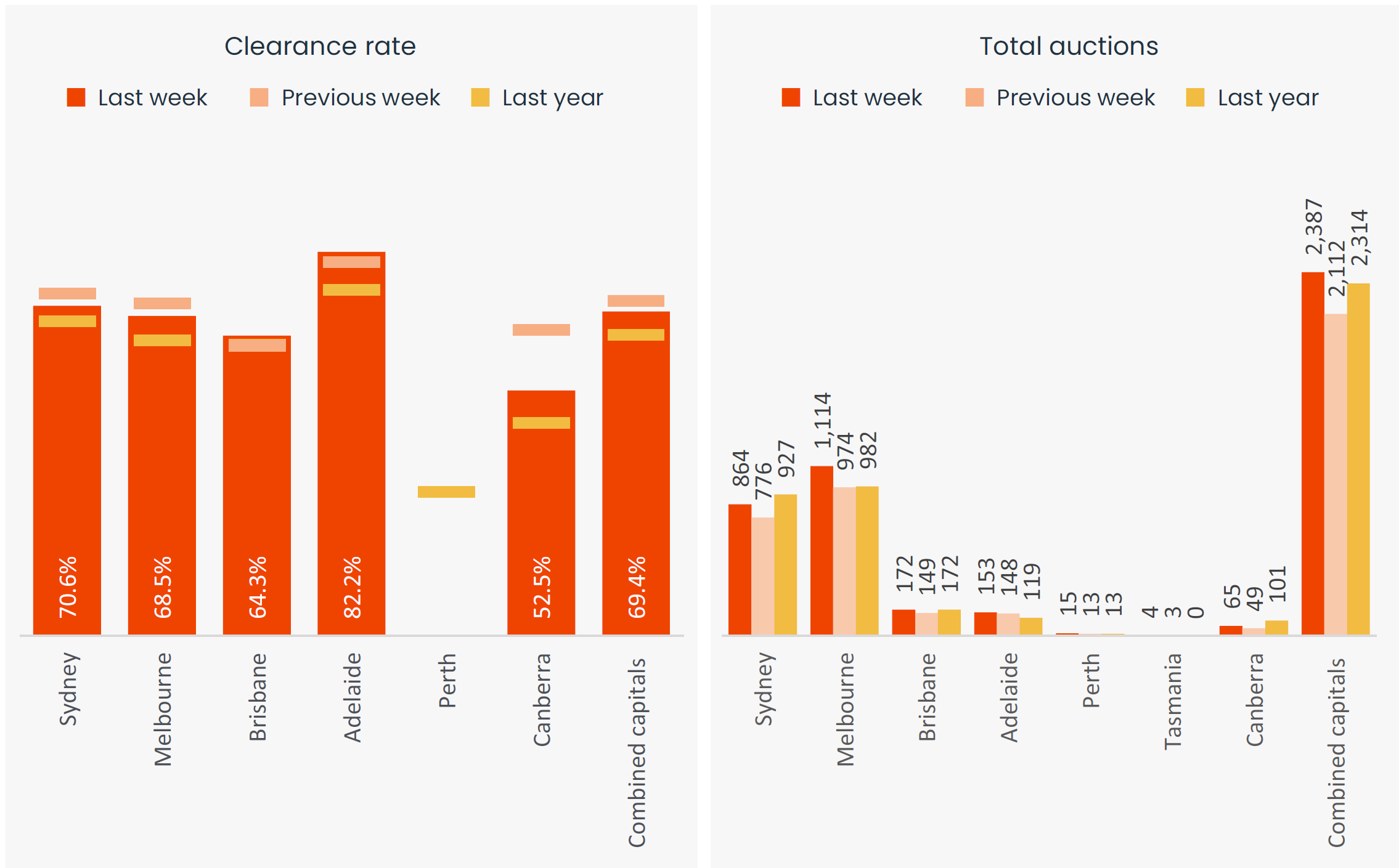

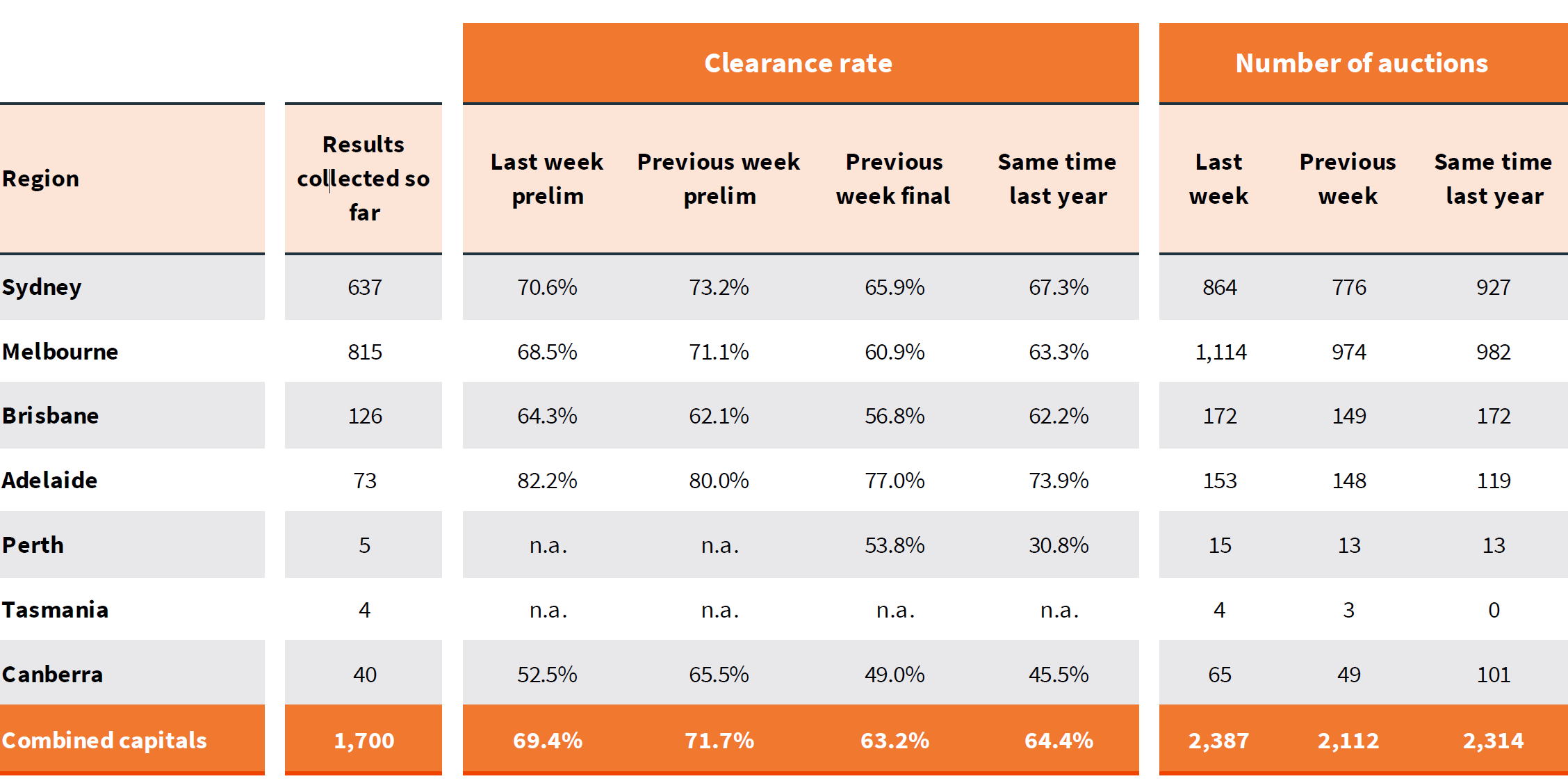

The preliminary auction clearance rate fell below the 70% mark for the first time in six weeks, coming in at 69.4%. This is down from the previous week’s preliminary result of 71.7% which revised down to 63.2% on final numbers.

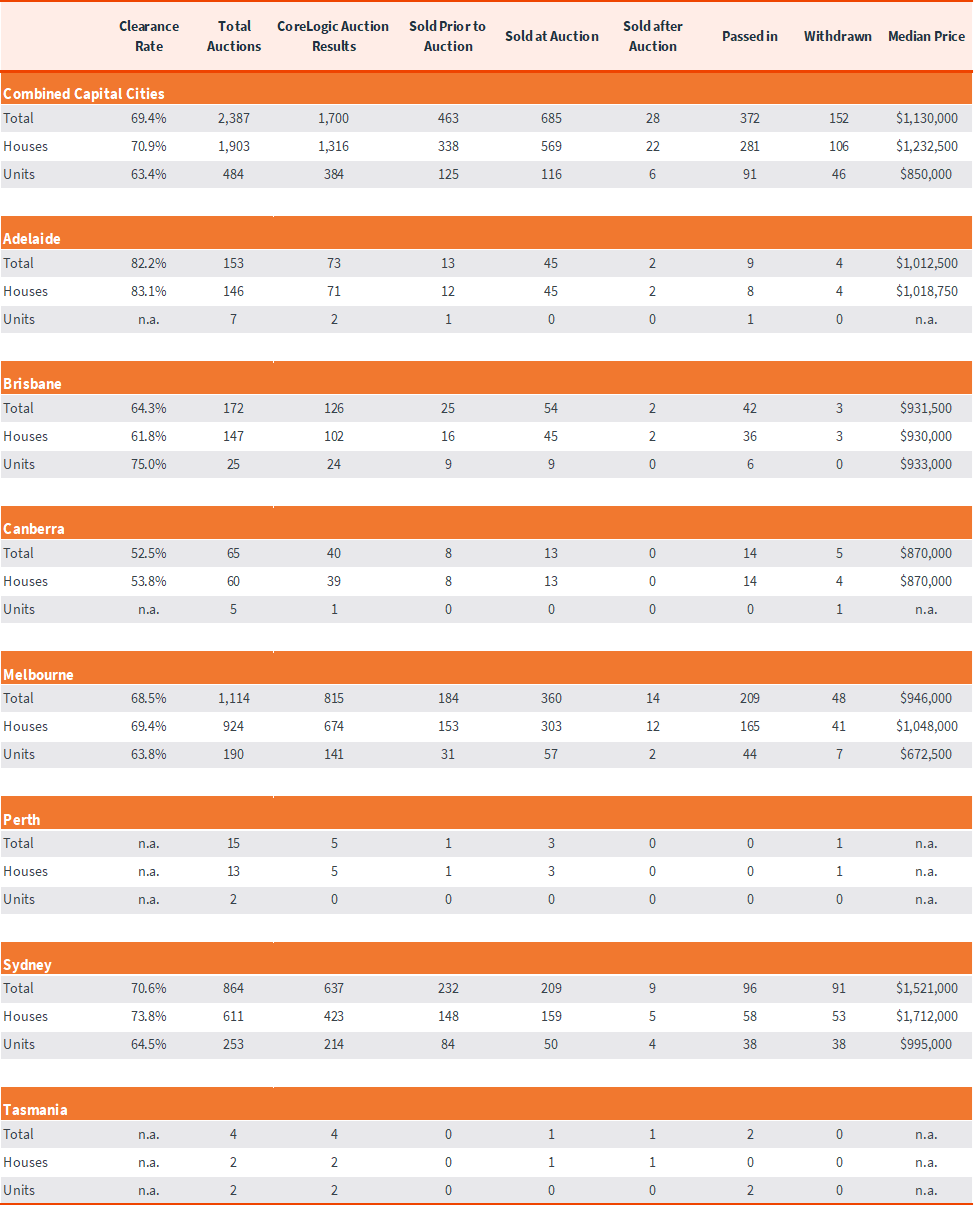

Capital City Auction Statistics (Preliminary) – headline results

Melbourne hosted the most auctions, with 1,114 homes coming to market, the city’s highest auction count since the week leading into Easter (1,760). The preliminary clearance fell to 68.5%, 2.6 percentage points lower than the week prior (71.1%, which was revised down to 60.9% once finalised). Around 1,300 auctions are scheduled for the coming week across Melbourne.

864 auctions were held across the Sydney housing market last week, 11.3% higher than the previous week. The preliminary clearance rate reduced to 70.6%, 2.6 percentage points lower relative to the week prior (73.2% which revised down to 65.9% once finalised). Around 1,050 auctions are scheduled for this week, rising to around 1,250 the week after.

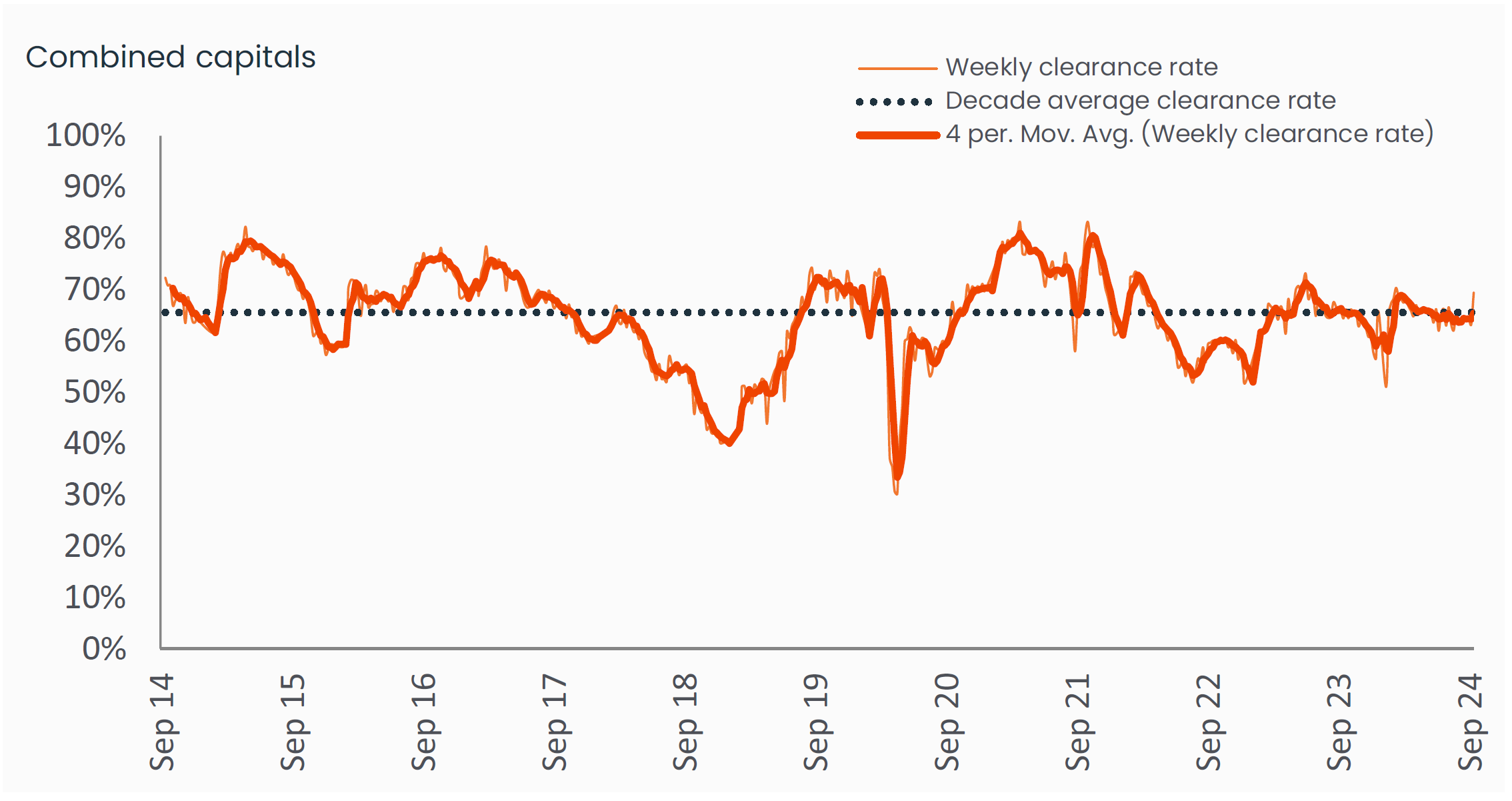

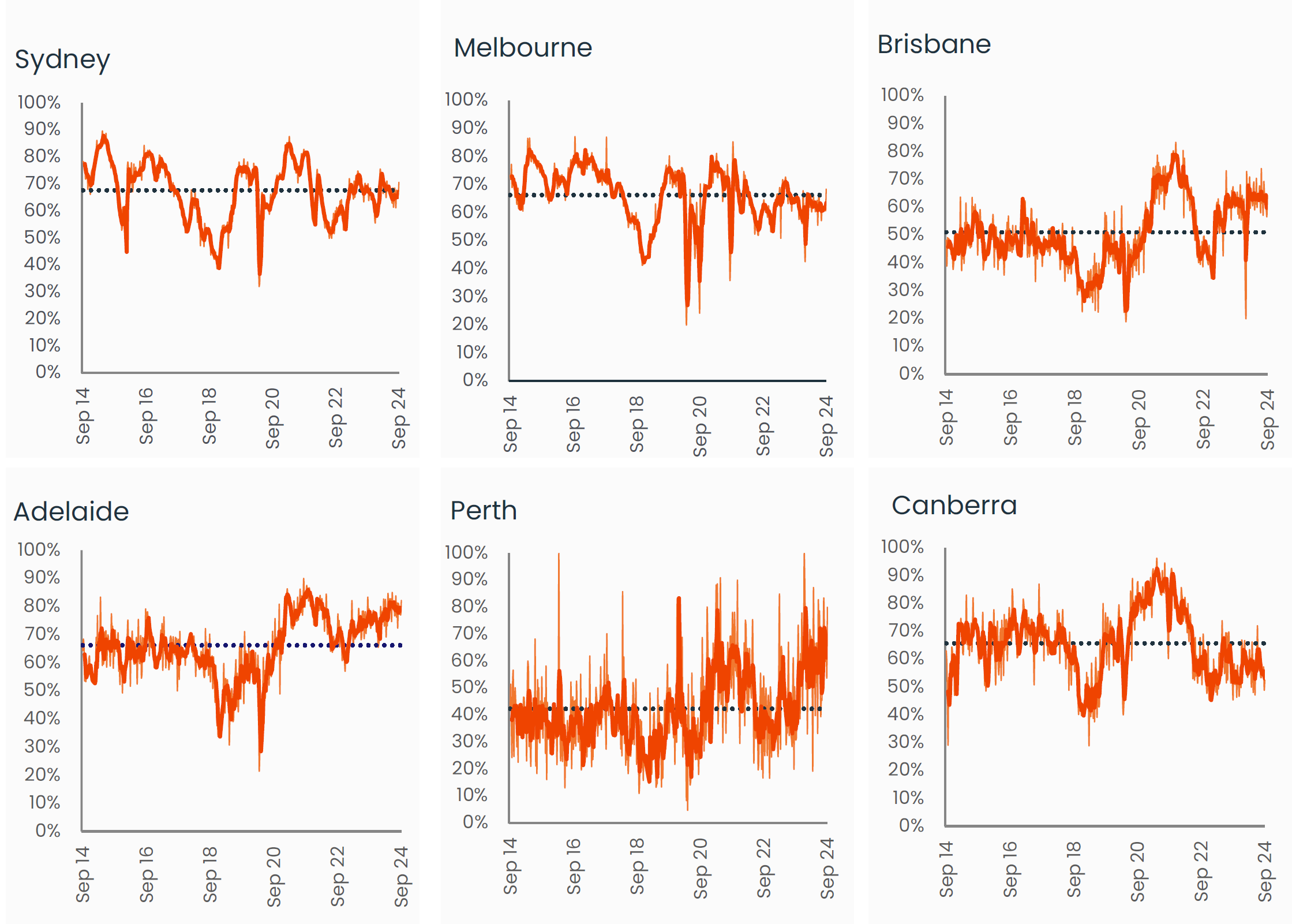

Capital City Auction Statistics over time

Historical clearance rates utilise the final auction clearance rate, while the current week is based on the preliminary clearance rate.

Brisbane led the smaller auction markets in terms of volume, with 172 homes taken under the hammer, returning a preliminary clearance rate of 64.3%. Adelaide continued to record an 80%+ preliminary clearance rate, with 82.2% of the 153 auctions so far reporting a successful result. 65 auctions were held across the ACT with an early clearance rate of 52.5%.

More broadly, CoreLogic is reporting a higher-than-average flow of new listings coming to market. The four weeks ending September 15th saw almost 42,000 freshly advertised properties listed for sale, 5.8% higher than at the same time last year and 16.5% above the previous five-year average. The rise in advertised stock levels is great news for buyers, who benefit from more choice, but sellers will need to be aware of the heightened competition, with advertised supply levels likely to rise further through spring and early summer.

Capital City Auction Statistics (Preliminary)

The above results are preliminary, with ‘final’ auction clearance rates published each Thursday. CoreLogic, on average, collects 99% of auction results each week. Clearance rates are calculated across properties that have been taken to auction over the past week.

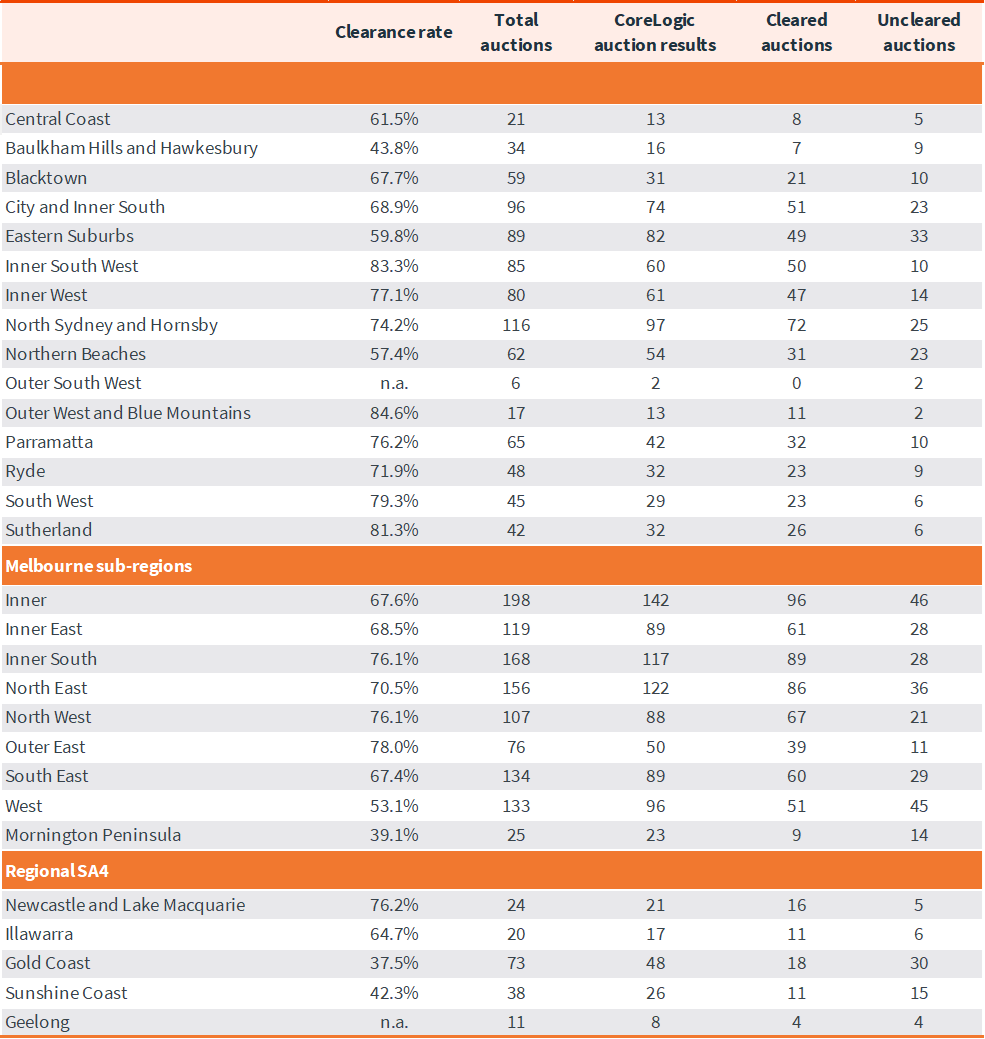

Sub-region auction statistics (preliminary)

CoreLogic, on average, collects 99% of auction results each week. Clearance rates are calculated across properties that have been taken to auction over the past week.

Download Property Market Indicator Summary