Australia Key Findings - (Page 1 of 7)

Cautiously Optimistic 2025 Ahead

The 2025 outlook builds on the cautious optimism seen in 2024:

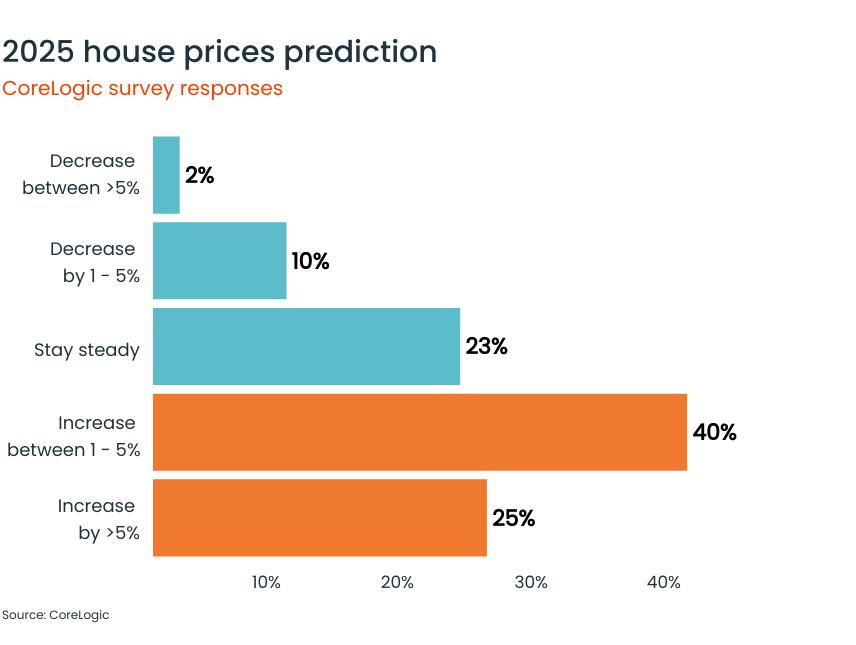

- 65% of agents anticipate house prices will rise, up from 57% in our 2024 survey.

- 25% expect growth to exceed 5%, reflecting a 12% increase from last year’s prediction

This growing confidence is underpinned by improving affordability, rising household incomes, and easing interest rates, although some affordability challenges may persist early in the year.

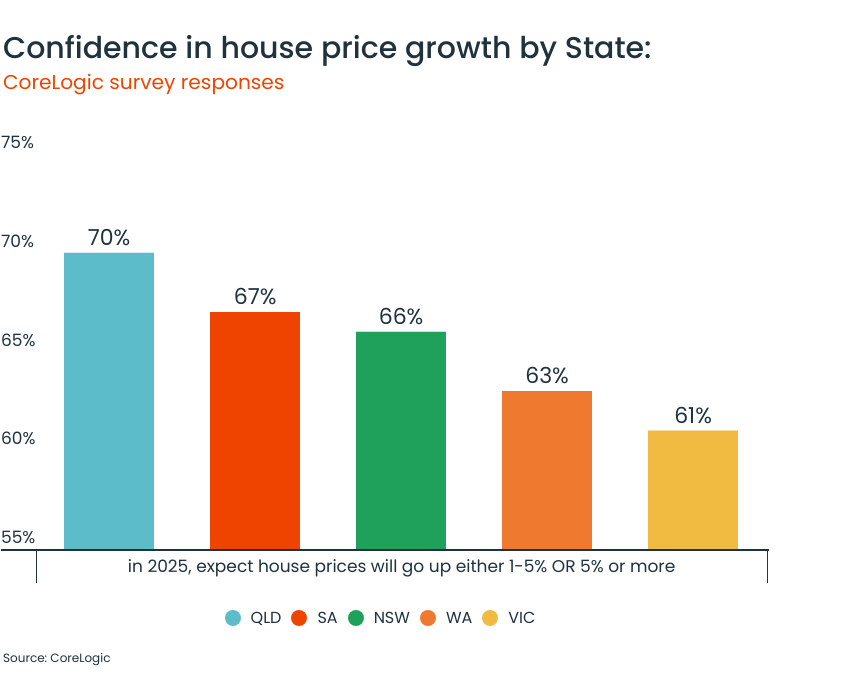

Sun to continue to shine on Queensland

Strong internal migration trends have solidified Queensland’s position as the market to watch, with 70% of respondents forecasting price growth in 2025

Melbourne the one to watch

While median dwelling values remain 6.4% below their 2022 peak, Melbourne’s affordability advantage is setting the stage for renewed demand.

“Melbourne has established an affordability advantage and could experience improved capital growth performance in 2025, driven by lower interest rates, higher real incomes, and better affordability,” CoreLogic’s Head of Australian Research, Eliza Owen said.

Australia Key Findings - (Page 2 of 7)

Key Metrics to Watch in 2025

While the start of 2025 might bring subdued activity, signs of recovery are expected to emerge later in the year, driven by improving household savings and easing interest rates.

"Improving household savings and easing interest rates are expected to drive demand later in 2025, even as supply challenges persist," Ms Owen said.

However, she cautioned the recovery pace is likely to be more modest compared to the 4.9% value growth achieved in 2024, with agents needing to navigate ongoing challenges in affordability and stock availability.

On the frontline of market shifts, agents will be closely monitoring:

- Appraisal numbers

- Open home foot traffic

- Auction clearance rates

These indicators will provide early signs of a market recovery, particularly in the year’s second half.

“Agents are at the coal face of turning sentiment, whether it’s lacklustre auction bidding, sparse open homes, or reduced enquiry levels,” Ms Owen said.

“CoreLogic data can help frame that shift with localised insights, empowering the conversations agents are having with buyers and sellers.”

Australia Key Findings (Page 3 of 7)

First-Home Buyer New Realities

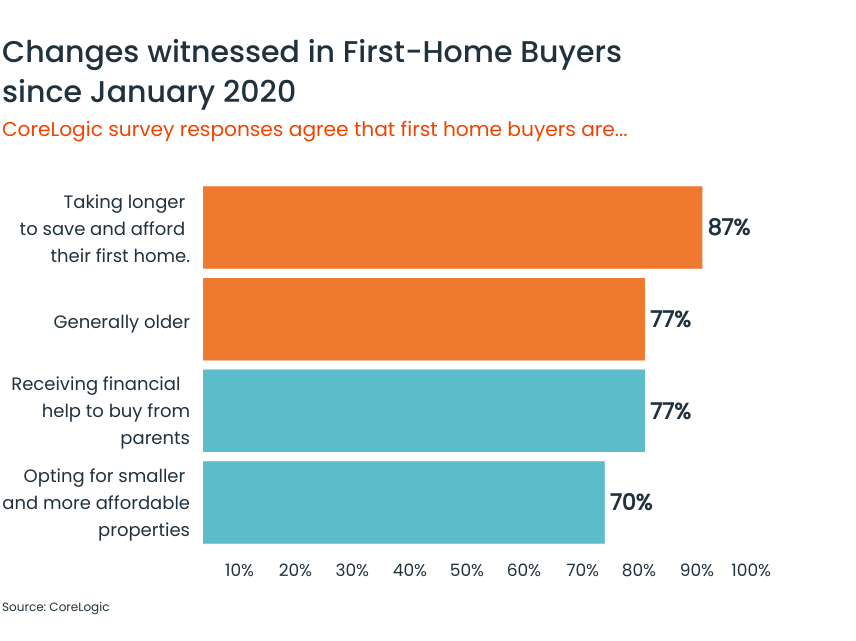

Affordability continues to challenge first-home buyers, with CoreLogic’s survey uncovering several key trends that are reshaping this segment of the market:

- Longer savings times – 87% of respondents observed buyers taking more time to save for a deposit, with the average savings period now at 10.6 years.

- Older buyers – Seven out of ten agents reported that first-home buyers are older than in previous years.

- Reliance on the Bank of Mum and Dad – 77% noticed more buyers relying on financial help from parents to secure a purchase.

- Higher demand for compact housing – 78% highlighted growing interest in smaller, more affordable properties.

“Housing values have grown much faster than incomes, which blows out the time to save a deposit, even if the household can maintain a high savings rate,” Ms Owen said.

These affordability pressures are driving a shift in buyer behaviour, including the rise of ‘rentvesting,’ where buyers rent in desirable locations but purchase investment properties in more affordable areas.

Where to Find Emerging Opportunities

While meaningful affordability gains will take time, some markets are already becoming more accessible due to weaker housing values since the 2022 peak.

Key regions include:

- Melbourne

- Hobart

- Canberra

Year of the Unit

With the price gap between detached houses and units reaching record levels, buyers are gravitating towards more affordable housing types, with momentum likely to build.

“Toward the end of 2024, we did start to see slight outperformance in unit markets,” Ms Owen says.

“As houses become less attainable, I think more buyers could deflect to the unit sector, despite units presenting strata challenges and lower capital growth prospects.”

Impact for Agents

Understanding these shifts is critical for agents looking to guide first-home buyers through an evolving market. By focusing on affordability trends, emerging opportunities, and changes in buyer preferences, agents can provide actionable advice and position themselves as trusted advisors in this competitive segment.

Australia Key Findings (Page 4 of 7)

Housing Policy Matters More Than Ever

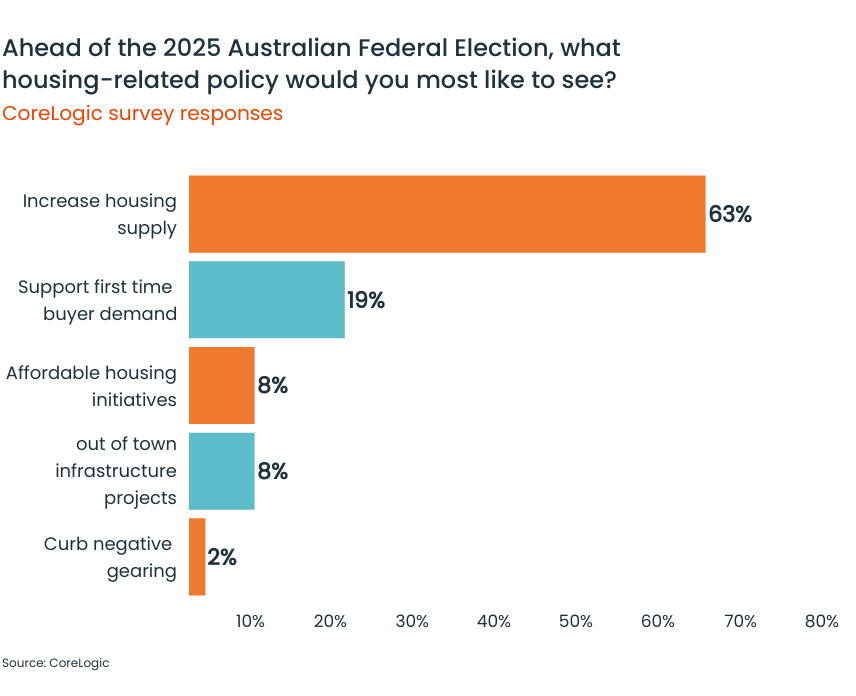

With a Federal election looming, housing supply is dominating both policy discussions and headlines. It’s a critical issue for the real estate industry, with 63% of survey respondents identifying increasing supply as the top priority for addressing affordability pressures.

“Increasing housing supply substantially seems to be the key focus for housing policy on both sides of politics, though we’re starting to see some nuance in how that supply gets delivered,” Ms Owen said.

What’s on the Policy Agenda?

Ms Owen highlights two key strategies that could shape the market in 2025:

- Boosting unit supply – Increasing the number of units could alleviate pressure on both rental and purchase markets.

- New house-and-land developments – These would add much-needed stock, providing opportunities for sales and rental portfolios.

For real estate professionals, more stock means new opportunities—but also challenges. Adapting to shifts in policy will be critical to staying ahead.

The Election Effect on Sentiment

While elections often bring short-term market hesitation, history shows the right policies can boost confidence.

“In 2019, uncertainty surrounding negative gearing reforms resulted in subdued transaction volumes. However, clear and supportive policies can instil confidence and drive activity post-election,” she says.

Impact for Agents

Understanding how housing policies will impact supply, affordability, and buyer confidence is essential. Agents who can interpret these changes and guide their clients effectively will be well-positioned to thrive in a rapidly evolving market.

New Zealand Key Findings (Page 5 of 7)

Market First Insights from NZ Agents

The New Zealand real estate market reflects similar challenges to Australia, with affordability remaining a significant barrier. However, stabilising economic conditions and easing interest rates are expected to play a pivotal role in 2025.

- Property values dipped – The national median value fell to $803,624 in December, down 3.9% year-on-year and 17.6% below the post-COVID peak.

- Only modest price growth expected – One in five agents anticipate price increases of more than 5%.

- Affordability challenges persist – High housing costs continue to impact first-home buyers, although easing interest rates may improve accessibility.

“Affordability challenges remain a significant barrier, particularly for first-home buyers, as property prices are still high relative to incomes,” CoreLogic’s Head of Research, Nick Goodall said.

“However, we’re seeing easing interest rates and stable economic conditions improve accessibility in 2025, and this could bring more buyers back into the market.”

For a full report on New Zealand results, click the link below

Real estate industry insights - (Page 6 of 7)

Why Smarter Data is a Non-Negotiable for 2025

First-party data has become the cornerstone of success for real estate businesses. In 2024, 49% of agents identified CRM-based outreach, via emails, SMS, and calls, as their most effective strategy for driving new business. 67% prioritised better data utilisation, recognising its potential to give them an edge in a competitive market. That trend continues into 2025, with agents doubling down on smarter, data-driven approaches. According to this year’s findings:

These figures reflect a growing realisation among agents that data isn’t just a tool, it’s a strategic asset that can elevate every aspect of a business.

Shift in Focus from Traditional to Digital

While social media engagement saw 29% of agents prioritise it for brand building in 2024, traditional advertising methods like billboards and print ads received only 4% of the vote. This trend is set to continue in 2025, with agents increasingly leveraging digital platforms and first-party data to enhance performance.

Unlocking the Power of First-Party Data

CoreLogic’s Head of Real Estate Solutions, Josh Symons, emphasises that success in 2025 will hinge on how effectively agents use their data.

“Building relationships through personalised, timely outreach is essential. By strengthening first-party data collection and management, agencies can improve performance while enhancing client trust,” he said.

Symons identifies three key opportunities for agents:

- Publish smarter - Share content, like property listings, on owned platforms (websites, social media) before third-party sites to strengthen brand visibility.

- Boost traffic - Drive more engagement to your platforms, improving SEO and increasing the chances of direct client contact.

- Add value at scale - Use AI tools to deliver personalised content and communications that resonate with your audience.

“This approach not only strengthens brand visibility but also drives traffic back to owned assets, enhancing SEO and increasing the likelihood of direct client engagement,” he said.

Turn Data into Results

In 2025, leveraging first-party data is more critical than ever. Agents are increasingly focused on using their data to nurture relationships and drive results, especially when it comes to converting website traffic into listings. “Converting website traffic to listings has never been rated more important by most of the industry,” Symons said. “It means delivering personalised content and communications through the right channel at the right time will add unparalleled value to real estate businesses. The ability to nurture relationships at scale, market effectively to your audience, and maintain transparency requires leveraging first-party data as an essential component of your strategy.” For agents, this means prioritising:

- Timely, personalised outreach to engage clients meaningfully.

- Effective use of CRM data to nurture relationships and identify opportunities.

- Owning your digital presence by driving traffic to your platforms instead of relying solely on third-party sites.

By treating data as a strategic asset, agents can foster trust, deliver results, and position themselves as leaders in a digital-first industry.

Real estate industry insights - (Page 7 of 7)

Your 2025 Playbook

Real estate success in 2025 hinges on one thing: how well you leverage your data. First-party data isn’t just another tool in your kit, it’s the secret weapon for building stronger relationships, delivering personalised service, and staying ahead in an increasingly competitive market.

Why First-Party Data Is a Game-Changer

By tapping into insights from your clients and prospects, you can:

- Understand what they want, when they want it.

- Communicate in ways that truly resonate.

- Build trust and loyalty at scale.

A robust first-party data strategy will provide agents a competitive advantage by enabling targeted, relevant communications, fostering trust, and driving results.

"First-party data is a game-changer for agencies looking to thrive in 2025. By understanding your clients’ needs and preferences, you can personalise interactions, build trust, and create enduring relationships that drive success." Symons said.

Four Steps to Get Started Now

Not sure where to begin? Here’s a quick roadmap to set your strategy into motion:

- Audit your data – Identify gaps, organise your information, and clean up your CRM.

- Invest in tech that works – Build a tech stack that supports your goals, from marketing automation to advanced CRM tools.

- Stay compliant – Keep up with evolving privacy laws to ensure transparency and trust with your clients.

- Focus on relationships – Use timely, relevant data to foster meaningful connections that lead to real results.

A Winning Formula

The best agents aren’t working harder, they’re working smarter. Australia and New Zealand’s top performers are already:

- Owning their platforms – Publishing listings and content on their own websites and social media to strengthen their brands.

- Boosting engagement – Driving traffic back to their platforms, improving SEO, and increasing direct client contact.

- Adding value with AI – Leveraging AI tools to deliver personalised content at scale, saving time and boosting performance.

“This not only delivers strong returns to their bottom line but also gives them back time and renewed confidence to grow and dominate their market,” Symons said.

Simplify Your Data Strategy

Data is powerful, but it can also be overwhelming. That’s where CoreLogic comes in. By partnering with real estate professionals, we simplify data strategies, provide actionable insights, and help you drive sustainable growth.

With CoreLogic, you’re not just keeping up, you’re leading. Let us help you turn your data into your most valuable asset. Contact us today to discover how we can help you level up against your competitors in 2025.

Survey Sample Data:

Survey respondents are a combination of customers across CoreLogic's real estate, property, banking and finance products, and industry peers subscribed to CoreLogic communications. A full sample size of up to 2427 was collected and fielded from November to December 2024.