In today’s Pulse, Eliza Owen explores the potential impact of tenancy reform on property investment trends.

- Stronger capital growth markets have seen more resilience in investor activity, despite rental reforms.

- Investor lending declines when housing market returns are low.

- In WA, where ‘no grounds’ evictions remain firmly in place, investor activity over the past few years has been rising strongly, and the state is attracting a higher share of investment loans. However, capital growth could be the main driver, and the high investment activity has not stopped the state having the highest rental growth in the country.

Tenancy reform is making headlines this week after the NSW government announced a ban on ‘no grounds’ evictions.

One fear associated with tipping the balance more in favour of tenants is that landlords could exit the market, and new investors may be dissuaded from purchasing property, thus reducing rental supply and pushing up rents.

But does tenancy reform actually deter investor activity?

Dynamics in the rental market still seem overwhelmingly driven by broader economic and demographic factors of supply and demand, rather than tweaks to tenancy laws. The supply of rental property seems largely influenced by access to finance and capital growth return.

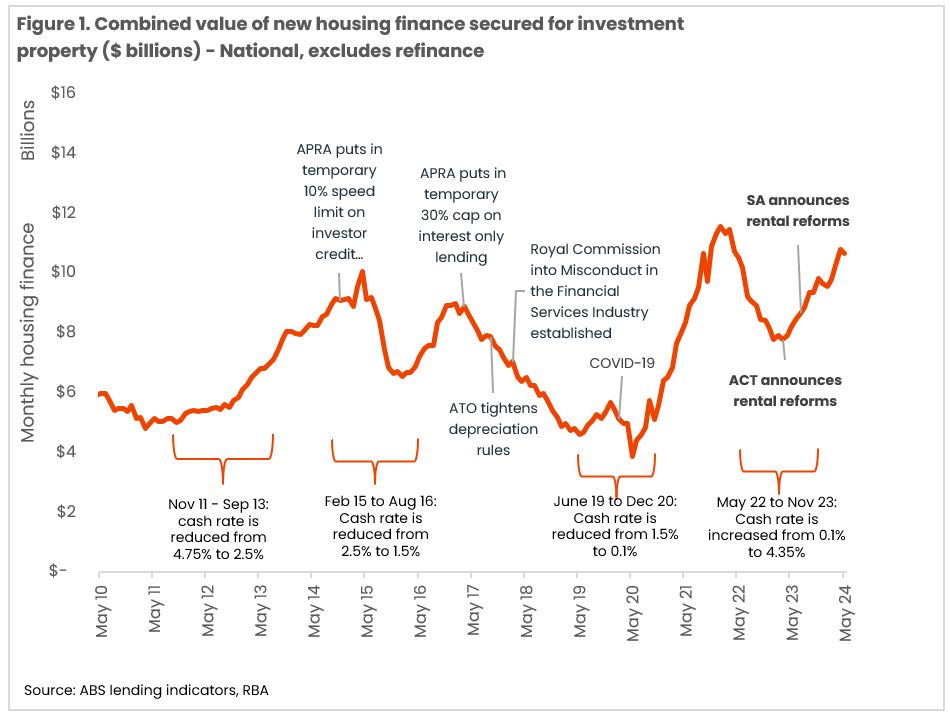

Figure 1 shows ABS reporting on the value of housing finance secured for investment property purchases – a proxy indicator of investor demand for residential property. The series shows marked drop offs in investor finance following changes to lending rules by the banking regulator, a rise in interest rates (at least until early 2023), and the uncertainty of the global pandemic. Announced changes to ‘no grounds’ evictions seem to have little impact on this series. In fact, recent value increases in residential property, and the hold in the cash rate since November last year, may be contributing to an ongoing increase in investor demand.

Investor lending declines when housing market returns are low

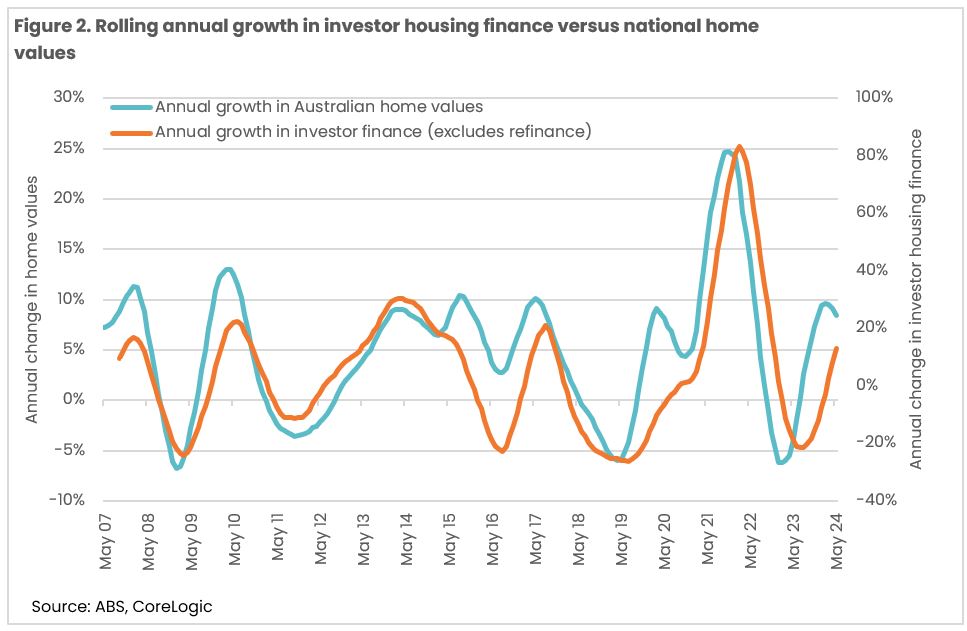

A clearer relationship with changes in investment activity can be seen against changes in home values. Figure 2 shows the rolling annual change in the CoreLogic home value index against the rolling 12 month change in annual investment finance secured for property purchases. Annual growth in investment activity was strongest in the year to February 2022, which followed a cyclical peak in Australian home value growth of 24.8% in the year to November 2021.

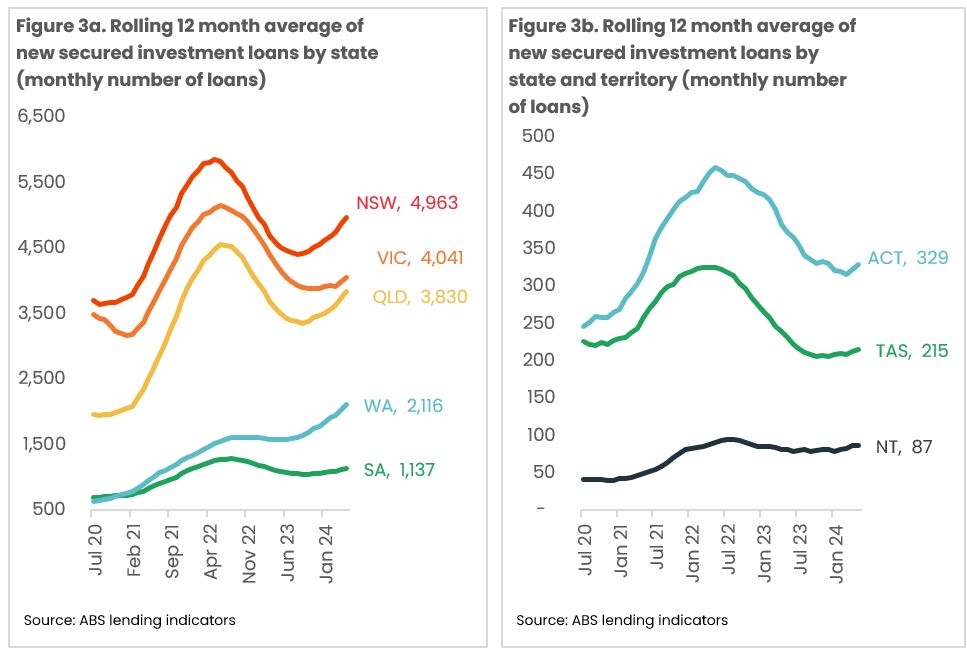

Stronger capital growth markets by state and territory have also seen more resilience in investor activity, despite rental reforms. In July last year, the South Australian government announced its ban on ‘no grounds’ evictions, along with other rent reforms that took effect from the start of this month. Since these reforms were announced in July last year, new investment property finance has only trended higher, and is up around 37% as of May 2024.

Investment activity in the ACT has dwindled since the announcement of its ban on ‘no grounds’ evictions in April 2023, but this could also be due to the fact that capital gains in the Territory has been relatively weak in the period, and there are some indications this market is slightly over-supplied. Rather than rents soaring in the absence of investor activity, rent values were up just 1.3% between April 2023 and June this year.

In WA, where ‘no grounds’ evictions remain firmly in place, investor activity over the past few years has been rising strongly, and the state is attracting a higher share of investment loans. The number of new investment loans secured for WA investment properties in May was up 53% year-on-year, and the value of lending was up 74%.

However, it is hard to tease out the effect of more flexible landlord arrangements from other market conditions, like unusually strong population growth or the highest annual capital growth rate of the states and territories. Notably, the added flexibility for landlords was not enough to entice investors into the low-growth conditions of the late 2010s in WA, and it also hasn’t been enough to boost rental supply to the extent that it is making life easier for renters now. Rents rose faster in WA in the past year than any other state or territory (12.8%).

Ending ‘no grounds’ evictions will support greater security of tenure for tenants. While this will come at the cost of flexibility, and potential rental income gains for landlords, reducing the power imbalance for tenants is unlikely to have a substantial impact on investor activity or rent values. Prices in the rental market will continue to be dominated by demand factors such as population growth, household size and income, while the supply of investment property will be largely influenced by market conditions, such as capital growth prospects, availability of credit and interest rates.