As the gap widens between house and unit values, we reveal the suburbs with the largest and smallest house premium.

Underlying land value, scarcity factor and desire for more space through the pandemic has led to a substantially larger rise in house values relative to unit values over the past four years.

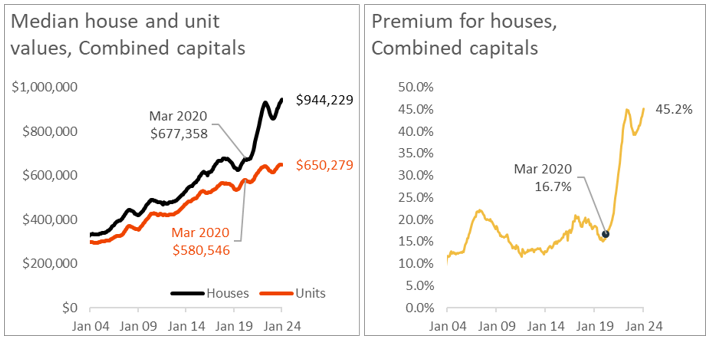

At the onset of the pandemic in March 2020, the house premium, or the difference between median capital city house and unit values, was just 16.7%. Fast forward almost four years later, and that premium has jumped to 45.2% or $293,950.

CoreLogic research director, Tim Lawless, said while houses have historically attracted a price premium over units, and have shown a higher rate of capital gain, several factors have led to the accelerated value growth for detached dwellings over recent years.

“The house premium rose sharply through the pandemic upswing as more people sought out space and were more willing and able to live further afield in our cities. While we saw the premium contract through the early part of the rate hiking cycle as house values fell more than unit values, across the combined capitals the gap between house and unit values has since rebounded to a new record high as house values once again rise at a faster pace than units.”

Since the onset of the pandemic to January this year, capital city house values have increased by 33.9% or by $239,000. Unit values over the same period are up 11.2% or $65,235. A similar trend has played out over the past 12 months with house values up 11.0% ($93,552) while unit values are up a lesser 6.9% ($41,789).

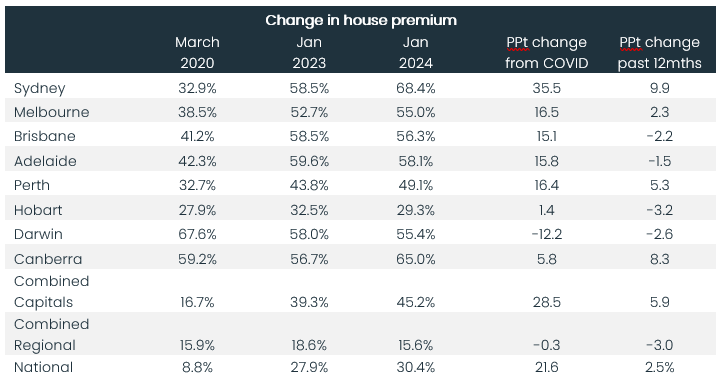

Across the capital cities, Sydney has seen the largest expansion in the house premium since the pandemic, with the gap between house and unit values widening by almost 36 percentage points, catapulting it from sixth to first position on the premium leagues table. Melbourne, Perth, Adelaide and Brisbane have all seen their house premium grow between 15 and 16 percentage points over the same period, while Darwin has seen its house premium reduce by -12.2 percentage points.

“Over the past 12 months, we see a different picture. While Sydney tops the table again for largest 12-month change in premium followed by Canberra, several cities have seen the premium shrink back a little, including Brisbane and Adelaide. This could be reflective of homebuyers seeking out more affordable housing options, which has diverted more demand towards units,” Mr Lawless said.

Top suburbs for largest and smallest house premium

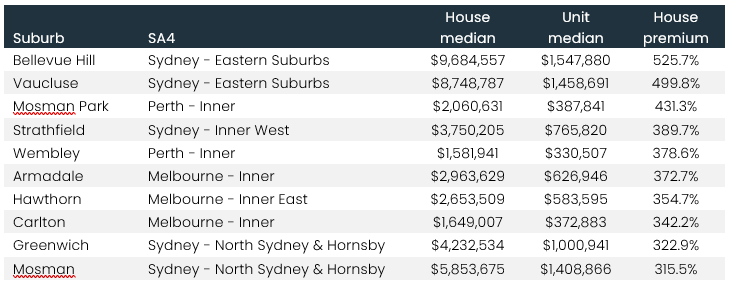

Across the combined capitals, five of the suburbs with the largest house premium are in Sydney, three are in Melbourne and two in Perth.

Mr Lawless said many of the suburbs with the largest house premium are very affluent markets.

“In Sydney the largest premium for a house is at Bellevue Hill with a 525% premium for houses over units. In Melbourne it is Armadale with a 372% premium and in Perth it is Mosman Park with a 431% premium. Homebuyers attracted to these blue-chip suburbs who can’t afford a freestanding home may be attracted to the significantly more affordable price point to get into a high-end suburb,” Mr Lawless said.

Top 10 Suburbs by largest house premium – combined capitals

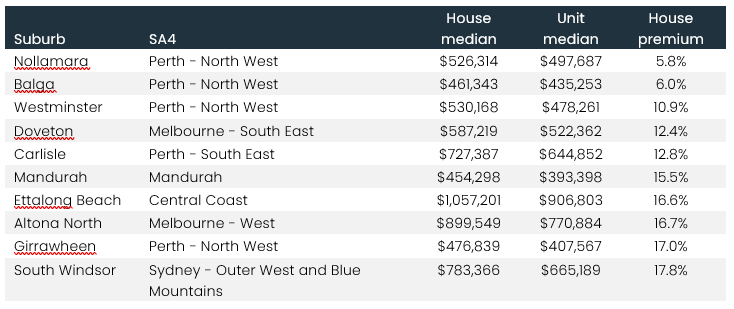

“Conversely, the suburbs with the smallest differential in price between a house and unit may offer good buying opportunities for those able to stretch themselves to secure a piece of land without the hefty premium we’re seeing more broadly across many parts of our cities. With houses typically yielding a stronger capital gain outcome over time, these suburbs with a lower house premium could be strong investment opportunities.”

Top 10 suburbs by smallest house premium – combined capitals

“House prices have moved out of reach for a growing portion of the population, especially those seeking a first home or lower income households. With housing affordability remaining a key challenge across Australia, the substantially lower price points across the medium to high density sector are likely to become increasingly in demand as buyers become more willing to sacrifice space for proximity to essential amenities.

“Alongside lower prices, medium to high density housing options are often strategically located close to transport networks, major working nodes and high amenity precincts,” he said.