Research Director Tim Lawless shares commentary on today's RBA cash rate decision.

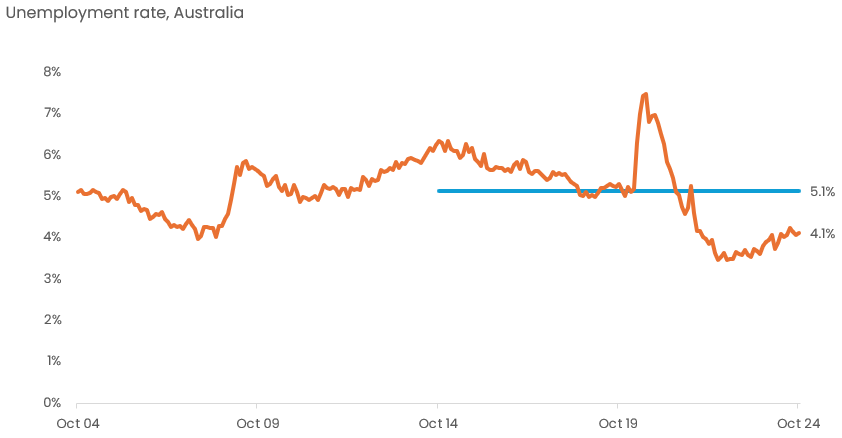

The hopes for a December rate cut were slim leading into today’s meeting, with financial markets giving just a 6% chance of a rate cut in December. That’s not surprising given the rise in the monthly inflation indicator through October to 3.5%, alongside ongoing tightness in labour markets, where the unemployment rate has held around 4.1% since April.

But the hold decision also comes at a time when economic growth has stalled and is tracking lower on a per capita basis over the past seven quarters. Outside of the pandemic period, the annual change in GDP hasn’t been this weak since 1991 as the economy was emerging from recession.

Tight labour market conditions, juxtaposed with a combination of low productivity growth, weak economic conditions and high inflation demonstrates the ‘narrow path’ the RBA is traversing, keeping rates high while avoiding a recession or blow out in the unemployment rate.

So far, the RBA has held to this path; the economy has staved off a recession, albeit largely due to population growth and government spending. Similarly, households are battling through a seven-quarter ‘per capita’ recession that has been compounded by a period of negative real income growth and a depletion of savings, yet we haven’t seen mortgage arrears rise beyond 2%.

The housing market

From a housing perspective, the fact that we have seen national home values rise a further 5.5% in the past 12 months is a reminder that housing markets respond to more than just interest rate settings. An undersupply of newly built housing, low levels of advertised supply, strong demand from population growth, and windfall gains in home values have kept some upward pressure on the market, and have kept sales volumes elevated through most of 2024.

This is changing now with high interest rates and affordability constraints finally cooling the pace of growth in home values. Home purchasing is winding down, total listing numbers rising, the clearance rate is falling and homes are taking longer to sell. Affordability may increasingly see buyers drop out of the market amid high interest rate settings. CoreLogic and ANU affordability metrics show a record high portion of income required to service a new mortgage for the median income household (50.6%), and the value to income ratio has climbed back to previous series highs from June 2022 (8.0).

With less demand and more available supply, some heat is leaving the housing market. CoreLogic’s national home value index virtually flatlined in November with a 0.1% rise, while four of the eight capitals recorded a negative quarterly change in values.

Rate-cutting cycle to be cautious and gradual

The timing of a rate cut remains a guessing game, but lower rates look likely within the first half of next year. The RBA has three meetings in the first half of next year, with monetary policy decisions handed down on Feb 18, April 1 and May 20.

Whatever the timing, once interest rates do start to reduce, it might be enough to stave off further declines in home values, or even support some subtle growth across the more affordable markets. However, the rate-cutting cycle is likely to be a cautious and gradual one, suggesting we aren’t likely to see a return to the frothy growth conditions of recent cycles any time soon.