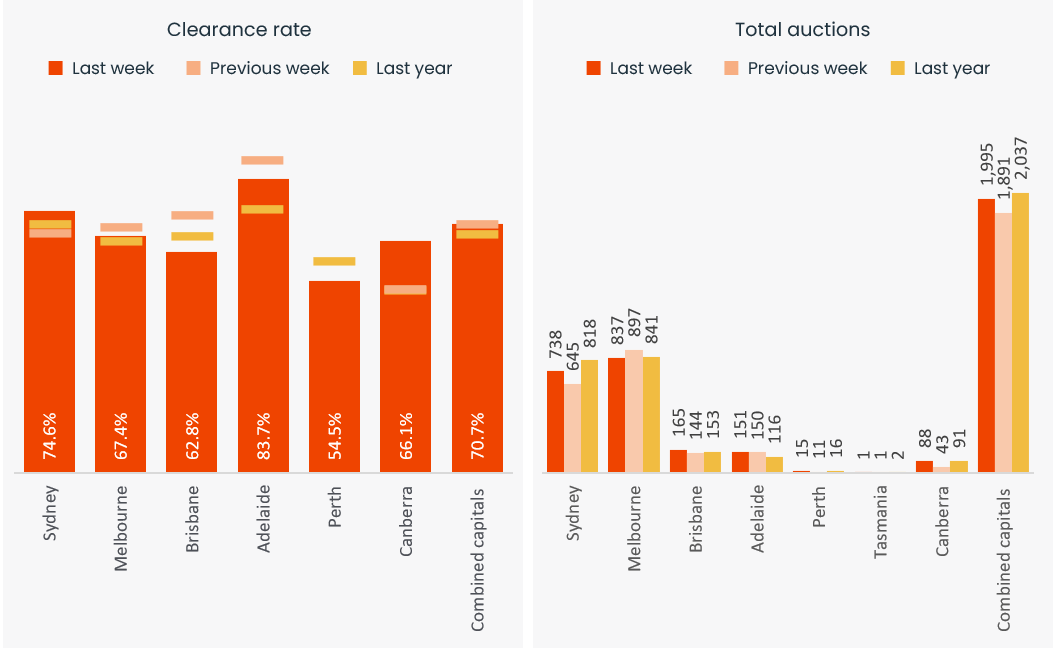

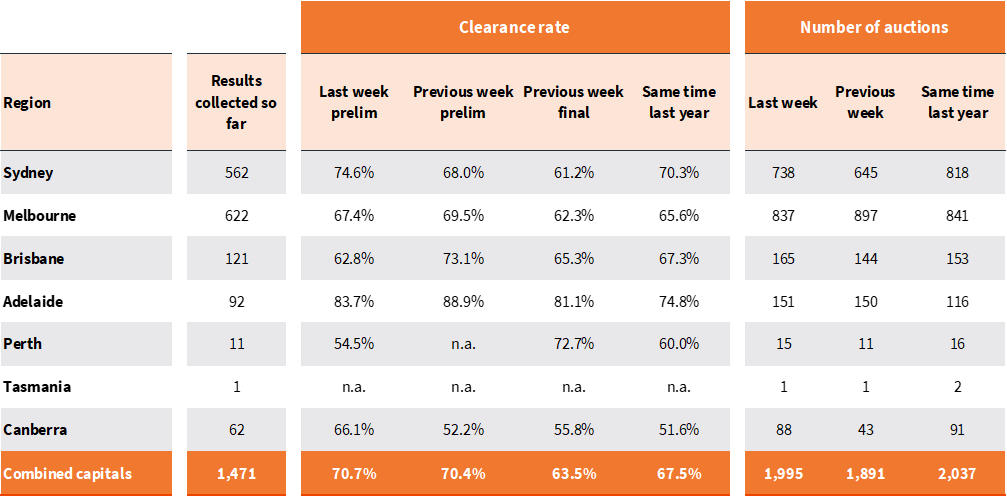

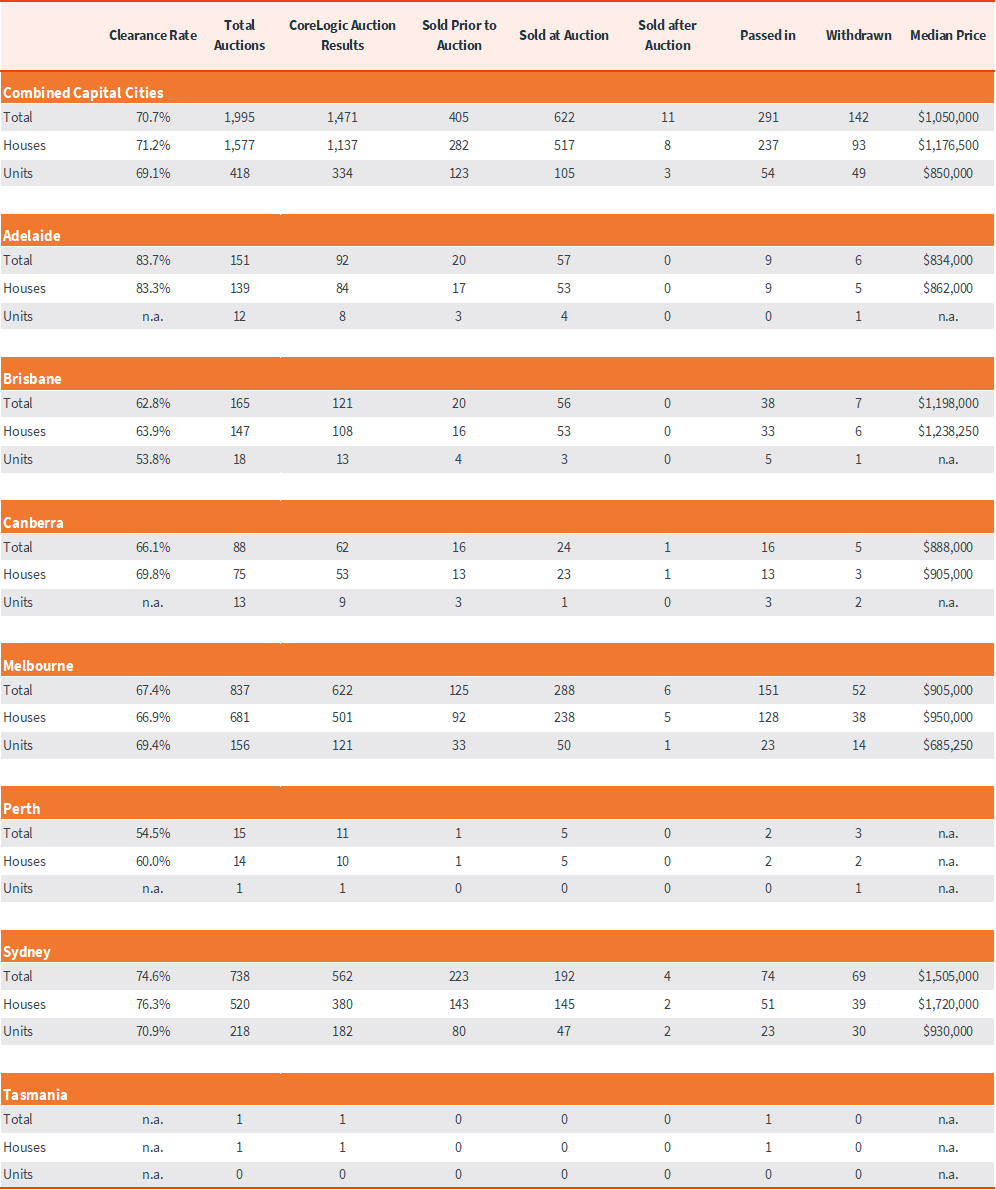

The volume of auctions didn’t quite reach the 2,000 mark last week, with 1,995 homes taken under the hammer. This was the largest volume of auctions held in a week since the last week of June (2,030) and up 5.5% on the previous week’s volume of auctions.

The preliminary clearance rate nudged a little higher relative to the previous week, coming in at 70.7% across the combined capitals last week, compared with 70.4% the week prior (revised down to 63.5% once finalised).

The rise in the preliminary clearance rate was mostly driven by Sydney, where 74.6% of auctions were successful so far, up from 68.0% the week prior (revised to 61.2% on final numbers).

Capital City Auction Statistics (Preliminary) – headline results

Melbourne’s preliminary clearance rate slipped to 67.4%, holding below the 70% mark for four of the past five weeks and down from the 69.5% preliminary result a week prior (revised down to 62.3% once finalised).

Across the smaller auction markets, Adelaide continued to lead the auction clearance trends, with 83.7% of homes selling under the hammer last week, although this was down from 88.9% the week prior. Brisbane recorded the highest volume of auctions across the smaller capitals, with 165 homes going to auction, returning an early clearance rate of 62.8%. Canberra saw 88 homes taken to auction last week, returning a preliminary clearance rate of 66.1%. Only 15 auctions were held in Perth, with a preliminary clearance rate of just 54.5% - a soft result for such a strong market, but the clearance rate can be extremely volatile across Perth amid low auction volumes.

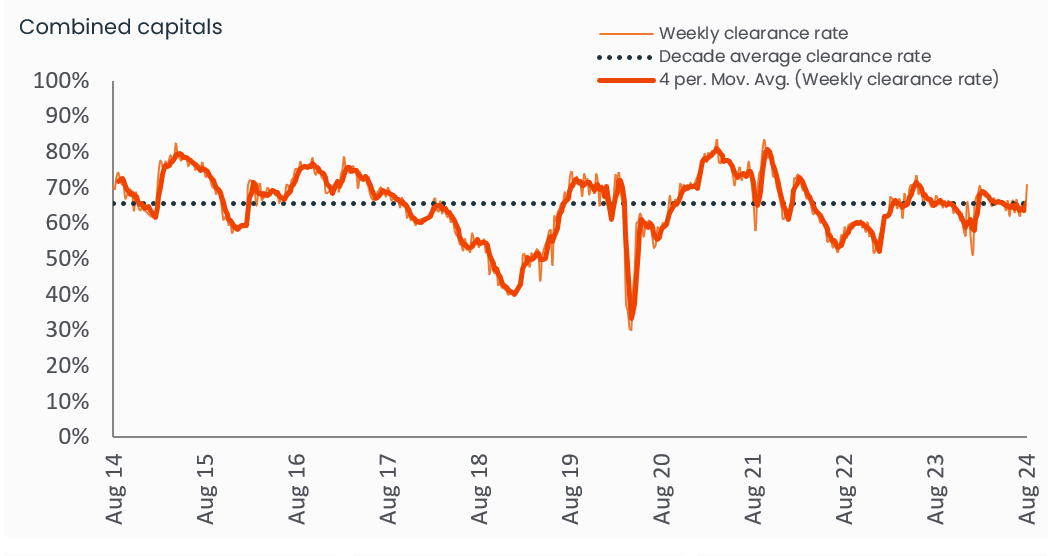

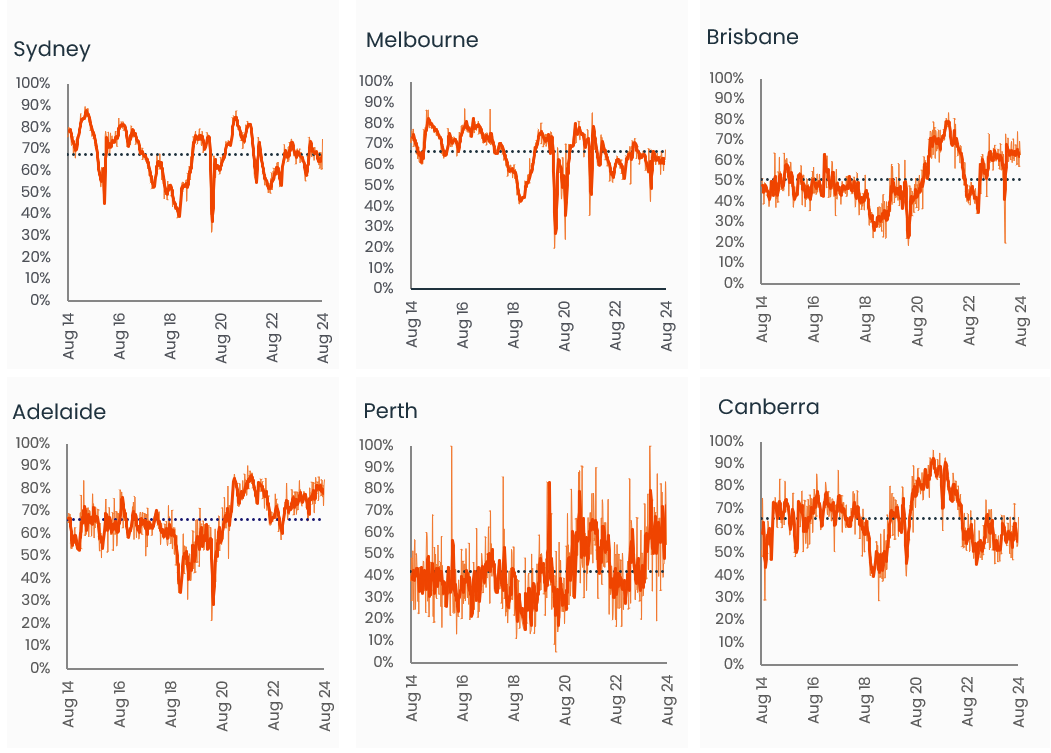

Capital City Auction Statistics over time

Historical clearance rates utilise the final auction clearance rate, while the current week is based on the preliminary clearance rate.

The outlook for auctions is for a step up in volume over the coming weeks. Around 2,100 homes are scheduled to go under the hammer this week, rising to around 2,300 the week after.

More broadly, the count of new listings coming to market has been tracking slightly higher than a year ago, up 2.5% nationally to be 11.8% above the previous five-year average (based on the number of listings coming to market over the four weeks ending August 18th). The flow of freshly advertised housing stock is likely to pick up more substantially as spring arrives, as noted in last week’s research note from Eliza Owen outlining an average 18.2% lift in new listings between winter and spring over the past decade.

Capital City Auction Statistics (Preliminary)

The above results are preliminary, with ‘final’ auction clearance rates published each Thursday. CoreLogic, on average, collects 99% of auction results each week. Clearance rates are calculated across properties that have been taken to auction over the past week.

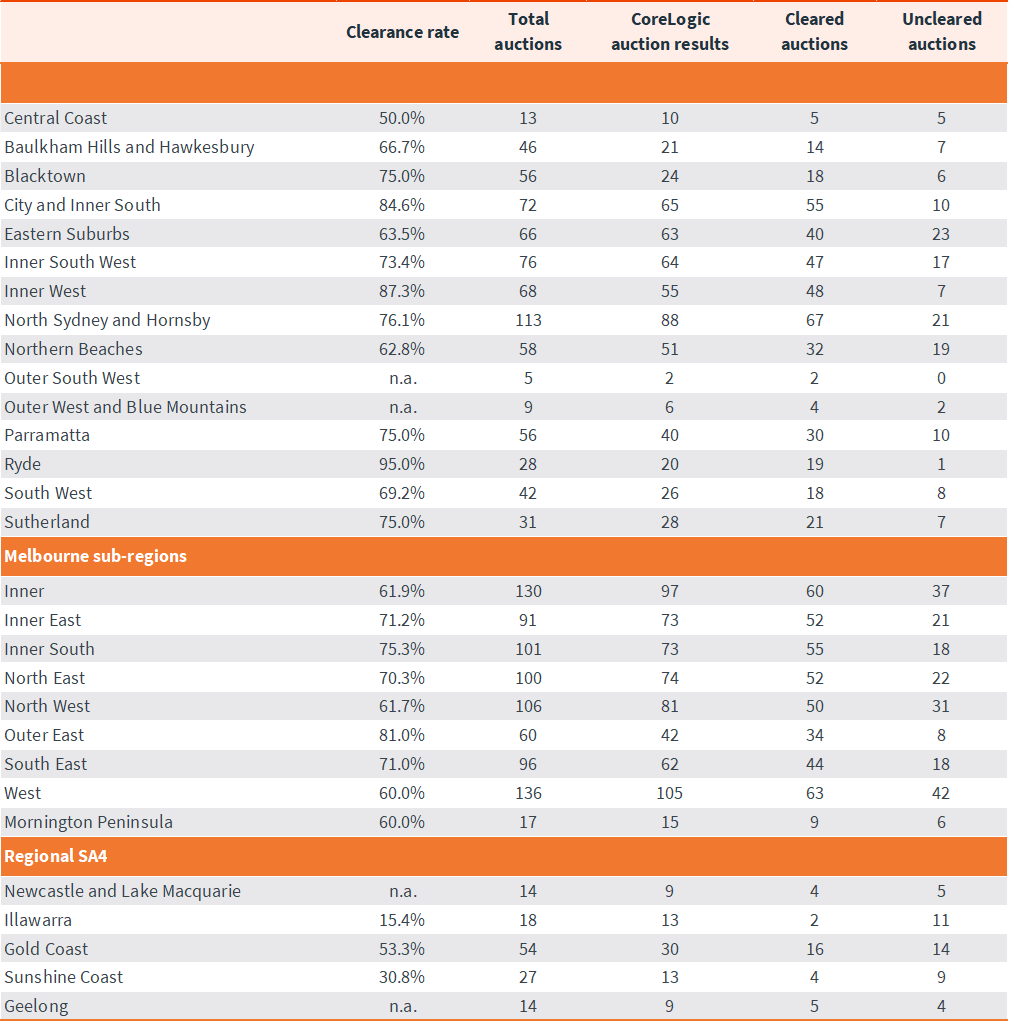

Sub-region auction statistics (preliminary)

CoreLogic, on average, collects 99% of auction results each week. Clearance rates are calculated across properties that have been taken to auction over the past week.

Download Property Market Indicator Summary