Property values in Australia’s combined regions are outperforming the combined capital cities despite the normalisation of internal migration trends, affordability challenges and a reduction in borrowing capacity amid higher interest rates.

CoreLogic’s Regional Market Update, which analyses value and rent changes across the country's 50 largest non-capital Significant Urban Areas (SUAs), shows dwelling values in regional Australia recorded a quarterly increase of 1.2% in the three months to January 2024, compared to the capital cities' 1.0% increase over the same period.

Although the rate of growth across the combined regions has eased, CoreLogic Research Director Tim Lawless said this follows the sector’s ‘boom’ during the worst of the pandemic on the back of high net internal migration flows and strong affordability.

“Outside of the pandemic growth between 2020 and 2022, the outperformance of regional markets relative to the capital cities is a fairly new phenomenon,” he said.

“The more recent trend where growth in regional housing values has outpaced the capital cities is attributable to a slowdown in capital city growth rates rather than an acceleration in regional growth.”

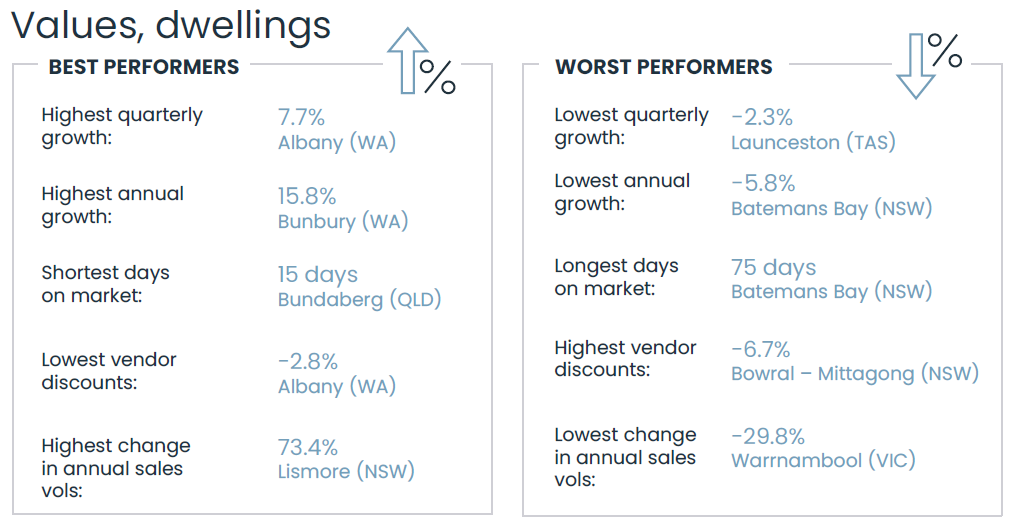

Capital growth remains varied across Australia's 50 largest SUAs, however many of the standout performers are in WA and Queensland.

WA’s coastal towns of Albany and Bunbury recorded the highest quarterly rises, with value growth of 7.7% and 6.2% respectively, ahead of Northern NSW's Lismore (5.5%), and Townville (4.7%) in Queensland's North.

Only six SUAs recorded an annual increase of 10% or more including WA's Bunbury (15.8%), and Central Queensland's Bundaberg (12.0%) and Rockhampton (12.0%).

“The strongest growth conditions have been skewed towards regional areas of WA and Queensland. These areas have a diverse economic base and are generally supported by a mixture of agriculture, tourism, ports and mining,” Mr Lawless said.

“They’re the only states with a positive rate of interstate migration that helps support housing demand and they’re relatively affordable markets.”

Tasmania's Launceston (-2.3%) and Devonport (-2.0%) recorded the largest quarterly falls. Annual declines were recorded in 11 regional markets across Victoria, Tasmania and NSW where the coastal market of Batemans Bay (5.8%) had the largest annual decline.

“The weakness across Tasmanian housing markets is broad-based but follows a solid run of growth with values up 91% over the past decade,” Mr Lawless said.

“A combination of affordability constraints following the pandemic surge in values, negative interstate migration and a normalisation in internal migration rates are other factors that are likely contributors to the softer conditions across Regional Victoria and Regional Tasmania.”

Regional rental market on the rise

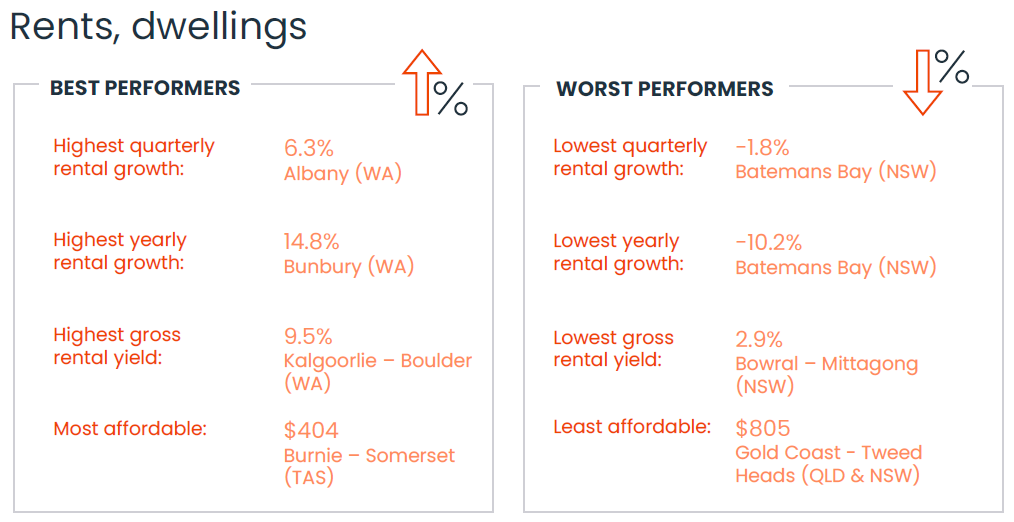

As the regions entered peak rental season, CoreLogic’s regional rental index recorded a 2.3% increase over the three months to January, up from a recent low of 0.4% over the September quarter of 2023. Comparatively, capital city rents rose 2.1% over the three months to January.

Rents increased 3% or more in 13 of the SUAs analysed. Albany (WA) recorded the highest quarterly increase in rents up 6.3%, followed by Bunbury and Busselton (WA) at 4.6% a piece. This translates to an approximate increase in the median weekly rental value of between $25 to $30.

WA dominated the list for highest annual rental growth, with the top four regions being Bunbury (14.8%), Busselton (12.7%), Geraldton (12.1%) and Albany (11.2%). Queensland’s Gladstone (11.6%) and Mackay (10.4%) were the other two regional markets with double-digit rental growth in the past year.

NSW’s Bateman’s Bay was Australia’s weakest rental market, recording the highest quarterly fall in rents (-1.8%) and an annual decline of -10.2% in the 12 months to January.

Yields strongest in volatile mining regions

Mining centres dominated the top five regions with the strongest yields with WA’s Kalgoorlie – Boulder recording a gross rental yield of 9.5% ahead of Mackay (QLD), Geraldton (WA), and Gladstone (QLD) which had gross rental yields of 6.6%, 6.5% and 6.4%, respectively. The Bowral – Mittagong region in NSW, which has a median dwelling value of $1,124,869, has the lowest gross rental yield at 2.9%.

Outlook for regional housing markets

Demographic trends, migration patterns and localised economic drivers will be critical to regional housing values in 2024, Mr Lawless said.

He said while there is likely to be a legacy of COVID, with remote working at least partially embedded in workplace policies, it’s unclear how work from home policies will evolve over time.

“Regional cities in the 'sweet spot' — offering commuting options to a capital city, a lifestyle dividend, and affordable housing — will likely experience stronger demand than they did pre-COVID,” he said.

“In contrast, the performance of more remote regional markets will hinge on local economic factors, with infrastructure projects impacting housing demand, and climate, weather, currency flows, and policies affecting farming or coastal areas.”

Download the Regional Market Update