In today's Pulse, Eliza Owen analyses Australia's rental market performance, using CoreLogic's newly launched bedroom count metric.

- There are stronger rental growth trends in larger dwellings, potentially reflecting the formation of share houses or multiple family households, with an 8.7% rise in rent for houses with five bedrooms or more.

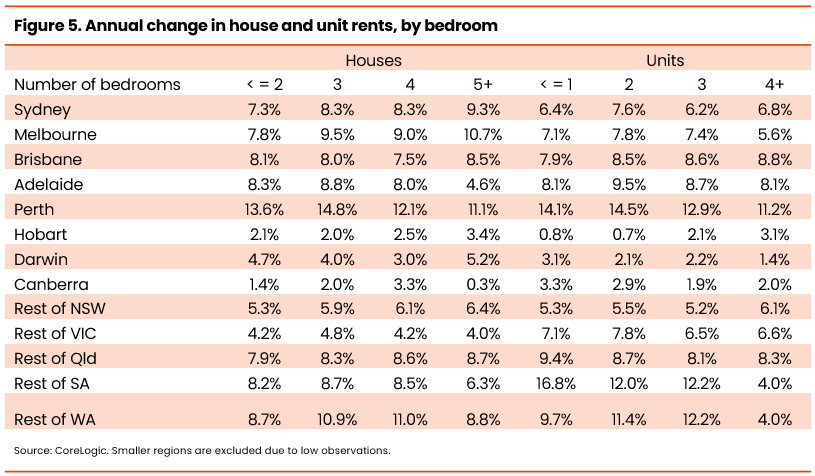

- Substantial slowdown in the rent growth of smaller dwellings, with annual growth in one-bedroom units and studios slowing from 16.8% in the year to April 2023 to 7.1% in the past 12 months.

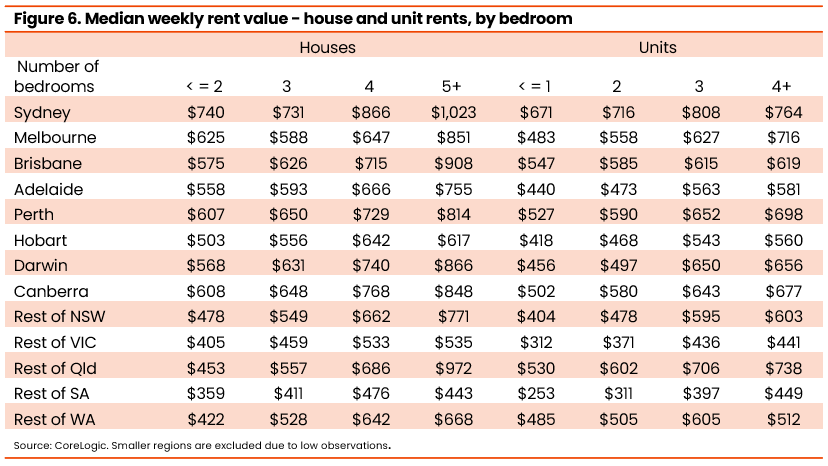

- The average rent for a bedroom becomes cheaper the higher the number of bedrooms a dwelling has.

- The national median weekly rent values hit a fresh record high of $634 per week in June, up $48 relative to a year ago.

Rental affordability continues to deteriorate in Australia, however new data from CoreLogic shows renters are starting to favour larger dwellings. A slight slowdown in net overseas migration might also be a driving factor slowing demand for smaller, inner-city units.

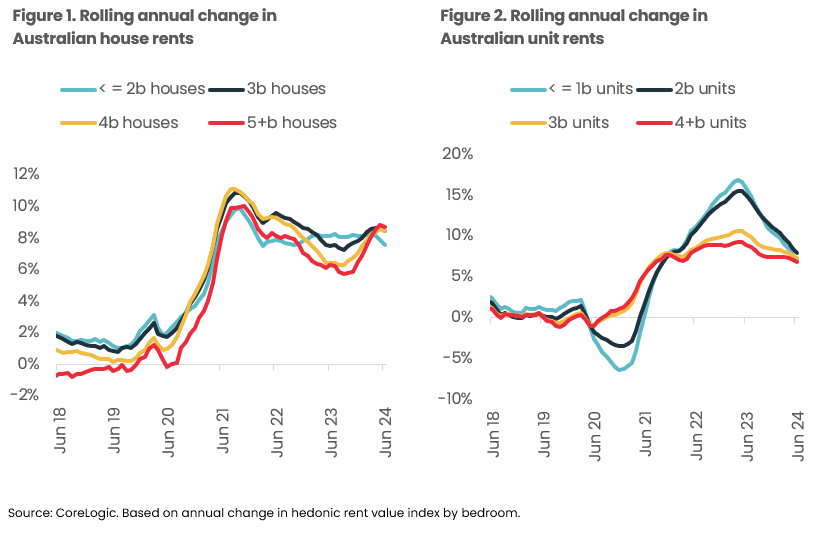

CoreLogic’s newly launched bedroom count metric - which analyses housing market performance segmented by the number of bedrooms - reveals a slowdown in rental growth for dwellings with fewer bedrooms. For houses, rents increased 8.4% nationally in the year to June, and this ranged from a 7.6% rise in houses with up to two bedrooms, to 8.7% in larger houses with five bedrooms or more (Figure 1).

In the unit segment, which includes properties on strata titles such as townhouses and apartments, there has been an even more substantial slowdown in the rent growth of smaller dwellings. Annual growth in one-bedroom units and studios slowed from 16.8% in the year to April 2023 (a series high), to 7.1% in the past 12 months. This was the weakest annual growth of unit rents by bedroom count in the period. Similarly, two-bedroom units have seen a slowdown in annual rent growth from 15.4% in the year to May 2023, to 7.9% in the past 12 months (Figure 2). Despite the slowdown, two-bedroom units maintained the highest rent growth on a national level.

Why are bigger dwellings popular amid a cost of living squeeze?

Interestingly, larger rental properties are showing more resilient rent growth, despite being more expensive. Large rental properties may actually be more feasible for renters in share situations, including reforming group households and multi-generational households. Figure 3 shows the current median weekly rent across Australia by bedroom, and divided by the bedroom count. At least for the national medians, the average rent for a bedroom (i.e. total rent divided by number of bedrooms) is lower the higher the bedrooms are.

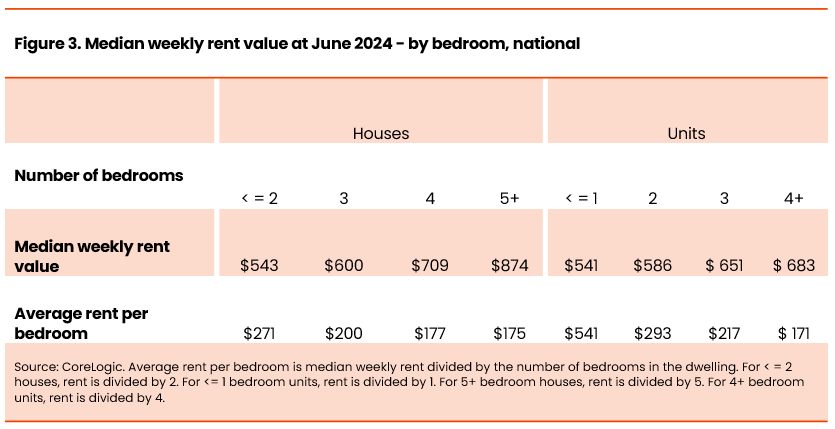

A mixed picture by region

Figures 5 and 6 show a summary of annual rent growth and value by capital city and regional market of Australia. Despite larger houses seeing higher rent growth on a national scale, this is a trend largely led by NSW and Queensland, with Melbourne also showing distinctly higher growth in house rents with five or more bedrooms. In most capital cities, two-bedroom units have sustained the highest increases in rent over the year. Looking ahead, cities where larger house rents are underperforming, such as Perth and Adelaide, may eventually see a similar shift to higher demand for larger dwellings that can be occupied by shared households.

Please see Eliza's full analysis below, including additional commentary, and more graphs on % change in rent values by bedroom count across houses and units.