Residential construction costs grew 3.4% over the 12 months to December 2024, the largest annual increase in construction costs since the year to September 2023 (4.0%), according to CoreLogic's latest Cordell Construction Cost Index (CCCI).

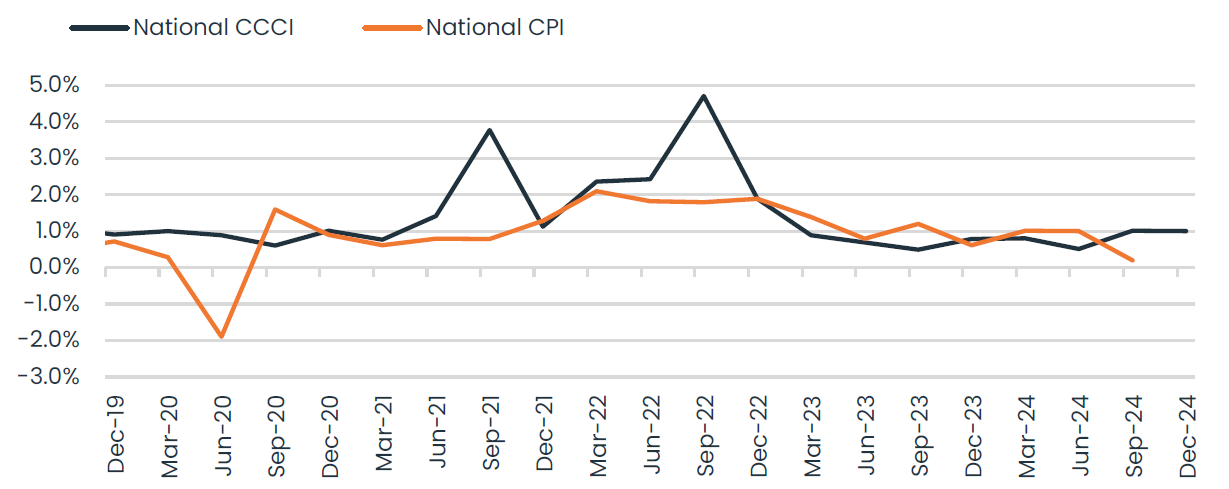

After the quarterly change in construction costs eased to below 1.0% in 2023 and the first half of 2024, the quarterly pace of growth rose to be in line with the pre-COVID decade average of 1.0% through the second half of 2024, shifting the annual trend higher.

Quarterly change in construction costs v CPI, National

CoreLogic Economist Kaytlin Ezzy said the latest data represents another challenge for an industry that is already struggling.

While still around 40 basis points below the pre-COVID decade average of 4.0%, the recent uptick in the annual pace of construction cost increases will be unwelcome news for builders already contending with tight profit margins.

"Residential construction companies continue to face profitability challenges with the CCCI up 30.8% since the onset of COVID

"Outside of compressed margins and continued labour challenges, the construction industry is also facing a looming shrinkage in the construction pipeline."

She said building commencements have trended lower, with ABS data for new dwelling commencements over the year to June 2024 at 10-year lows.

"These factors combined have contributed to an increasing number of liquidations, with 2,832 construction companies becoming insolvent in the 2023-2024 Financial Year, representing the greatest proportion of company collapses."

"Although up over the year, dwelling approvals over the 12 months to November also remained -7.1% below the decade average, suggesting this shortfall of new projects entering the construction pipeline may continue for some time."

This was supported by the latest monthly CPI results, with new dwelling purchases sub-categories recording a -0.6% decline in November.

"While deflation in new dwelling purchases seems contrary to increasing construction costs, the ABS noted this decline was primarily driven by builders offering discounts and promotional offers to entice business, putting further pressure on margins."

Over the year to November, new dwelling prices increased 2.8%, compared to a 2.3% increase in headline inflation.

CoreLogic Construction Cost Estimation Manager John Bennett said movements in the costs of specific components varied for the quarter.

"It was a bit of a mixed bag this quarter, with increases and decreases across different categories. What is constant Is that labour continues to be a key driver of cost increases."

He said concrete blocks were one area with falls, down by 15% on average, while plumbing PEX fittings and pipework were up by 5%.

"We're not seeing any dramatic movements one way or another."

Across the states

Across the states, Queensland once again recorded the largest quarterly increase in construction costs (1.2%).

New South Wales, Victoria and Western Australia all saw construction costs rise 1.0% over the three months to December, in line with the national result, while South Australia recorded the smallest increase, up 0.9% over the quarter.

For more information visit corelogic.com.au/news-research/reports/cordell-construction-cost-index