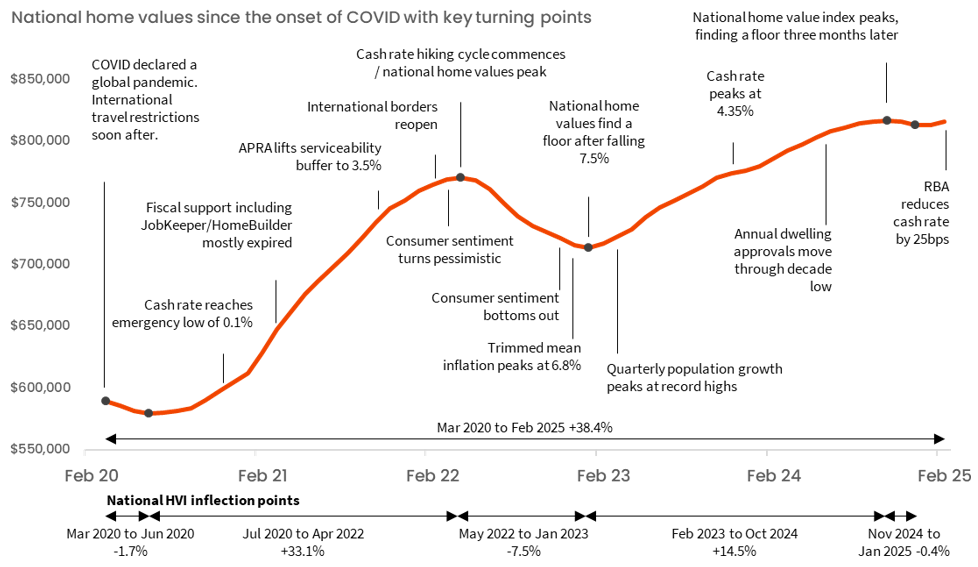

One of the most significant factors five years on from March 2020 is how housing values have changed.

Nationally, home values have been on a roller coaster ride, rising by a cumulative 38.4%, adding approximately $227,000 to the median dwelling value. For some context, the previous five-year period saw national home values rise by a much smaller 20.6%, and the five years before that the market was up just 14.7%.

The path of growth has been far from straightforward:

- Early COVID drop. The national home value index dropped 1.7% in the early months of the pandemic but found a floor by June 2020. The temporary drop could be attributed to the initial shock of a global pandemic that was accompanied by border closures, social distancing measures and a sharp drop in consumer confidence.

- The most significant surge in values occurred between July 2020 and April 2022, with national home values jumping 33.1%. Such a rapid rate of home value growth occurred despite the absence of overseas migration. However, with significant shifts in internal migration, a drop in the average household size amplified housing demand, interest rates fell to emergency lows and a record amount of fiscal spending supported households and consumer confidence.

- The housing market moved through an interlude as interest rates started to rise, with national home values recording a short but sharp decline of 7.5% over the nine months as interest rates rocketed from record lows, sentiment plunged, and serviceability constraints bit into demand.

- Growth in home values caught a second wind from February 2023, lifting by 14.5% to the end of October 2024. This second wave of growth occurred despite high interest rates, low sentiment and affordability challenges, and very low supply.

- The most recent data shows housing values levelling off, with the national home value index edging lower by a cumulative 0.4% between November ‘24 and January ‘25 before rising 0.3% in February. This was characterised by a flat trend over the past four months as the market adjusts to normalising population growth, affordability challenges and what is likely to be a gradual and cautious rate-cutting cycle.