CoreLogic Indices

TimelyPublished the first working day each mon...

TimelyPublished the first working day each mon...Published the first working day each month, the Hedonic Indices covers the month prior making it the single most timely source of housing market data across Australia.

TrustedOften quoted, always trusted. Used by po...

TrustedOften quoted, always trusted. Used by po...Often quoted, always trusted. Used by policymakers and decision makers across banking, finance government and real estate.

SophisticatedWe combine comprehensive property data w...

SophisticatedWe combine comprehensive property data w...We combine comprehensive property data with a timely flow of housing sales data to estimate the value of every property in Australia on a daily basis.

ComprehensiveAustralia is a diverse country. Our indi...

ComprehensiveAustralia is a diverse country. Our indi...Australia is a diverse country. Our indices span national, state, & non-standard boundaries including LGAs, suburbs, postcodes & customised regions

How can the CoreLogic Indices benefit your business?

The housing market rarely stands still. The timeliness of our data is your advantage.

Over 60% of bank balance sheets are dedicated to residential mortgages. It makes CoreLogic indices a powerful tool to help drive decisions around risk, opportunity, market share and business benchmarking.

Be the source of up to date information your clients rely on. CoreLogic indices give real estate professionals a winning edge with independent, respected and timely insights that show what is happening in the market today.

It’s critical data to inform your team, and build credibility and trust that turns prospects into customers – and customers into long term clients.

Grow referrals, nurture repeat business and be the expert your prospects return to by keeping customers up to date with the latest market trends. It can drive decisions spanning first purchases and upgrades, to refinancing and investing to really get your business growing.

Gain a clear picture on the patterns, emerging trends and costs associated with home ownership – as well as the interplay between housing supply and demand to make informed policy decisions across town planning, lending rules and home buyer support schemes.

How can the CoreLogic Indices benefit your business?

The housing market rarely stands still. The timeliness of our data is your advantage.

Over 60% of bank balance sheets are dedicated to residential mortgages. It makes CoreLogic indices a powerful tool to help drive decisions around risk, opportunity, market share and business benchmarking.

Be the source of up to date information your clients rely on. CoreLogic indices give real estate professionals a winning edge with independent, respected and timely insights that show what is happening in the market today.

It’s critical data to inform your team, and build credibility and trust that turns prospects into customers – and customers into long term clients.

Grow referrals, nurture repeat business and be the expert your prospects return to by keeping customers up to date with the latest market trends. It can drive decisions spanning first purchases and upgrades, to refinancing and investing to really get your business growing.

Gain a clear picture on the patterns, emerging trends and costs associated with home ownership – as well as the interplay between housing supply and demand to make informed policy decisions across town planning, lending rules and home buyer support schemes.

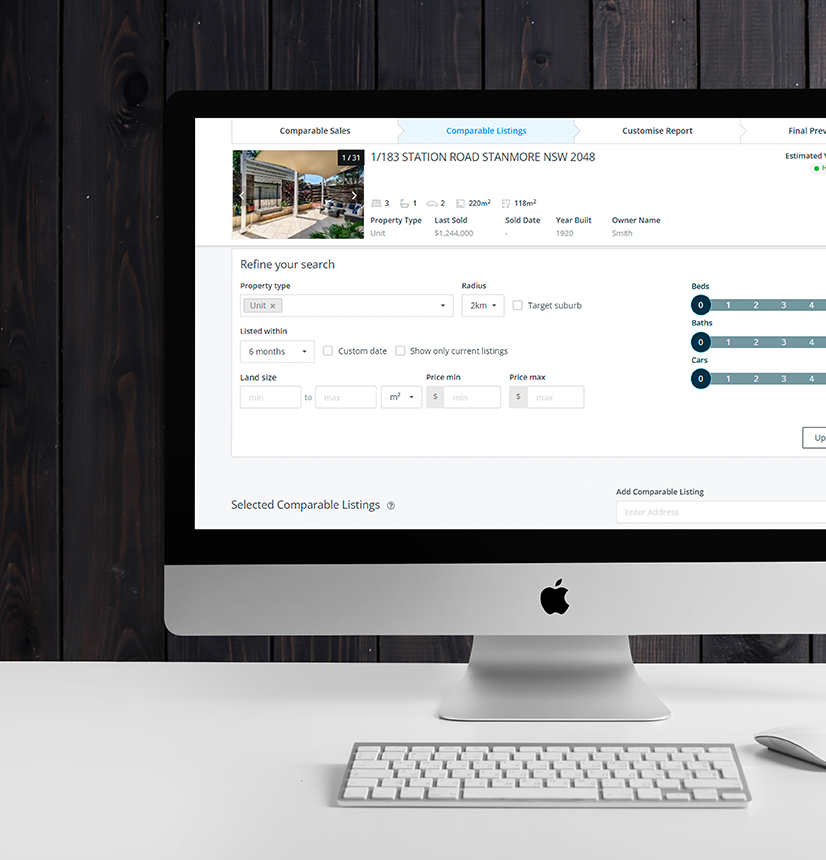

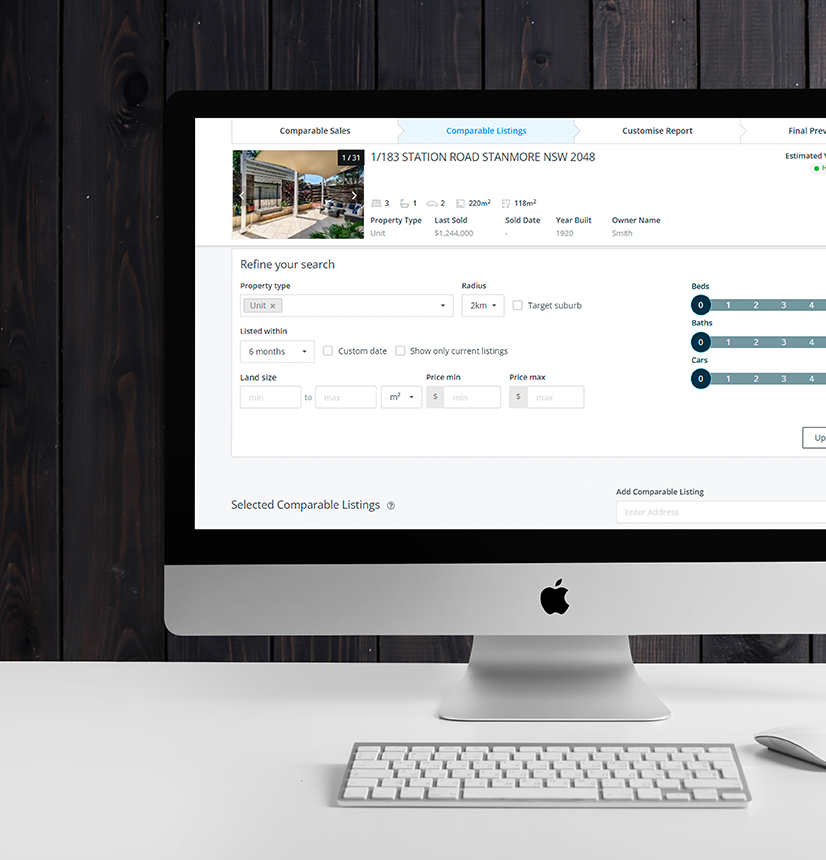

Rich analytics that make sense of market complexities

CoreLogic indices are the market-leading solution for assessing housing values over time at both a macro and micro level, and are available:

Rich analytics that make sense of market complexities

CoreLogic indices are the market-leading solution for assessing housing values over time at both a macro and micro level, and are available:

For the latest market data, available for Australia's five capital cities we have you covered on with our Daily Indices

The Quarterly Economic Review looks at macroeconomic factors, housing finance, housing supply and broad demographics alongside capital city property market trends. Banking, finance and mortgage lending commitments for all buyer segments are covered in the state-by-state analysis to provide an market sentiment insights.

The Regional Market Update is a quarterly report providing comprehensive analysis of the housing market performance across Australia’s largest regional areas.