Overview

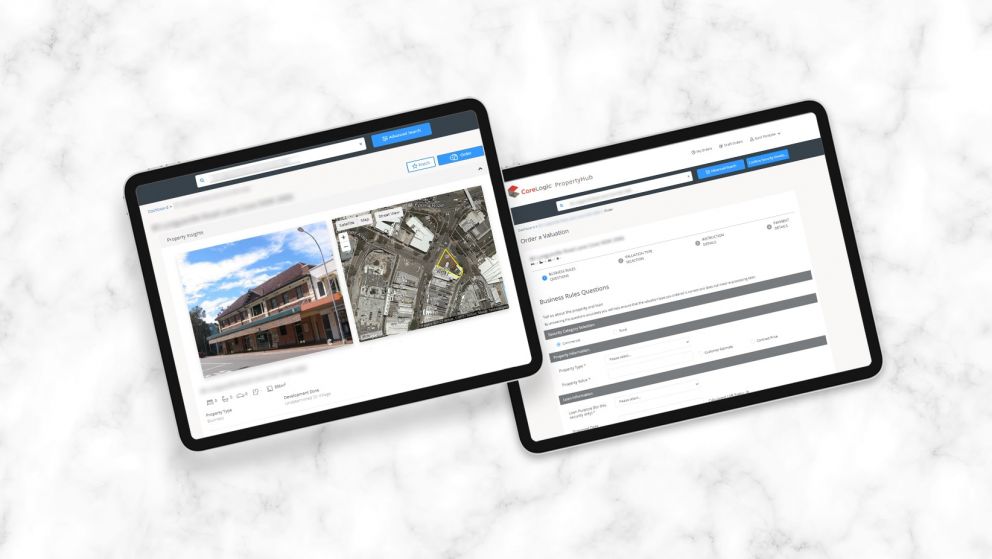

CoreLogic’s commercial valuations platform is designed to smooth out the bumps on the non-residential lending and property valuation road. Connecting banks and brokers with qualified local valuers, it enables the delivery of compliant valuation reports for commercial and rural properties.

Cloud-based and end-to-end, our modern valuations solution automates and streamlines all those manual processes into one easy-to-use platform, tailor-made for the Australian commercial lending market.

Proven performance:

- 5,000+ non-residential valuations per month

- 300+ valuation firms completing non-residential valuation reports

- 30+ platform clients

Streamline your commercial valuations

Experience the ultimate in commercial valuation fulfilment, with CoreLogic’s streamlined and easy-to-use platform. Order, track and pay via one workflow.

Streamline your commercial valuations

Experience the ultimate in commercial valuation fulfilment, with CoreLogic’s streamlined and easy-to-use platform. Order, track and pay via one workflow.

Automate and streamline the entire commercial valuation ordering and tracking process.

Increased speed means quicker approvals, enhanced user experience and higher productivity.

Tailored platform to boost efficiency, whatever your lending, service, location, panel, and compliance needs.

A range of payment options are available, including customer payment flows to reduce operational overheads.

Support from expert, hands-on team members, who know the Australian valuations market inside-out.

Comprehensive performance reporting

Detailed reporting provides valuable insights into valuation activity and peer performance benchmarking.

Comprehensive performance reporting

Detailed reporting provides valuable insights into valuation activity and peer performance benchmarking.

Review your valuation activity in detail to understand performance and adherence to policy.

Understand the breakdown of valuations coming through first-party and third-party channels.

Gain insight into how each valuation firm is performing across key metrics.

Manage valuation risk across your portfolio

End-to-end oversight of valuations and valuer certification ensures full regulatory compliance.

Manage valuation risk across your portfolio

End-to-end oversight of valuations and valuer certification ensures full regulatory compliance.

Implement your valuation policy with inbuilt business rules, ensuring the right valuation type is used in every scenario.

Ensure you’re meeting compliance and regulatory requirements with targeted reviews of all valuations.

Be confident that valuers are accredited and their professional indemnity policies is current.

Latest news and research

More News & Research

Partnering with Pepper Money to improve the valuation ex… Partnering with Pepper Money to improve the valuation experience

Supporting Pepper Money in streamlining mortgage origina… Supporting Pepper Money in streamlining mortgage origination

Latest Cityscope News - July 2023 Latest Cityscope News - July 2023

How can we help you?

Let's get this conversation started! Our team is here to provide you with more information, answer any questions you may have.