New analysis from CoreLogic has identified 65 markets in Sydney and Melbourne where values are below record highs from the 2010s and vendors are even willing to sell at a loss… but buyers aren’t interested.

Housing affordability in Australia continues to deteriorate on several fronts. The rate of newly built housing supply has largely been insufficient to meet demand from strong population growth and new household formation. However, new analysis from CoreLogic has identified 65 unit markets in Sydney and Melbourne where values are below record highs from the 2010s. In some of these markets housing affordability is improving despite high interest rates and a high portion of vendors are willing to sell at a loss.

But buyers aren’t biting. The reason? The wrong kind of supply.

Figure 1 (available here) lists the unit markets where values are below historic highs, alongside the current median value, peak value date, and value change in the past 12 months. While most other unit markets in the country have made a recovery from the supply glut in apartments through the 2010s, many Sydney and Melbourne markets are still underperforming.

Despite Melbourne dwellings currently being the weaker of the two capital city markets, it is Sydney that accounts for most of the list, with 51 unit markets sitting below a peak from 2018 or 2017.

Across the entire Sydney unit market, values have risen 8.7% since mid-2017. But suburbs like Epping stand in stark contrast, which currently has a median unit value of just under $800,000, and the value of the unit market is down -18.4% from a peak in May 2017.

Relative to incomes, affordability has improved in the unit market of the Pennant Hills-Epping SA3 region. Between the June quarter of 2017 and 2024, the amount of time to save a 20% deposit for the median income household fell from 9.8 years to 7.6 years. Despite mortgage rates rising, the amount of income required to service a mortgage has also remained low relative to the broader Sydney average, at 36.0% in the June 2024 quarter (down from 36.1% in the June quarter of 2017).

Values across the Greater Melbourne unit market have increased 6.5% from mid-2017 to September this year, but across the Melbourne City SA3 region (a good proxy for inner Melbourne), which accounted for 8 suburbs on this list, unit values are still -8.6% below a high in 2017. The median unit value in this market was just $514,000 as of September 2024, and in June required just 5.4 years to save a deposit and 34% of the median household income to service a mortgage. Buyers truly have the advantage in this market, with resale data for the June quarter suggesting 42.2% of unit owners in the Melbourne City Council area incurred a loss from selling in the June quarter of this year.

Why have these markets underperformed?

Under-performing unit markets in Sydney and Melbourne are generally tied to an over-supply of investment-grade units built in the 2010s. As interest rates moved lower post-GFC, residential property investment became particularly attractive in the inner and middle ring suburbs of Sydney, and inner-city suburbs of Melbourne and Brisbane.

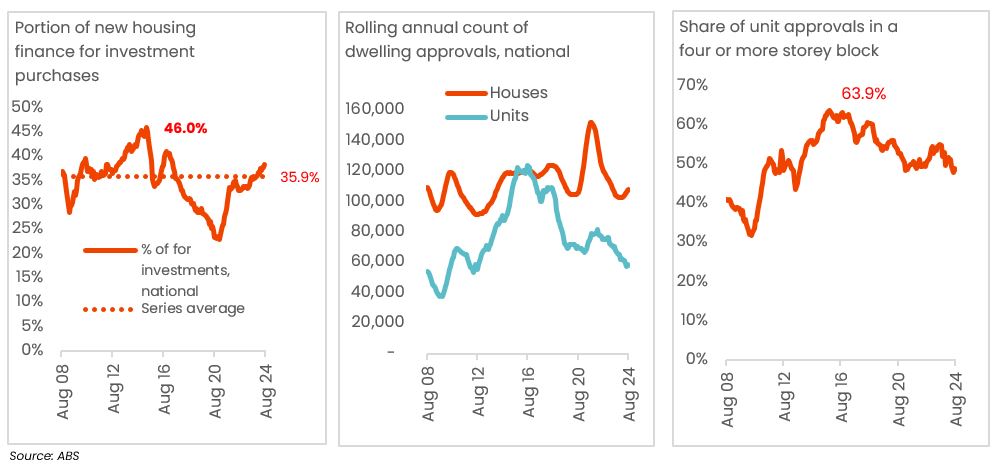

This period saw the investor share of new housing finance hitting record highs of 46% in 2015. Foreign investment purchases of off-the-plan apartments rose, and strong investor uptake of interest-only loans for tax purposes possibly added to speculative activity in the apartment sector.

Based on gross median household income and an annual savings rate of 15%.

Australia’s off-the-plan apartment boom

This led to a boom in unit construction, where investor activity is generally far more concentrated in the unit sector. Nationally, apartment approvals peaked at 123,000 in the year to August 2016. Notably, apartment approvals eclipsed detached house approvals during this period, another sign that the market was shaped by elevated levels of investment activity. Housing and occupancy data from the ABS at the time showed owner occupiers overwhelmingly opted for house purchases, with around 80% of recent home buyers purchasing a house in the 2015-16 financial year.

Granular ABS approvals data showed almost 5,000 unit approvals across Melbourne and Southbank SA2 markets in the 2015-16 financial year alone. In the same period, 1,300 units were approved in Epping - North Epping SA2, and 770 units were approved in Liverpool - Warwick Farm.

The boom in apartment investment came to an end around 2017, when a temporary cap on interest-only lending was introduced to curb potentially risky lending. At the time this cap was announced, around 70% of new investor loans were taken out on interest-only terms. With the cap in place, alongside other tightening in lending conditions, investors quickly came out of the Australian property market, undermining the value of newly built units.

To make matters worse, the apartment market also suffered a crisis in confidence after a raft of construction quality issues emerged from recent builds. These included high profile cases like Mascot Towers, and the cracks in Opal Tower in Olympic Park.

The wrong kind of supply

The result of the 2010s apartment boom has meant some of the most convenient and well located development sites were utilised for a specific type of buyer at a specific point of time – however, supply built during an investment boom may not meet needs of today’s buyers. Instead of first home buyers rushing to this relatively affordable stock, many are likely to be wary of defects in these builds, or turned off by the high density and relatively small size of the units.

Even today’s investors may be deterred from these markets, which have delivered poor capital growth returns for the better part of a decade. Although rents have risen strongly in the past few years, interest rates are also now higher than in the 2010s, and values in some of these apartment markets may need to fall further in value to be attractive from a rent yield perspective.

Interestingly, some of these unit markets have seen a strong turnaround in capital growth of late. In Tallawong, where the metro Northwest line opened in 2019, unit values have gained an extraordinary 11.9% in the 12 months to September. Low-priced unit markets in Punchbowl and Lakemba in Sydney, and Parkville in Melbourne, have also relatively high rates of growth in the past year, and still have a median unit value below $600,000. This suggests that buyers may eventually be swayed to consider purchasing in medium-to high density unit markets… but only if the price is right.